The excitement around recent Anti-dumping duty (ADD) in NBR is waning as finance ministry...

Arjun

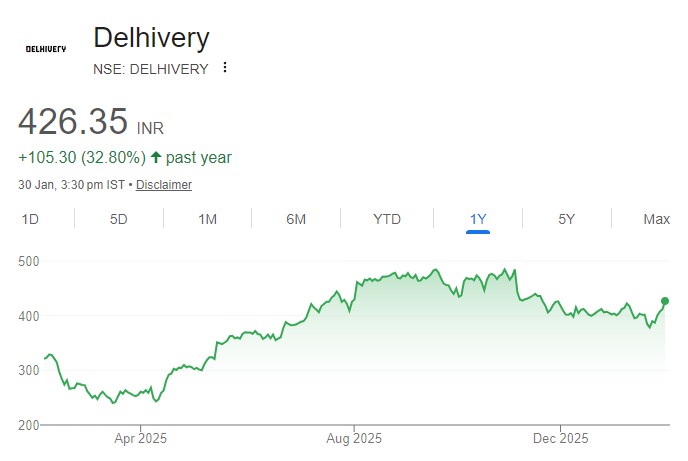

The integration of Ecom Express is set to enhance network efficiency and reduce capital...

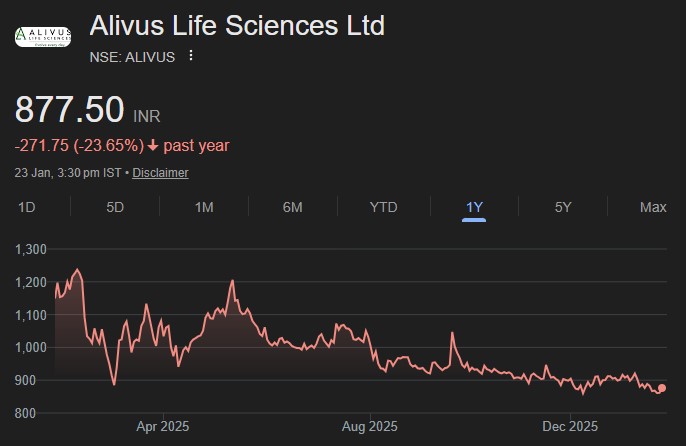

RCML’s expertise in the most case-sensitive healthcare cohort that is paediatric and perinatal care...

Given likely strong cash flow generation, we see SRIN to step up new project...

DLF has a strong land bank (development potential of 188msf (70%+ in Gurgaon) of...

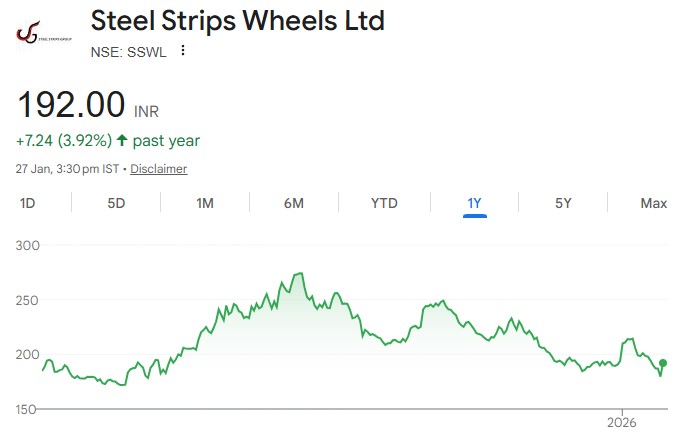

We expect EBITDA per wheel to rise to Rs 264 in FY27E and Rs...

RKL’s revenues and PAT are expected to grow at CAGR of 19% and 38%...

TATVA expects SDA revenue growth to sustain, with new customers’ offtake in CY26 and...

The company is also into CDMO services (~7% of FY25 revenues) catering to a...

The company is on track to expand its production capacity from 5 Mn ton...