Muhurat Pick – 2024

Dear customers,

Wishing you all a Happy and Prosperous Diwali!

Indian equity, have faced some jitters in last 1 month, amid the heavy FII selling of close to ₹ 1 lakh crore amid escalated geopolitical tensions and talks of incremental flows into China given the stimulus. Nonetheless, Positive catalysts such as a) robust corporate earnings (likely to grow at 14% CAGR over FY24-26) and b) Favorable growth Inflation dynamics of India (~6-7% sustainable GDP growth with comfortable inflation of sub ~5%), continues to present Indian equity as superior proposition in this global backdrop.

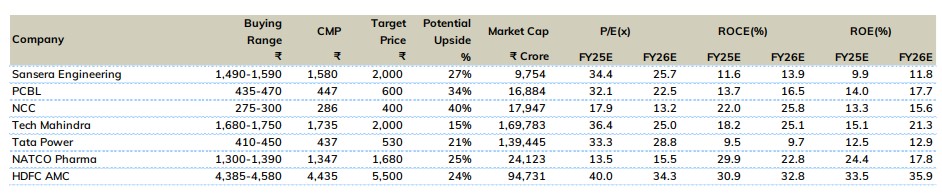

Our one year forward, Nifty target is at 27500 (22x FY26 EPS) with sectoral preference towards Capital Goods/Infra, Private Banks (and AMCs) and select Auto, IT and Pharma pack.

Keeping the key filter of quality and growth visibility, we continue to see reasonable opportunities across the market spectrum. Investors are advised to utilize equities as a key asset class for long term wealth generation by investing in quality companies with strong earnings growth and visibility, stable cash flows, RoE and RoCE.