Nandan Chakraborty, Head of Strategy at DAM Capital, said in uncertain times, two things are important when investing. First, one should have a margin of safety when selecting stocks, which is why DAM has created a list of stocks that the strategists believe could double in value. Second, it’s important to have a balanced portfolio, with both low-risk and high-risk investments.

DAM Capital has released a report outlining key market themes and identifying stocks they think could double in the next three years.

The stocks are well known & have a huge margin of safety. They have more than 27% earnings CAGR for the next three years. Their PE will not derate or rerate too much.

“The rationale for the doublers is that you should have a huge margin of safety. So, we took stocks which are more than 27% earnings compound annual growth rate (CAGR) for the next three years, and therefore you have a shortlist of those stocks which can double in three years. Then we used our judgement to figure out those where the PE will not derate or rerate too much, and therefore we built this set of 14 stocks,” the expert said.

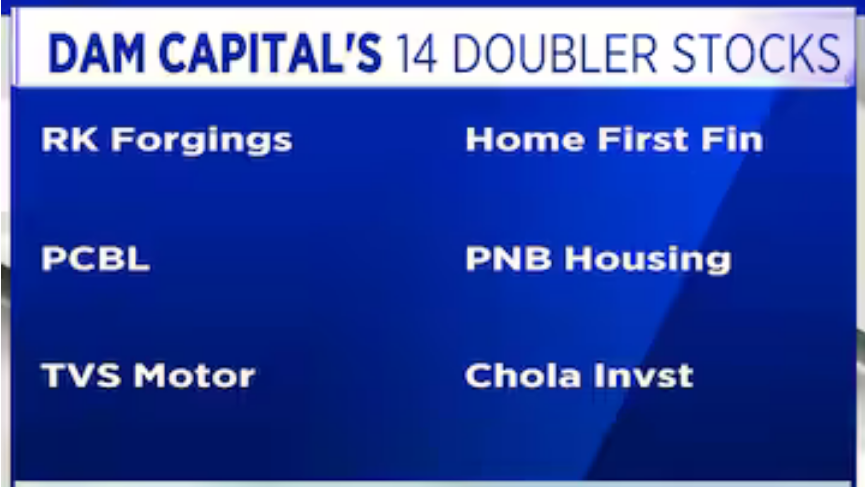

The 14 multibagger stocks recommended are Glenmark Pharma, M&M Financial, Strides Arcolabs, Greenlam, JSPL, Sharda Crop, Entero Health, Radico Khaitan, RK Forgings, PCBL, TVS Motors, Home First Finance, PNB Housing and Chola Investments.