Saurabh Mukherjea of Marcellus PMS Fund is known to be very bullish about Divis Labs. Earlier, in June 2022, when the stock had dipped, Saurabh had stated that he is “delighted” that investors are dumping the stock and that he is buying it aggressively at cheap prices.

"We are delighted investors are selling Divi's Labs. We are buying it on a daily basis": Saurabh Mukherjea has explained that no other Indian Pharma Co comes close to Divi's and that investors are making a big mistake by dumping it indiscriminately https://t.co/5kwET8HoET pic.twitter.com/HYNIHfAW8k

— RJ Stocks (@RakJhun) June 19, 2022

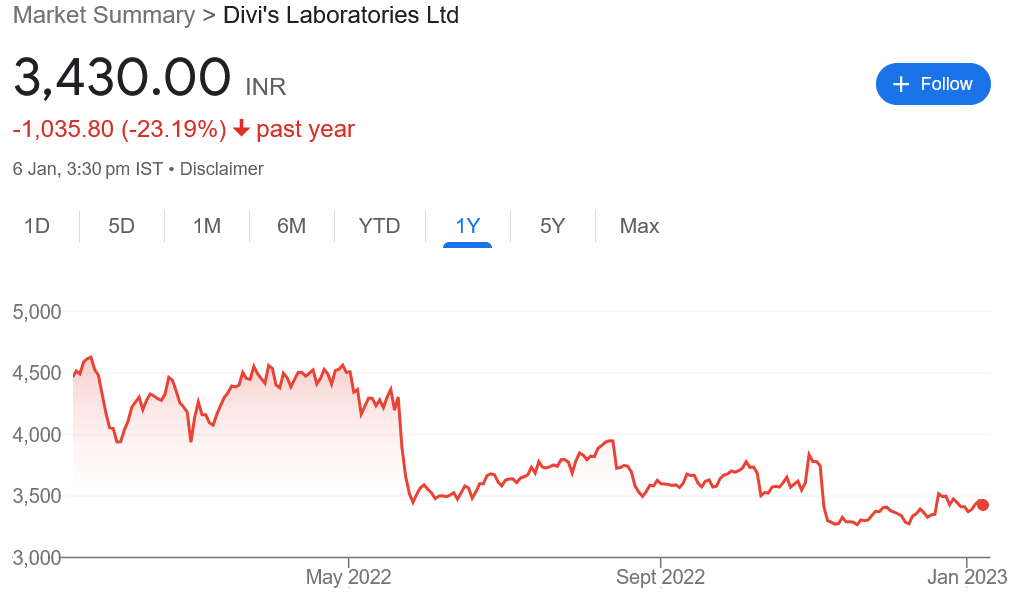

However, to everyone’s disappointment, the stock has continued dipping and is not showing signs of recovery. It is down 24% on a YoY basis.

So, Team Marcellus has released a detailed analysis report of what is ailing the stock and what are its future prospects.

