Lock-in period for 20 IPO stocks ends in November

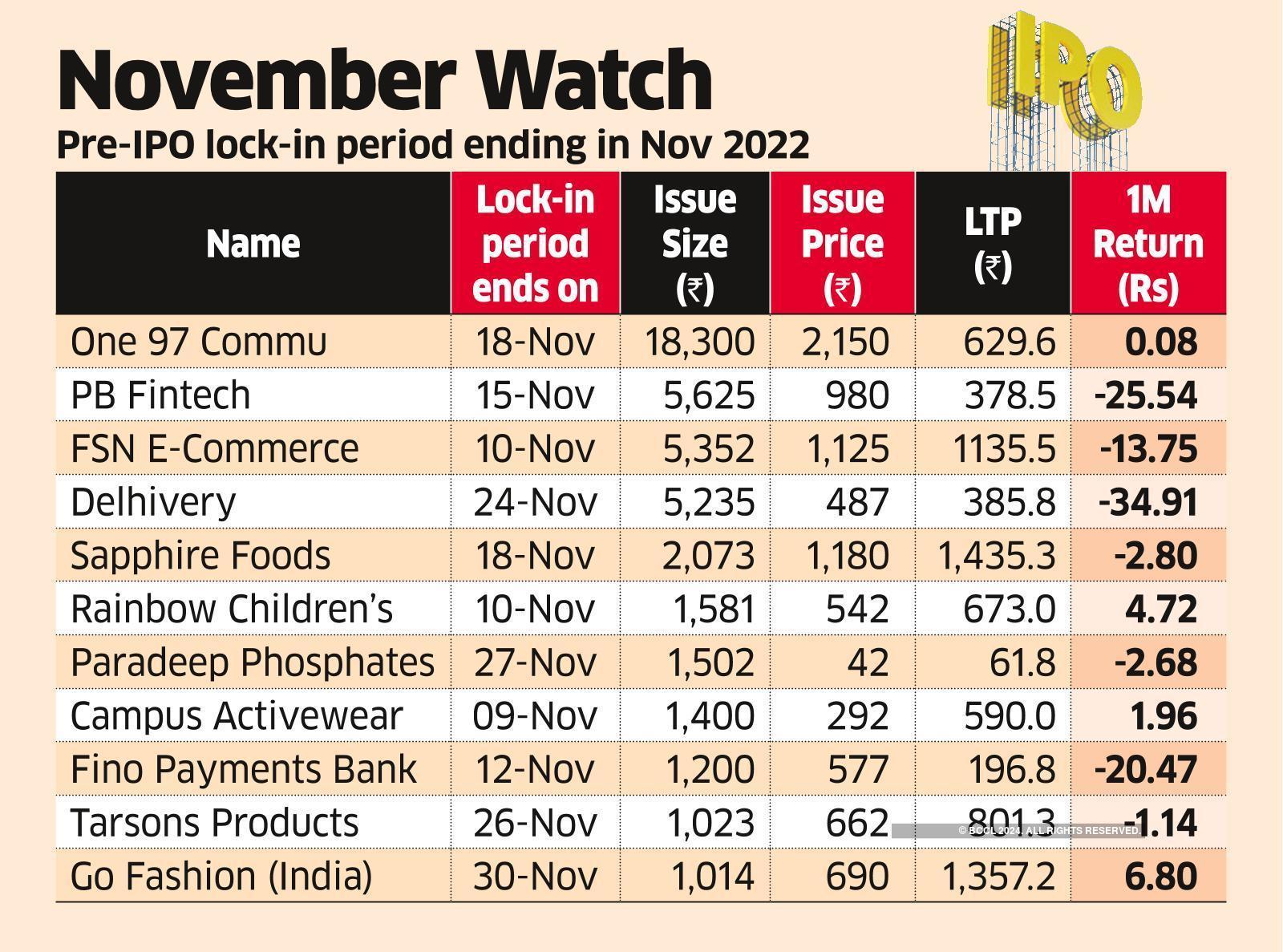

According to a report in the ET, November could see a massive supply of shares of nearly 20 companies, including Paytm, Nykaa, Delhivery and PB Fintech that went public last November or in May this year, as the lock-in period will end for investors in pre-IPO placements as well as for promoters.

It is pointed out that SEBI cut the lock-in period for investors who purchase shares in a pre-IPO issue, or promoters’ shareholding in excess of 20%, to six months from one year effective from April this year.

So, pre-IPO investors need to compulsory hold the shares for six months from the IPO, while promoters must hold a minimum of 20% for a year.

