Relative Underperformance Provides an Opportunity to Add Equity for the Long Term: On a YTD basis, the Indian market has underperformed the US market and other emerging markets by a notable margin. FTSE India is now trading at a PE premium of 49% to the EM index (PE), vs. an average premium of 44%. During Sep’24, the Indian market traded at a 97% PE premium to EM. And now, after the correction, it is trading at a 49% premium, which looks attractive compared to the past. Liquidity, on a YTD basis, remains strong in the market, led by strong domestic and SIP flows. Our DIIs have invested a massive $ 65.2 Bn in the Indian market while FIIs sold $17.4 Bn for the same period, indicating the Indian market’s a shift from overdependence on the FII flows as visible in the pre-COVID era. That said, relative valuation stabilisation does not necessarily translate into an immediate rally in the current scenario. Markets are expected to track the following four key parameters, in addition to various other developments: 1) Progress on US trade deal negotiations, 2) Revival of the earnings growth cycle, which is likely to start from Q3FY26 onwards, 3) Revival in a credit growth cycle, and 4) Transmission of fiscal and monetary benefits into consumption growth.

Style & Sector Rotation – A Key to Generating Alpha Moving Forward: Risk-Reward is slowly building towards Mid and Smallcaps. Nonetheless, recovery will be slow and gradual as we progress towards FY26, led by strong earnings expectations, improving domestic liquidity, and stable Indian macros. We believe the market needs to sail through another couple of months smoothly before entering into a concrete direction of growth. As a result, we expect near-term consolidation in the market, with breadth likely remaining narrow in the immediate term. Against this backdrop, our focus remains on Growth at a Reasonable Price, ‘Quality’ stocks, Monopolies, Market Leaders in their respective domains, and domestically-focused sectors and stocks. These, we believe, may outperform the market in the near term. Based on the current developments, we 1) Continue to like and overweight BFSI, Telecom, Consumption, Hospitals, and Interest-rate proxies, 2) Continue to maintain positive view on Retail consumption plays, 3) Prefer certain capex-oriented plays that look attractive at this point due to the recent price correction as well as reasonable growth visibility in the domestic market in FY26, and 4) Maintain cautious stance on export-oriented sector due to tariff overhang and macroeconomic uncertainties.

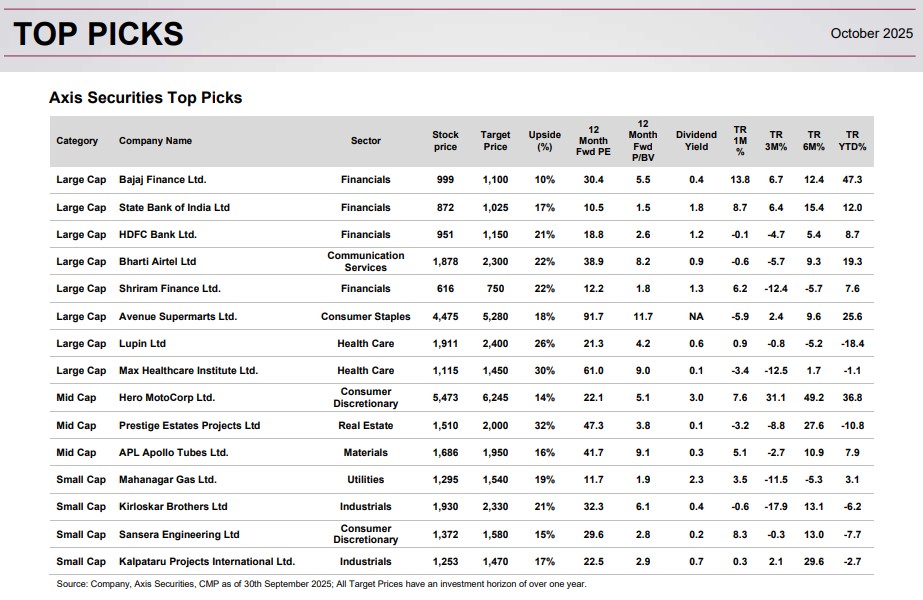

Based on the recent developments, we have made one change to our Top Picks recommendations. This includes booking profit in Varun Beverages and the addition of Mahanagar Gas. Our modifications reflect our comfort towards ‘Growth at a Reasonable Price’ picks.

Based on the above themes, we recommend the following stocks: HDFC Bank, Bajaj Finance, Shriram Finance, Avenue Supermarts, State Bank of India, Lupin, Hero Motocorp, Max Healthcare, Kirloskar Brothers, Kalpataru Projects, APL Apollo Tubes, Mahanagar Gas, Bharti Airtel, Prestige Estates, and Sansera Engineering