First, we must pay tribute to Saurabh Mukherjea and his ace team at Ambit for their brilliant stock picking skills. Their emphasis on only buying stocks with clean managements and efficient capital allocation has paid yielded hefty gains and rich dividends.

The “Coffee Can” portfolio of 17.11.2014, meant to be held for decades, has yielded a return of 13.3% on an absolute basis and heavily out-performed the BSE 500 return of (-) 2.1%.

The “Ten-Bagger portfolio” of 05.01.2015 has yielded a return of 4.9% on an absolute basis which compares favourably with the BSE500 return of (-) 3.2%.

In the latest report titled “Exit the fantasy, enter the reality”, Saurabh Mukherjea and his team have sent the grim warning that the “fantasy of a secular bull market” is fading and there is dire reality ahead. They say:

“As the fantasy of a ‘secular bull market’ fades, we cut not just our FY16 GDP growth estimate from 7% to 6.8% (driven largely by a drop in industrial growth) but also our end-FY16 Sensex target from 32K to 28K. We further highlight that there is a high risk of the Sensex dropping to as low as 22K, as the odds appear to be in favour of a continued Yuan devaluation. The combination of an enfeebled banking system, a sliding real estate sector and a PM determined to reset the way the Indian economy works makes India a risky investment destination”.

It is further stated:

“Even after the 6% fall over the past nine days, there are no rational grounds for claiming that the Sensex has bottomed out. As Prime Minister Modi’s resets bite deep into the Indian economy, we expect GDP growth to slow down and we expect earnings growth to remain weak. In fact, as retail flows wane, the support system propping up the Sensex is likely to give away.”

The implication of this dire state of affairs is that investors must focus on “financially robust, market leading franchises which are trading at sensible valuations” Saurabh says.

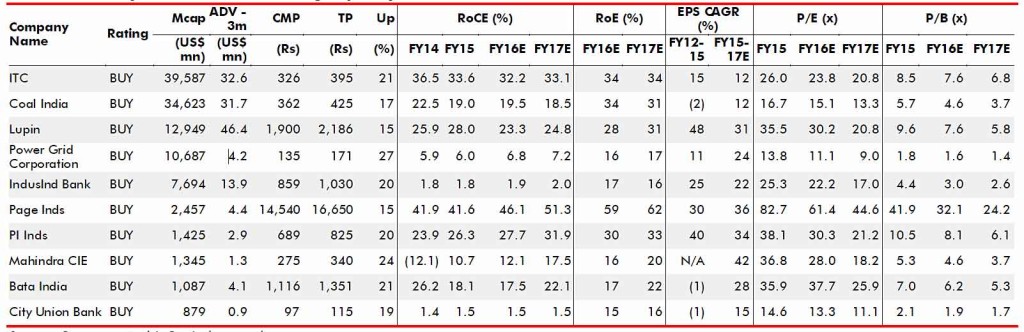

Fortunately, Saurabh and Co have identified ten such high-quality stocks which are safe to buy now. These are ITC, Coal India, Lupin, Power Grid Corporation, IndusInd Bank, Page Inds, PI Inds, Mahindra CIE, Bata India and City Union Bank. A detailed explanation about each stock, together with price targets, is given in the report.

Saurabh Mukherjea’s advice makes a lot of sense. One should never fool around with junkyard stocks at any time. These stocks are especially dangerous during market crises because they will crumple like a miserable ton of bricks. Instead, focusing only on high-quality stocks will keep our portfolio in good stead!

Well… Very interesting actually!! He was one of the foremost fundamental analyst and investor, who issued a forecast of 34000-36000 on Sensex back in Jan-Feb 2015. The index never saw its high again, as as on today, while he has issued a revised forecast of 22000 on Sensex!