When Blackstone entered India with a bulging bank balance and high optimism, it bought everything in sight. Unfortunately, you have to pay a steep price for making indiscriminate investments as Blackstone has now realized.

The Financial Express has put together a grim story detailing the crippling losses that Blackstone India has suffered on its investments in India.

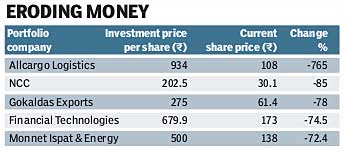

Blackstone invested $158.7 million in garments exporter Gokaldas Exports in August 2007 at a price of Rs. 275 per share for a stake of 68.27%. At today’s share price of Rs. 61.4, Blackstone has suffered a staggering loss of 78%.

In September 2007, Blackstone invested Rs. 617 crore in NCC for a stake of 20.14%. The price paid per share was between Rs. 202.5 and Rs. 225 per share. Today, the shares are trading at Rs. 30 each.

Financial Technologies was another disaster. In August 2012, Blackstone bought a 7.02% stake at Rs. 679 each. Today, the shares are trading at Rs. 173 each.

Yet another horror story is Monnet Ispat & Energy where Blackstone invested $50 million (Rs. 230 crore) in 2011 for a stake of 7.12%. It paid Rs. 500 per share which is currently trading at Rs. 138 each. Blackstone has lost 72.4% of its investment.

Wait, there’s more. In February 2008, Blackstone invested Rs. 242 crore in Allcargo Global Logistics for a stake of 10.4%. It paid Rs. 934 per share. It pumped in a further $23 million (Rs. 110.4 crore) in 2009. At the prevailing share price of Rs. 108, Balckstone has lost 88% of its investment.

Yet another fiasco that FE missed is Blackstone’s investment in VIP Industries. While Rakesh Jhunjhunwala bought the stock at Rs. 13 (adjusted for split), Blackstone bought it at about Rs.200. The result, at the CMP of Rs.60, Rakesh Jhunjhunwala is sitting on a pretty multibagger profit while Blackstone is staring at a loss of 70% of its investment.

Now, when the top brass sitting pretty in New York woke up to the unmitigated fiasco in Blackstone India, they were shell-shocked and livid. The first thing they have done is to put Blackstone India’s boss man Akhil Gupta to pasture in the post of “non-executive chairman”. In his place, fresh and dynamic blood in the form of Amit Dixit and Mathew Cyriac have been roped in to save the beleaguered investing firm from disaster.

Hopefully, the new top brass will exercise more discretion before rushing off to sign the cheques. Maybe they can learn a few tips from Pulak Chandan Prasad, the founder of Nalanda Capital Pte Ltd, on what safeguards have to be taken before making equity investments.

Blackstone India, however, managed to salvage some pride when it sold its 13.1% stake in Emcure Pharmaceuticals to Bain Capital for Rs 700 crore. The investment of Rs. 230 crore in Emcure had been made in 2006. Blackstone made a handsome 3 fold gain on the seven year-old investment.

However, the question is whether Blackstone exited too early. Emcure reported good results. Its revenue is about Rs 2,800 crore with an operating profit of Rs 600 crore and net profit of around Rs 250 crore. Also, Emcure has filed a DRHP for an initial public offer.

Post the IPO, Emcure may have a higher value than the enterprise value of Rs. 6,000 crore ($1 billion) that Blackstone sold it for. So, what was the great hurry to sell a winning investment? Yet another fiasco?

Looot gaya Bechaara. Khaaye ga avi Chaara.