Exasperating farrago of novice investors masquerading as Gurus

The response of the novices was both shocking and baffling.

“Is AM Naik an equity analyst that he is giving price targets? The matter should be reported to SEBI,” the novices fumed, their knickers in a twist.

The hostile reaction was in response to a soothing comment by AM Naik, the legendary chief of L&T, that he is turning around the fortunes of L&T Finance Holdings.

Also, because novice investors are accustomed to price targets, he spelt them out in plain terms:

“We made some changes in L&T Finance and it is now on track to growing return on equity. This will drive share prices more and it will cross Rs 100 in three-four months and Rs 150 by December next year. Anything that grows well, can manage well, can compete well and can have interlinking businesses with the rest of L&T, is core.”

I tried explaining to the novices that they should take advantage of AM Naik’s visionary abilities and queue up obediently to buy the stock.

However, if people are unwilling to listen to the wisdom of a living legend, where is the question of their listening to an ultra-novice like me?

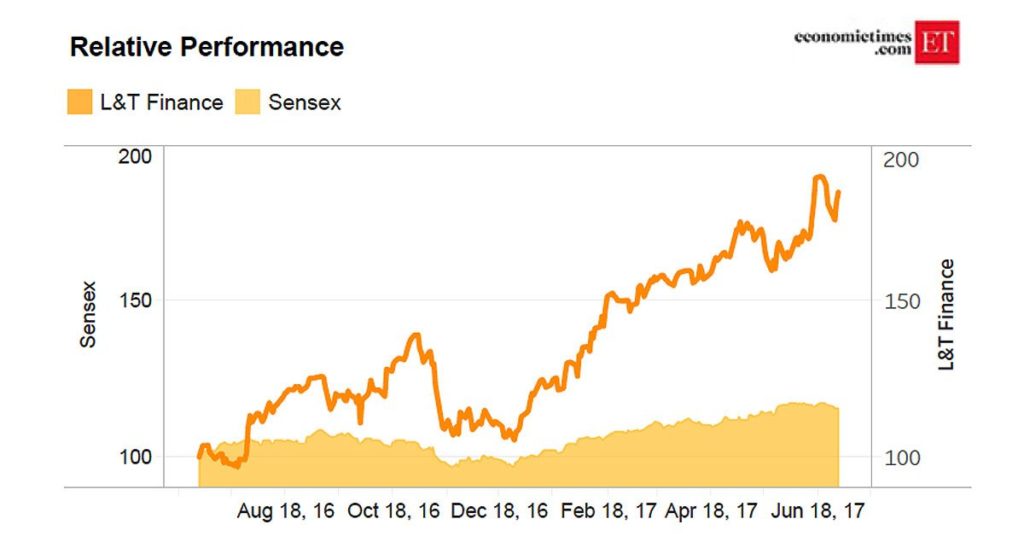

Hefty gains of 65% have come in just 9 months

Anyway, to cut a long story short, both the price targets solemnly assured by AM Naik have been delivered by L&T Finance.

The first price target of Rs. 100 was achieved in October 2016.

They say the chairman is the best analyst of a stock and thats true for L&T FINANCE HOLDINGS LTD. atleast…TP came early 😉

— Nigel D'Souza (@Nigel__DSouza) October 14, 2016

The second price target of Rs. 150 was achieved on 6th July 2017.

L&T Finance Holdings hits 150….Mr AM NAIK predicted in Sep 2016 it could reach 150 by December 2017….sure he will be very happy man 🙂

— Varinder Bansal (@varinder_bansal) July 6, 2017

In fact, AM Naik is ahead of time because while he promised that the target price of Rs. 150 would be achieved in December 2017, it has been done in June 2017 itself.

L&T Finance will see better days: ET

Luckily, it is still not too late to make amends. More gains are due from the stock.

Narendra Nathan of ET has done a lot of number crunching and opined that L&T Finance will see better days.

Low NPAs

“Improvement in asset quality is another point that needs to be mentioned. Though gross nonperforming assets (NPA) grew 9 basis points to 4.95% in the fourth quarter, the company made excess provisions and brought down its net NPA by 93 basis points to 2.89%. This voluntary provisioning include Rs. 186 crore charged to this year’s profit and another Rs. 352 crore from the benefits it gained due to the merger of group entities L&T Finance, L&T Fincorp & L&T Family Credit. With this additional provisioning cushion, L&T Finance Holdings is ready for a smooth transition to the 90 days NPA recognition regime. Analysts also expect that its gross and net NPAs will go below 4% and 2% respectively by 2018-19.”

