Nifty to cross 28k levels

❑ We are constructive on markets and believe the recent correction offers good entry point to start accumulation for long term wealth generation. With modest ~7% growth expectations in Nifty earnings for FY25E (on a high base), we expect Nifty to resume its double digit earnings growth trajectory with earnings over FY25-27E expected to grow at a CAGR of 15%. Earnings growth enablers would be pick-up in domestic GDP growth rate, decline in interest rates and continued growth supportive policy framework. However, the focus going forward should be to invest in companies with certainty of growth longevity, healthy balance sheets, less susceptible to foreign shocks, capital efficient business models.

❑ Our fair value for Nifty is pegged at 28,300 wherein we have valued the index at 21x PE on FY27E. Our Sensex target is pegged at 94,300. We see healthy double-digit upside in boarder markets in CY25

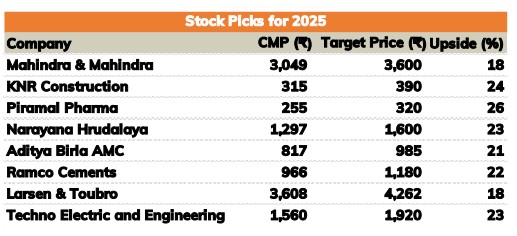

❑ Our stock picks of CY25 are reflective of key big themes such as (i) capex and infrastructure development; (ii) premiumisation and Electrification; (iii) financialization and (iv) Indian CRDMO players gearing up for global opportunities