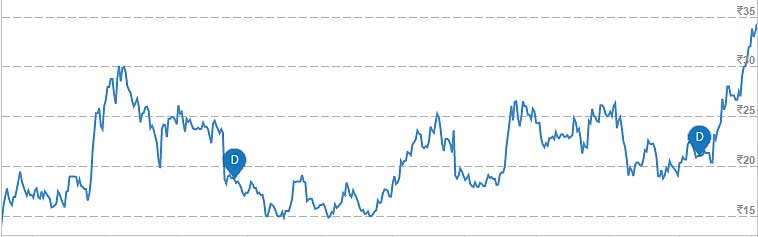

Few people had heard of Meghmani Organics, a micro-cap, till Daljeet Kohli pulled it out of the cold and put it on the center stage. The stock was then languishing at Rs. 15.

“Meghmani Organics is a classic turnaround story and has a target price of Rs. 34” Daljeet said in his customary soft-spoken voice.

It appears the stock was awaiting a word of encouragement from Daljeet because within three months of Daljeet’s pronouncement, Meghmani spurted like a rocket and notched up incredible gains of 86%.

Then, it was a rough roller coaster ride because the stock reported poor Q3FY15 results and plunged like a stone.

Here, we must compliment Daljeet because despite Meghmani’s poor operational performance, he was not disheartened. Instead, he exhorted his followers to take advantage of the crises situation to aggressively load up on the stock.

The commotion also attracted the attention of Dolly Khanna, our favourite stock wizard. She was spotted holding a chunk of 454,475 shares of Meghmani as of 31st March 2015.

Finally, today, 6th May 2016, Meghmani Organics breached Daljeet’s target price to reach a life-time high of Rs. 34.75.

This means that in the 21 months since Daljeet’s confident recommendation, the stock has delivered fabulous gains of 130%.

We will have to wait for an update from Daljeet as to what is to be done with the stock now. However, he hinted that the future prospects are great and that the target price will be revised upwards:

“All three divisions are now firing up. The result is that numbers will be fantastic. Last year they had some 5 percent kind of margin. This time, it should be around 7-7.5 percent which will be a big jump in terms of margins. That is the reason why we are expecting sales to grow by only 10-12 percent. But net profit can grow by almost 45 percent which is purely because of margin expansion. In terms of valuation again, it is quite cheap,” he said.

“The other trigger point for Meghmani is the reduction in debt. They had some Rs 500 crore odd of debt last year. They paid some Rs 53 crore. They have given a timeline of how they will reduce this debt. As of FY’16, they have Rs 480 crore of debt, Rs 111 crore will be paid in FY’17 as per management guidance. So, if they do that, then that will also add to the enterprise value. So, we remain very positive on it. As of now, we are maintaining previous target of Rs 34, but post results it will be revised upwards.”

Natwarlal (“Natu”) Patel, Meghmani’s MD, is also understandably gung-ho about the Company’s prospects. He explained that slowdown in China would benefit the business of the Company. He also said that the Bharuch plant would add Rs. 125 crore to the revenues and churn out EBITDA at 30%. He also promised to reduce the debt by Rs. 100 crore by FY 17 out of internal accruals.

DD Sharma, the veteran stock picker, is also bullish about Meghmani Organics. He called it a “shaandar” (excellent) investment and projected a target price of Rs. 60 for the stock.

So, if you are one of the lucky shareholders of Meghmani Organics, you have to hold on tight though the journey may be like a roller coaster at times!

#SHARE #MARKET #UPDATE on MEGHMANI #ORGANICS ::

Last year Meghmani Organics was very attractively priced and was very much undervalued stock. This was the reason behind 100% returns in the stock.

In last 3 years, revenues have gone up at 7-8% CAGR while profits have really jumped because of improvements in margins

Net profit CAGR for last 3 comes out to be more than 100%. Going ahead, at current price the stock is valued at PE of 11-12 compared to other players in Agro-chemicals at around 15-20 PE ratio. This year monsoon is going to be good and this will help agro chemical companies to gain some good revenue. Margins will slightly improve further. Hence on any declines again the stock can be bought for another 40-50% gain over a next 1 year.

You are really helping small investors like me alot by this website…May god bless u with life full of happiness 🙂

I am wondering if this scrip could deliver such returns why can’t Autoline Industries,DB realty and Viceroy Hotels do the same ?

Stocks held by the great RJ….

I agree with the info but what about Pennar industries pick by the same person

Dude analysis is probability not guarantee, not every stock pick is supposed to work. You have to diversify properly keeping in mind the risk associated with investment. Also if you are timing your investments then it must also have a exit plan.

An investment plan isn’t a plan unless it have diversification and exit strategy.

Yes what about Lumax Auto Tech stock which was recommended two years back not giving any returns

and why not winsome dioamonds

What a dud recommendation given by Mr Daljit Kohli with regard to Sharon Bio Medicine. How he does his analysis is beyond my comprehension. To me it appears that he must have been heavily paid to put up such a recommendation. Why is he not commenting on the stock now. All his recommendations should be taken with a bucket of salt.