Market Outlook: Samvat 2082 is poised to be an eventful and closely watched year for the Indian economy. Despite prevailing external headwinds, India’s domestic growth momentum remains resilient. Key macroeconomic indicators point toward a stronger performance in FY26 compared to FY25, with early projections suggesting an even more robust outlook for FY27. Both the RBI and the government are providing support to the Indian economy by front-loading pro-growth fiscal and monetary measures. These include a) A 50 bps CRR cut in Dec’24, b) A 100 bps rate cut till now, c) Improved bank liquidity, d) The RBI Dividend, e) A consumption boost provided in the budget, and f) An uptick in the government CAPEX spending. On top of this, the government has implemented GST 2.0 reforms. These developments collectively indicate that our economy is at an inflexion point and will gain benefits going forward.

Relative Underperformance Provides an Opportunity to Add Equity for the Long Term: On a YTD basis, the Indian market has underperformed the US market and other emerging markets by a notable margin. The FTSE India Index is currently trading at a PE premium of 49% to the EM Index, compared to its historical average premium of 44%. In Sep’24, the Indian market was valued at a significantly higher premium of 97% to EM peers. Following the recent correction, the current 49% premium appears more reasonable and offers a relatively attractive entry point when viewed against historical valuations. Going forward, the Indian equity market is expected to track the following four key parameters: 1) Progress on US trade deal negotiations, 2) Revival of the earnings growth cycle, which is likely to start from Q3FY26 onwards, 3) Revival in a credit growth cycle, and 4) Transmission of fiscal and monetary benefits to consumption growth.

That said, the country’s macro set-up continues to be positive and the fundamentals of Indian corporates are improving as compared to last year. The government has pivoted from CAPEX-oriented growth to consumption-led growth, and the Indian market is in a phase of adjustment to this new normal. Based on these dynamics, we believe the earnings weakness is nearing its bottom, with a broad-based recovery expected to begin from Q3FY26 onwards. Furthermore, from FY27, the full impact of GST 2.0 reforms is likely to be reflected in the economy, driving a sustained pickup in consumption demand across sectors. On the back of these expectations, double-digit earnings growth is projected for FY27, which could translate into double-digit market returns as the recovery in corporate earnings gains traction. While risk-reward is slowly building towards Mid and Smallcaps, recovery is expected to be gradual as we move ahead in the SAMVAT.

Considering the positive attributes of the Indian economy, we present the following themes for Samvat 2082:

• Private banks as a play on the uptick in the credit growth cycle • Discretionary consumption plays via Hotels, Auto Ancillary, and Retail stationary

• Play in the value chain of the Power sector with capacity expansion and investment in the transmission sector

• Export recovery play in Indian Midcap IT companies

• Asset-light Hub and spoke play in the Hospital sector

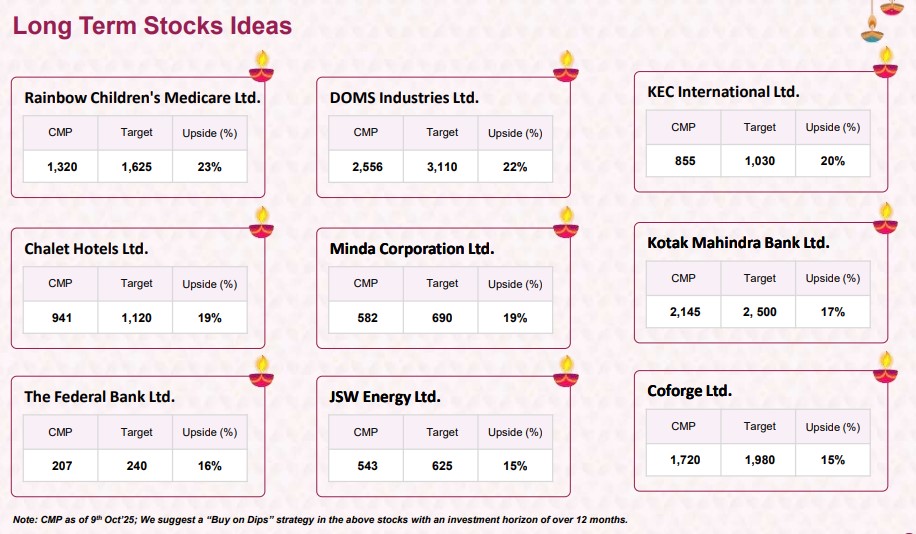

Based on these themes, our Diwali Picks are: Kotak Mahindra Bank, Federal Bank, JSW Energy, Coforge Ltd, DOMs Industries, Chalet Hotel, Rainbow Children’s Medicare, Minda Corp, and KEC International