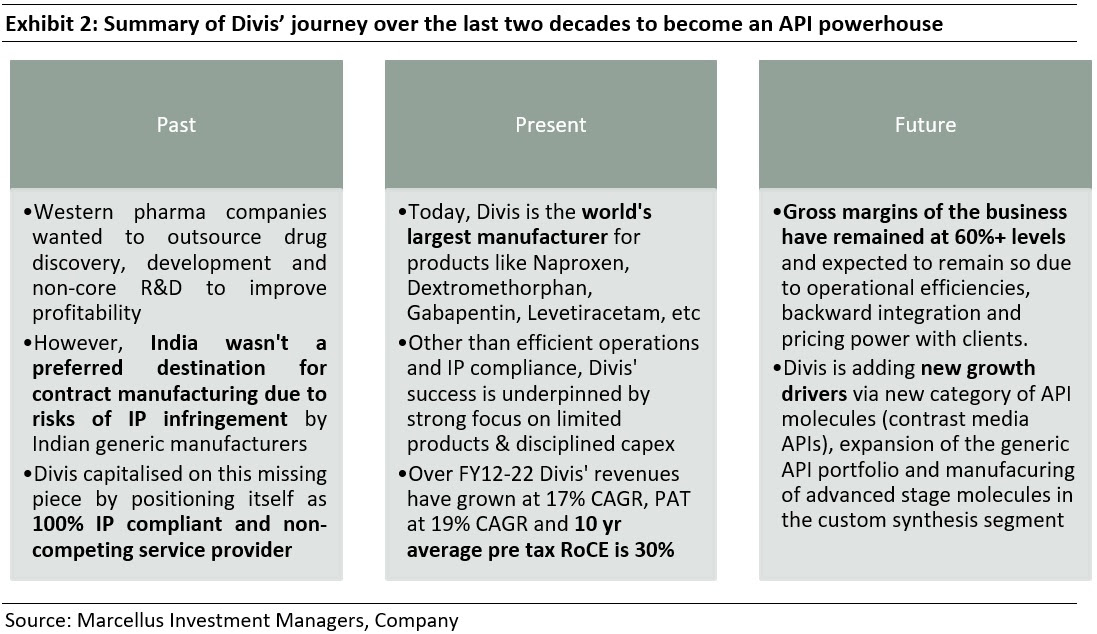

It is pointed out that Divis is a leading global manufacturer of generic APIs and a large-scale custom manufacturer of APIs for big pharma companies from both US and Europe. It is the world’s largest manufacturer for multiple APIs like Naproxen, Dextromethorphan, Gabapentin, Levetiracetam, etc. For Naproxen and Dextromethorphan, Divi’s accounts for over 70% of global market share (Source: Business Standard). In addition to its generic API business, Divi’s has a very large custom manufacturing business where some of world’s biggest pharma companies like Novartis, Sanofi, GSK, and Merck are its clients. Over the last decade (FY12-22), Divi’s revenues have grown at 17% CAGR, its PAT has grown at ~19% CAGR, FCF CAGR at ~38% and its 10-year average ROCE (pre-tax) has been ~30%.

However, the problem is that Divis’ business mix and segmental growth varies significantly every quarter as the custom synthesis business by its nature is unpredictable and lumpy. This is because the demand in this segment depends on success of client’s products and competitive intensity for client’s products. As a result, Divis’ revenues tend to be volatile, and this leads to short term share price volatility as well.

In Q2FY23 as well, Divis’ revenues were affected by the unpredictable nature of custom synthesis business as this segment reported a 33.3% QoQ decline amounting to around 400 crore rupees. Around 60% of this reduction was due to reduced supplies of covid drug which was expected to be a limited time opportunity. The rest of the decline is primarily on account of lumpy offtakes of certain non-covid products in Q1FY23 which impacted the volumes in Q2.

This has led to the sell-off in the stock price.

The experts at Marcellus have confirmed that they remain confident about Divis’ future prospects because of the following factors:

(i) The generics API segment of company has stabilised and started growing as the use of non-covid medicines around the world returns to normal levels

(ii) Although the generic APIs business was bigger contributor of revenues in Q2FY23 with 57% share vs 47% in preceding quarter, the gross margins of the company have remained very stable and healthy at around 63%. This points to

(a) the efficiencies that company has been able to build in its generics manufacturing;

(b) the benefit it is deriving from several backward integration projects completed in last 2 years; and

(c) pricing power based on the track record of timely supplies with quality and compliance adherence.

(iii) Divis is building on its strengths and execution track record to add multiple growth drivers in the coming years as per management’s commentary in recent quarterly conference call. Potential new drivers of growth include:

(iv) Supply of new category of APIs – contrast media APIs to global big pharma companies having global sales of ~ $5 bn. As per management, client validation has already been completed by one big pharma company and Divis is filing with regulatory authorities for approval. At the same time, validation process is underway for another global big pharma company

(v) The generics API portfolio of the company is set to expand over FY23-FY25 as many of the molecules targeted by Divi’s go off-patent over this duration. The current end market sales value of these molecules is around $20 billion. Divi’s has started filing paperwork for some of these molecules with the regulators in order to start commercial supplies

(vi) Divis is getting increased queries for manufacturing of more advanced stage molecules in its custom synthesis segment as its performance with Molnupiravir positions it uniquely for those products where the big pharma clients expect regulatory approvals and fast commercialisation (requiring large scale manufacturing in short period). Divis has already received two such molecules in the recent quarter.

At the end of the dissertation, the experts have opined that the initiatives highlighted above are expected to drive strong growth for the company in years to come and given that there’s no discernible deterioration in the business’ underlying moats, the stock’s correction in CY22 is an opportunity to buy the stock and/or to increase its position sizing in the portfolio.

Leave a Reply