Sudden plunge in the Indices caught traders off-guard

A study of the Bank Nifty chart shows that it was comfortably cruising in the range of 43900 to 44000 till about 14 hours IST. However, at 1415 hours, the Bank Nifty suddenly plunged and broke its first suport at 43800. Thereafter, it plunged non-stop and broke the second support at 43725. This led to a vertical fall which was stopped only by the ringing of the closing bell. It finally closed at 43498, down a whopping 550 points.

A similar story was repeated in the Nifty.

Traders report losses

Not surprisingly, most traders wore grim faces as they wearily reported their MTM losses.

“Worst market today … why reversal of tend came on expiry day ?,” Aakansha Gupta, a young and popular trader-cum-trainer complained.

She reported a loss of Rs 15 lakh. “Worst day as I saw my biggest loss today but covered most of it by selling aggressive calls,” she stated.

Worst market today … why reversal of tend came on expiry day ?

— Aakanksha Gupta (@aakankshalovely) December 15, 2022

Loss of 15lacs+ … worst day as I saw my biggest loss today but covered most of it by selling aggressive calls @gocharting is having some issue in their software, will share through it once they fix issue pic.twitter.com/PXkF5WI61u

— Aakanksha Gupta (@aakankshalovely) December 15, 2022

Another trader reported a loss of Rs 14 lakh. “Was not expecting 43700 to be taken out. Back to back second tough expiry for me,” he candidly stated.

14L loss. Was not expecting 43700 to be taken out. Back to back second tough expiry for me…

— Ronak Unadkat (@Ronak_Unadkat) December 15, 2022

However, everyone was taken aback at the disclosure of Ashesh Mehta, also a well-known trader. In his bio, Mehta describes himself as an “Index Option Buyer! Made a Fortune trading in Nifty and BankNifty.”

“4.40 Cr Loss. Booked 2 cr loss in the morning. Covered almost all loss in 44700 PE buy. The last hour insane selling took away almost 4Cr in a jiffy…Poor risk management cost heavily today,” he said bravely trying to keep a straight face.

4.40 Cr Loss.

Booked 2 cr loss in the morning. Covered almost all loss in 44700 PE buy. The last hour insane selling took away almost 4Cr in a jiffy…Poor risk management cost heavily today.

Check out my P&L – #VerifiedBySensibull https://t.co/9l7iN07MNC— Ashesh Mehta (@bulkindextrader) December 15, 2022

He also disclosed that his capital was Rs 11.50 crore and that the loss was 38% of the capital.

38% Drawdown

— Ashesh Mehta (@bulkindextrader) December 15, 2022

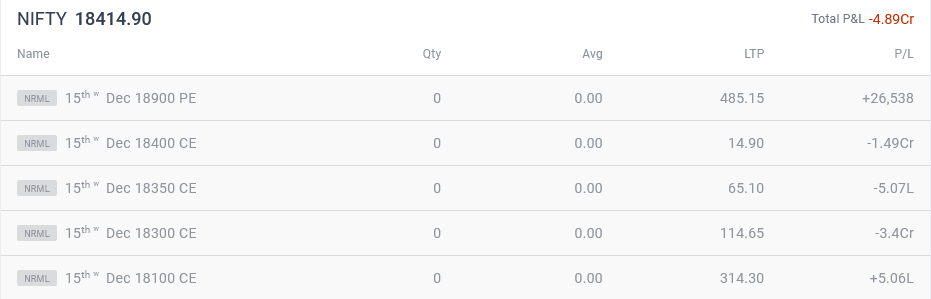

A study of the verified screenshot shows that maximum loss was suffered because the trader was ultra-bullish and had bought truckloads of calls of the 18300CE and 18400CE. However, the sudden downturn trapped him and he suffered a loss of Rs 3.4 crore and Rs 1.49 crore in the two Calls respectively.

Mehta made it clear that he is not overwhelmed by the loss but is actively planning the recovery mechanism. “Market is supreme and you have respect and Move on,” he stated in a philosophical manner.

Having said that….As a trader you have to back yourself and plan the recovery path rather than going in Zen mode. Market is supreme and you have respect and Move on.

— Ashesh Mehta (@bulkindextrader) December 15, 2022