Axis Top Picks Basket delivered excellent returns of 25.4% in the last one year against 8.8% returns posted by Nifty 50 over the same period, beating the benchmark by a wide margin of 16.6%. The previous three months were highly volatile for the market, and notable mixed performance was seen across sectors, market caps, and style indices. The Axis Top Picks basket declined by 4.2% in the last three months but managed to beat the market performance of the benchmark Nifty 50, which declined by 8.4% over the same period. It gives us immense joy to share that our Top Picks Basket has delivered an impressive return of 330% since its inception (May’20), which stands well above the 155% return delivered by the NIFTY 50 index over the same period.

On the domestic front, the market will closely monitor developments towards the upcoming budget and the rate cut trajectory in the Indian market. We anticipate one to two rate cuts from the RBI in 2025, contingent upon inflation trends and the broader growth dynamics. These events are expected to keep the Indian equity market volatile, and it could respond in either direction based on the developments. Some allocations will likely shift towards China in the near term based on recent developments. Nonetheless, we continue to believe in the long-term growth story of the Indian equity market. With increasing capex enabling banks to improve credit growth, we believe it is well-supported by a favourable structure emerging. However, with current valuations offering limited scope for further expansion, growth in corporate earnings will be the primary driver of the market returns moving forward. Hence, bottom-up stock picking with a focus on ‘Growth at a Reasonable Price’ and ‘Quality’ would be keys to generating satisfactory returns in the next one year.

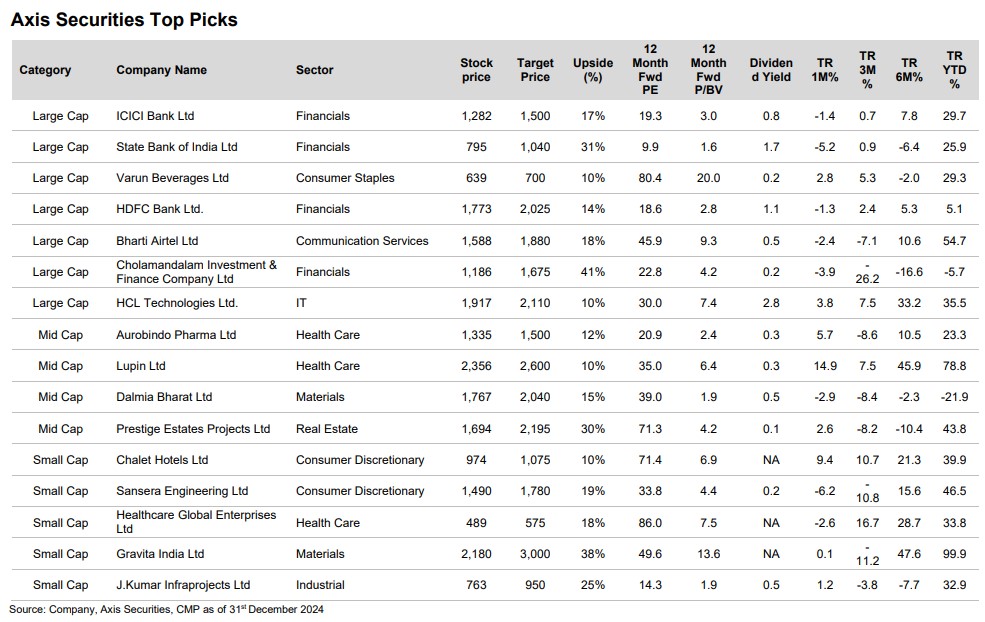

Based on the above themes, we recommend the following stocks: HDFC Bank, ICICI Bank, Dalmia Bharat, State Bank of India, HCL Tech, Lupin, Aurobindo Pharma, Healthcare Global, Varun Beverages, Gravita India, Bharti Airtel, Chalet Hotel, J Kumar Infra, Prestige Estates, Sansera Engineering, and Cholamandalam Invest and Finance

Do consider BAJEL (Bajaj electric projects) and IOC (Indian Oil Co) in your scheme of thought..