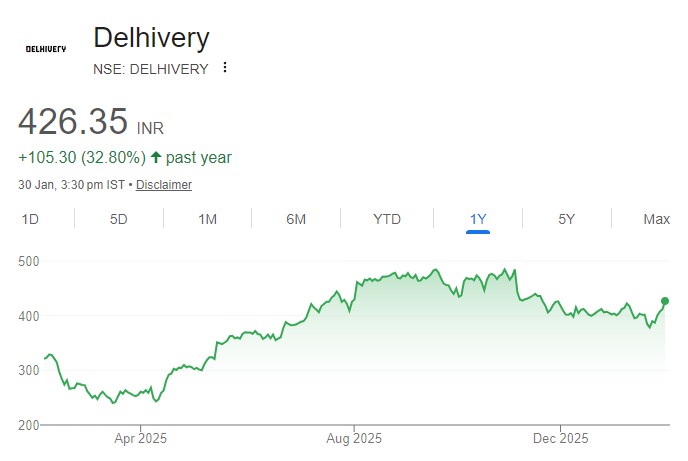

The integration of Ecom Express is set to enhance network efficiency and reduce capital...

Arjun

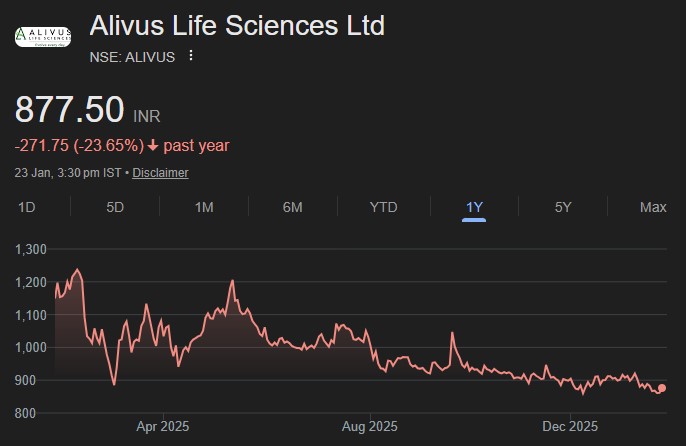

RCML’s expertise in the most case-sensitive healthcare cohort that is paediatric and perinatal care...

Given likely strong cash flow generation, we see SRIN to step up new project...

DLF has a strong land bank (development potential of 188msf (70%+ in Gurgaon) of...

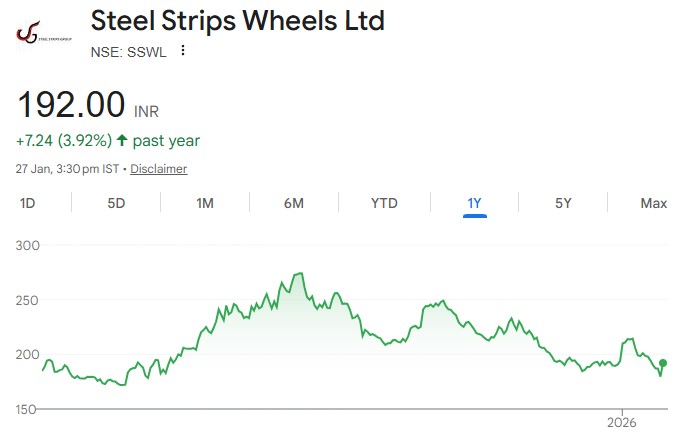

We expect EBITDA per wheel to rise to Rs 264 in FY27E and Rs...

RKL’s revenues and PAT are expected to grow at CAGR of 19% and 38%...

TATVA expects SDA revenue growth to sustain, with new customers’ offtake in CY26 and...

The company is also into CDMO services (~7% of FY25 revenues) catering to a...

The company is on track to expand its production capacity from 5 Mn ton...

ITC Hotels registered resilient performance in Q3FY26 aided by strong wedding, MICE and corporate...