ET pointed out that eight companies including Delhivery, Rainbow Children’s Medicare, Paradeep Phosphates and Campus Activewear went public after April this year, and the locked-in period for them will end next month. Paytm owner One97 Communications, PB Fintech, Nykaa parent FSN E-Commerce, Sapphire Foods and Fino Payments Bank were among eleven that will complete one year as publicly listed companies in November. These companies come under the one-year locked-in period rule.

November Rain ?

₹1 lakh Cr worth of shares get unlocked ?

New age companies to see pre-IPO lock-in expire?

Share prices could be jittery ?

Potential buyers might be spoilt for choice ? #Nykaa #Paytm #PBFintech #Delhivery #StockMarket

pic.twitter.com/txUmmvFwYV— Nigel D'Souza (@Nigel__DSouza) October 28, 2022

Deluge of selling expected

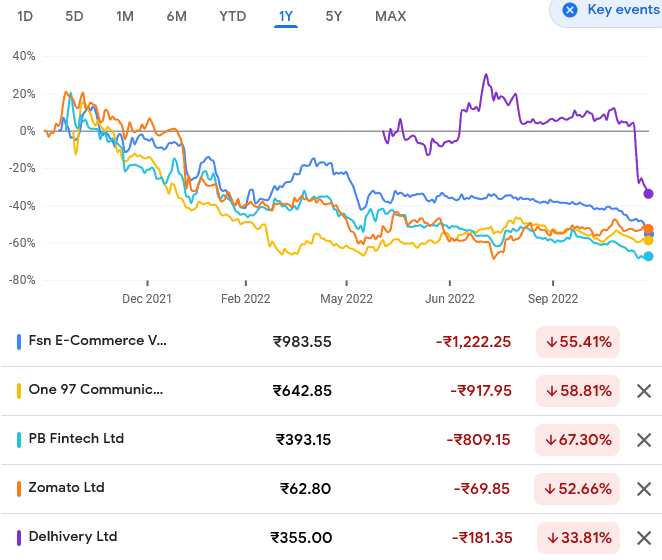

Past experience in stocks like Zomato shows that the anchor investors are eager to get out of the stocks as soon as the lock-in ends. Zomatos’ shares plunged 22% in July, immediately after the one-year lock-in period ended, as some of the pre-IPO investors including Uber and Tiger Global offloaded stakes.

Sachin Dixit of JM Financial was very blunt: “As new-age companies such as Nykaa, PB Fintech, Delhivery, and Paytm are expected to see their lock-in expire in November, potential buyers might be spoilt for choice. Hence, there could be a sharp dip in share prices if even a small set of investors decide to liquidate their position,” he warned in the ET report.

A similar sentiment was echoed by Dharmesh Mehta of DAM Capital: “These stocks may see some profit-booking if the pre-IPO shareholders decide to offload part of their holdings,” he said without mincing any words.

67% of Nykaa to be open for sale

ET said that in the case of Nykaa, the anchor investors’ lock-in period will expire on November 10 and about 67% of the share capital, or around 319 million shares, will open for trade on the lock-in expiry day.

Other investors are already bolting from the stock. The shares have declined 21% in the last one month and are currently trading below the IPO price of ₹1,125.

Why Nykaa is selling off today? pic.twitter.com/jaO8IHzx4U

— Mangalam Maloo (@blitzkreigm) October 28, 2022

Nykaa hits a new low today

stock down 6% now

-CTO sanjay suri resigns

-lock in period for pre ipo investors to expire on nov 10

-stock down 53% in 2022 so far

-stock now down 13% from IPO issue price of 1125rs— Sonia Shenoy (@_soniashenoy) October 28, 2022

Policybazaar (aka PB Fintech) is in a similar soup. Its shares have declined nearly 61% from the offer price. Its pre-IPO shareholders’ lock-in period will expire on November 15 and analysts expect about 28 million shares to open up.

Paytm’s share price has plunged 70% from the IPO price of ₹2,150. Shares of Delhivery have crashed to a record low as the company’s stock has tumbled over 30% in two days on a muted growth outlook. The lock-in period will end on November 18 for Paytm and November 24 for Delhivery.

?#IPO

Via @FreeturnsHQ pic.twitter.com/fdMkKwNq4V— Finance Memes (@Qid_Memez) October 30, 2022

Discretion is better than valour

Some veterans on Dalal Street advised investors in these new-age stocks to not cry over spilt milk. Instead, they should re-evaluate their rationale for investment in these stocks. If the rationale is not convincing, it is better to cut the losses and invest the funds in other stocks with better prospects, they said.