Rs 6.69 crore earned in 88 days with maximum drawdown of Rs 1 crore

According to the latest ranking of historical performance released by the Indian Trading League, a trader named Gaurav Reddy reported an earning of Rs 6.69 crore in a period of 88 days. His maximum drawdown is Rs 1 crore.

Another trader nicknamed ‘Realistic Trading’ came second with an earning of Rs 1.5 crore in 188 days with a max drawdown of Rs 6.9 lakh. Another nicknamed ‘Overtrader’ came third with an earning of Rs 1.33 crore in 63 days and a max drawdown of Rs 7.7 lakh.

Top 10 historical performances reported by stock market participants as of trade date Sat Jan 20 2024.

Criteria:

Continuous days of #VerifiedBySensibull P&L.

Sorted by net P&L.

Red and green arrows show direction of change from previous day.

Only realized P&L is considered. pic.twitter.com/aCaGYFqyqd— Indian Trader League (@indtraderleague) January 23, 2024

Reddy is a 27 year old youth based in Hyderabad. He describes himself as a “Discretionary Derivatives Trader” and trades exclusively in the Nifty options. He is a directional trader and buys or sells Call and Put options depending on his perception of whether the market is Bullish or Bearish.

Reddy’s capital is about Rs 3 crore. He trades with only a laptop. He does not have multiple screens nor does he have any indicators on the screen. He takes trading decisions based on Price Action, Open Interest and the prevailing mood of the market.

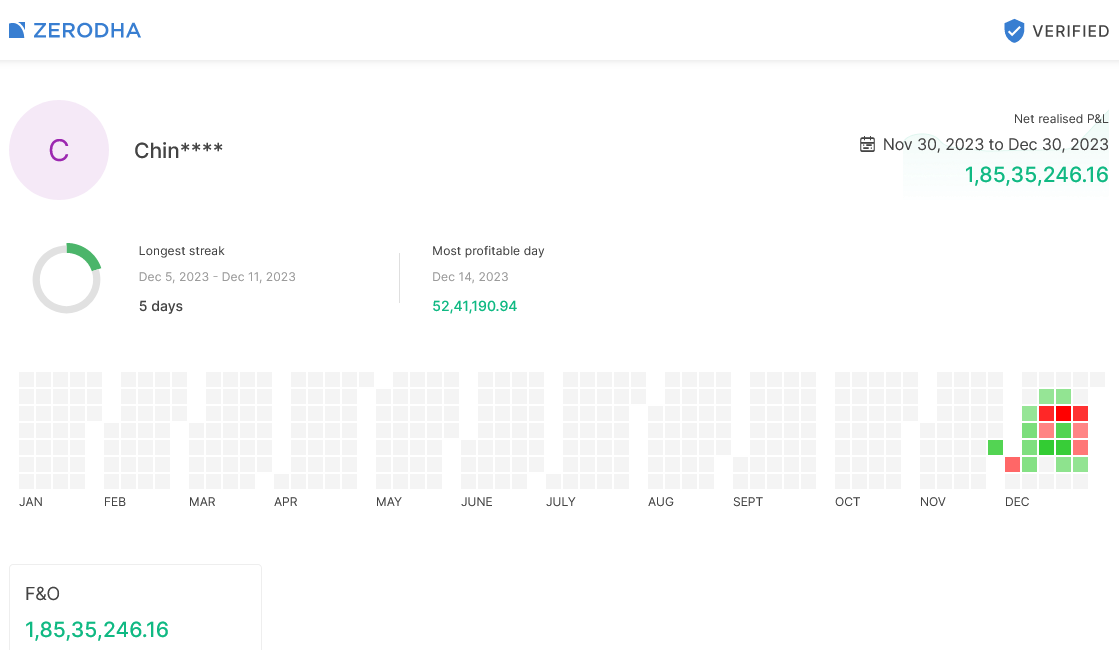

Rs 1.85 crore earned in December 2023

For the month of December 2023, Reddy reported verified earning of Rs 1.85 crore. 14th December was his most profitable day in the month with an earning of Rs 52.41 lakh. He had a streak of 5 winning days in the month.

Check out my P&L #VerifiedByZerodha https://t.co/QpBcYFmu3h

December Series performance.

— Gaurav Reddy (@Gaurav_Red) December 30, 2023

Directional trading has huge risks

While directional trading can shower handsome gains in one is right in predicting the direction of the market, it backfires badly if one is wrong.

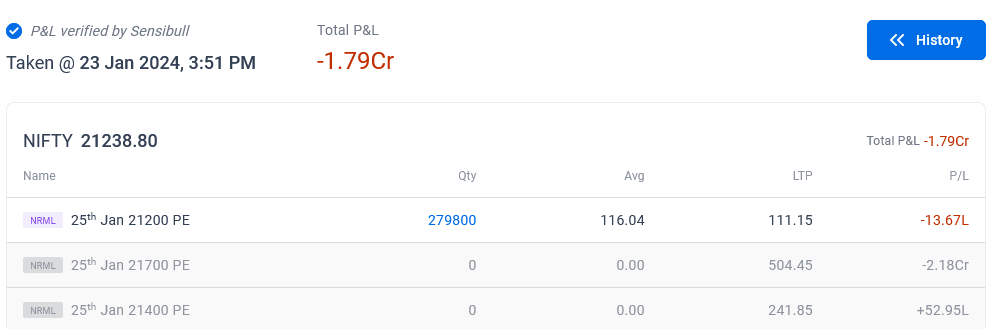

Reddy realized this the hard way recently when he was bullish and sold 57100 nos of Nifty Put Options of the strike price of 21700 at the average price of Rs 170.

To his bad luck, the markets opened with a gap down and the short Put options exploded in value to Rs 504. The Nifty closed at 21238, leaving Reddy with a loss of Rs 2.18 crore from that option.

The loss, after adjusting some gain from the Put options bought as a hedge, was Rs 1.79 crore.

On that day itself, Reddy bought a mammoth quantity of 2,79,800 Nifty Put Options of the strike price of Rs 21200 and carried them forward in the expectation that the Nifty would continue its bearish streak.

However, to his bad luck, on the next day (24th December), the Nifty surged upwards. It is not known when Reddy covered the long Put options and how much loss he suffered that day.

Understandably, the hectic trading with the mammoth quantities and the huge gains & loss took its toll on Reddy.

“The past few days volatility has been rough….going to take a break from trading for a while,” he said candidly.

The past few days volatility has been rough….going to take a break from trading for a while

— Gaurav Reddy (@Gaurav_Red) January 24, 2024

Reddy also fairly disclosed that his mammoth trading had exceeded a notional value of Rs 500 crore and fallen foul of SEBI’s margin regulations. His margin money is blocked for three months and he will be unable to trade in that period.

I always believed in being transparent….I shared my journey with all of you and really appreciate everyone who cheered me on thru wins and losses ….to everyone wondering why I’m taking a break and when I will start posting again …the thing is recently when I took a big hit and… pic.twitter.com/k1gPzoSNmL

— Gaurav Reddy (@Gaurav_Red) January 28, 2024