Pick and shovel approach is better

He explained we could bet on this theme through direct and indirect plays. The direct play would be through the OEMs which have taken a lead in EV. The better way to play that is to play component suppliers into the EV theme. He disclosed that he and his fund have done that early by betting on some of the ER&D software companies.

“If you want to play an India opportunity, you buy an auto ancillary or a battery company. You want to play a global EV opportunity, you buy a software company because for them the customers are global,” he said.

“Right now, the most efficient way to play this theme is to do it indirectly. It is like a pick and shovel approach, You do not want to buy the diamond company but you want to buy the guy who is mining the diamond and I think you have to do the same thing when it comes to these two themes,” he added.

Tata Elxsi & KPIT are classic examples of EV beneficiaries

Ved explained that Tata Elxsi and KPIT are two classic examples of companies that benefit from the whole electric vehicle revolution around the world because they are not limited to India. They are supplying software and technology to all the OEMs around the world so the globe is their market and this is a global opportunity, not just an India opportunity.

“In these two, there is a very long-term trend and we will find more companies over the next couple of years where we will be able to bet directly,” he added.

It is worth recalling that both stocks have been recommended to us many times earlier by Hiren Ved. Both stocks have blossomed into magnificent multibaggers in the past few years.

Amara Raja to set up Giga factories for manufacturing Li cells and offer battery pack and EV charging solutions

Taking a cue from Hiren Ved, we can look at other ancillary companies in the EV space such as Amara Raja, the second-largest lead-acid battery manufacturer in India which is making a foray into the EV sector.

In a press release to the stock exchanges, Amara stated that the demand signals for electric mobility are becoming more definitive. “In the long run, it is critical to create a domestic capability across the entire value chain. We are keenly engaged in creating India centric eco-system for the design, development, and manufacturing of advanced cell technologies,” Vijayanand Samudrala, President- New Energy said.

Amara Raja Group’s New Energy Business unit will be the new growth engine, he said. Last year, the company repositioned itself as an “energy and mobility” player in the industry as it seeks to expand its portfolio to cater to electric vehicle (EV) demand and other home energy solutions. Amara Raja’s strategy of “future-proofing” the business includes expanding the core lead acid batteries business inclusing lithium cell and battery pack, electric vehicle (EV) chargers, energy storage systems, etc.

“We have invested in a state-of-the-art R&D facility to develop advanced cell chemistry batteries for electric mobility and stationary energy storage applications. Amara Raja has charted out a road map to invest into Giga factories for manufacturing Li cells and offer battery pack and EV charging solutions for the fast-emerging electric vehicle sector, renewable energy markets, and energy storage systems,” the company said.

“New age energy storage technologies and manufacturing landscape in India is coming of age and is expected to gain pace in the coming years, thanks to proactive policy drive from the Central and State Governments,” Samudrala said.

The company is using multiple technology choices available to choose from for cell chemistry and form factors such as NMC (Nickel Manganese Cobalt), LFP (lithium ferro-phosphate), LTO (lithium-titanium-oxide), etc. in cylindrical, prismatic, and pouch form factors. “Amara Raja is focusing on developing NMC and LFP chemistries for the Indian market. In addition to offering its battery packs to Battery Electric Vehicles (BEVS), the company offers battery packs for various other niche applications,” Samudrala said.

It developed the HV Li-Ion Battery pack for e-Mobility application, active liquid cooling system, etc. with IoT features. In addition, the company has also invested in promising technology start-ups in the Li-ion technology space and is continuing to explore opportunities to develop globally competitive technology and manufacturing infrastructure as part of the Giga factory investments.

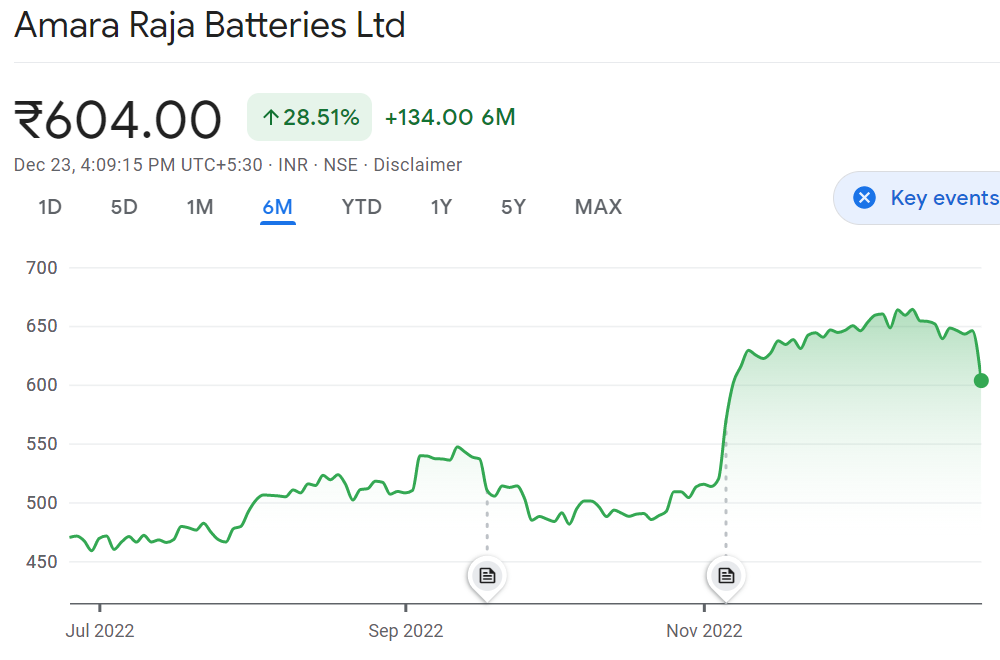

Amara Raja’s stock reacted favourably to the announcement though it has still underperformed.

Leave a Reply