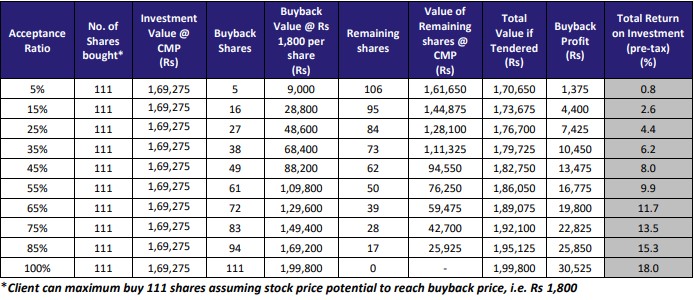

The board of directors of Infosys Ltd had approved buyback proposal on 11th September,...

investments

We initiate coverage of Brigade Hotel Ventures Ltd. (BHVL) with a BUY rating and...

Amber Enterprises India (Amber) is a leading manufacturer and solution provider for room air-conditioner...

Long term growth prospects at PCBL remain unchanged however since quantum jump in numbers...

Ellenbarrie Industrial Gases (ELLEN), with a legacy of over five decades, is among the...

Scoda Tubes Limited is an Indian manufacturer of stainlesssteel (SS) tubes and pipes with...

Route is moving up the value chain by shifting, from being a channel provider...

We met KVB MD and CEO B Ramesh Babu, to seek the outlook on...

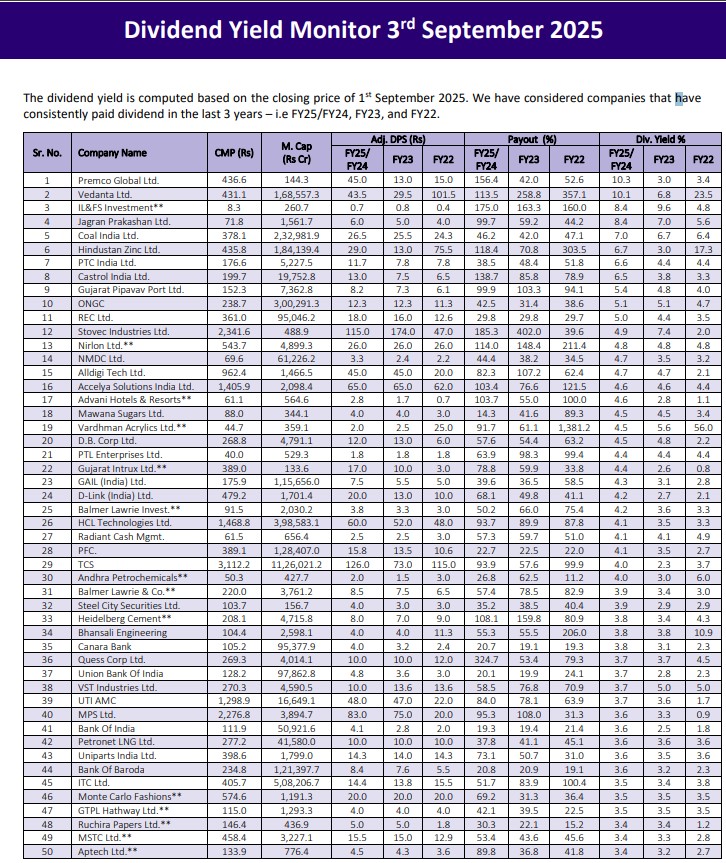

The dividend yield is computed based on the closing price of 1st September 2025....

We initiate coverage on SAMHI Hotels with a BUY rating and expect it to...