Strategy of reducing non-core business will increase RoE

“The company’s well articulated business restructuring strategy is also progressing smoothly. For example, L&T Finance Holdings’ ‘defocused assets’—assets not core to its business— came down 46% y-o-y and account for just 4% of the company’s total loan book, as of March 2017. Once its non-core business becomes negligible, L&T Finance Holdings plans to focus more on wholesale infrastructure lending. With high growth in lending and NPAs under control, the company may witness an earnings jump in the coming years and analysts expect a 36% earnings compound annual growth rate between 2016-17 and 2018-19. Return on equity has already improved from 10.8% in 2015-16 to 14.7% in 2016-17 and is expected to go above 17% by 2018-19.”

Prudent downsizing for attractive business revival: Angel Broking

Angel Broking has issued an initiating coverage report in which it has recommended a buy. The logic is quite sound:

“L&T Finance Holdings Ltd (LTFH), promoted by L&T Ltd (64.2%) is a leading NBFC with a diversified lending portfolio. Over the last one year the management has restructured its business model and is focusing on selective segments where it has competitive advantage, simultaneously downsizing some products which were making losses.

Range of offerings across diversified book: LTFH’s lending operations are focused on three primary segments viz. Rural 15% (Micro Finance, 2Wheeler & Tractors), Housing 19% (Home Loans, LAP & Builder loans) and Wholesale finance 62% (Renewable Energy, Operating Roads, etc.) of loan book. While the above segments will be the growth drivers, the management has started downsizing unattractive range of products.

…..

Outlook & Valuation: As LTFH operates in multiple segments, we have valued it based on SOTP. We have valued the rural finance segment at 2.5x, while the housing finance and wholesale finance has been valued at 3x and 2x its FY2020E BV each. LTFH’s AMC arm, L&T MF has been valued at 5% of average AUM. Accordingly, we have arrived at a fair value of Rs 179 based on SOTP, and hence recommend BUY on the stock.”

Structural story playing out well but long way ahead: PL

PL has foreseen that L&T Finance Holdings has a long way to go. Their buy recommendation is as follows:

“LTFH saw beat in earnings on back of better fee income and tax write back from goodwill amortisation from merger but these gains were used to further strengthen weaker part of balance sheet by voluntary provisions on potential shocks and move towards regulatory requirement. Operational levers have started to play out on fees/opex/topline, while these tax efficiencies will continue for some time ahead, LTFH will use these gains to further take voluntary provisions. We believe ROEs are on improving trajectory with medium risk to asset quality especially in the infra business. Improving ROEs with growth and run down in defocused businesses are going to be key for LTFH valuation going forward. We believe that the company is strongly on the recovery path and we expect the stock to get rerate upwards with an expansion in P/ABV as they keep improving their capital return ratios and strong growth. We maintain BUY with revised PT of Rs210 (revised from Rs140) based on 2.9x Mar‐20E ABV.”

Top quartile (18-20%) RoE by 2020 by focusing on increasing market share in focused businesses: Axis Direct

Axis Securities has also expressed confidence about L&T Finance’s prospects.

“Strict cost controls, sanguine growth outlook in focused businesses and option value from disposal of defocused businesses bode well for the company,” Axis opined.

Several catalysts will play out: HSBC

HSBC has recommended a buy of L&T Finance on the basis that the concerns on whole book RoE have receded and that there are several catalysts that are continuing to play out. It is also stated that the sustainable RoE will improve to 18% by FY19e.

The target price of Rs. 163 appears quite conservative.

HSBC Upgrades L&T Finance to buy with target of Rs 163/sh pic.twitter.com/y8r1Ic67QU

— Yatin Mota (@YatinMota) June 16, 2017

Technical analysis target: Rs. 200

According to an expert on technical analysis, the stock has a lot more to go and is expected to touch Rs. 200 sooner or later.

#L&T #Finance #holdings – this stock has a lot more to go.. #rally aint ending before 200 on this counter..#Silently closed at #AllTimeHigh pic.twitter.com/UfebS5Le2G

— Aakash K Hindocha (@aakashhindocha) July 12, 2017

Conclusion

There is no reason to despair if we missed the chance to buy the fail-safe blue-chip stock. There is still a chance for us to make amends!

L&T finance is good stock and has written about this when it was at 60 in stock talk in this forum for long term target of 10X.

still feel canfin is the leader in nbfc segment poised for huge growth as it has zero npa.