Pharma

Pharma Back on Growth Track

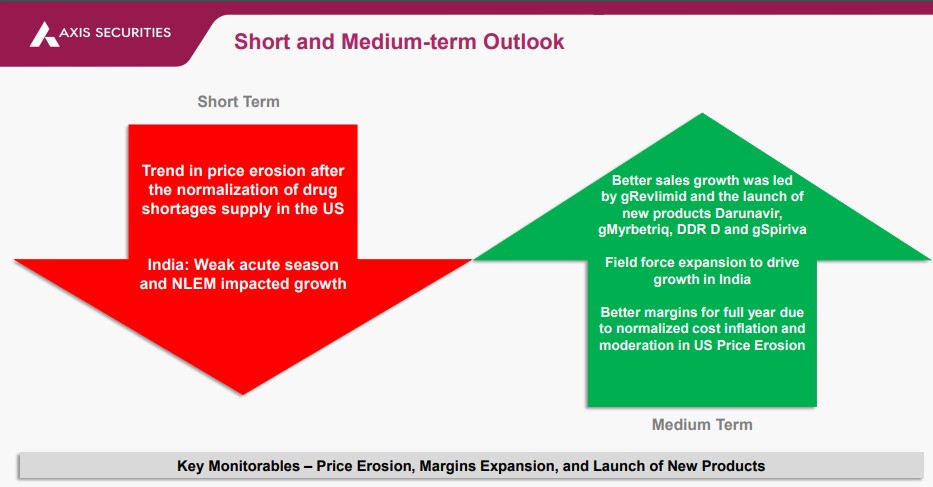

▪ High single-digit domestic growth is expected in FY25E. Growth in the US market is projected to remain robust, driven by price normalization in the base business, continued ramp-up of gRevlimid, and new product launches, including Darunavir, gMyrbetriq, DRR D, and gSpiriva.

▪ In the US business, supply constraints have led to a significant reduction in price erosion, which is anticipated to stay low for the rest of FY25E.

▪ In India, growth has primarily been fueled by price increases and strong performance in chronic therapies, with most major companies forecasting high single-digit growth for FY25E.

▪ Margins are expected to improve as raw material and freight costs stabilize, US price erosion moderates, and a better product mix is achieved.

However, USFDA inspections remain a risk factor, and price erosion in the US could accelerate once supply constraints ease.

▪ Given these dynamics, the focus remains on companies launching niche products in the US market and those with a strong chronic portfolio in the Indian market.

▪ Top Sector Ideas : LUPIN, KIMS, and Aurobindo are the preferred selections within the Pharma sector.