Company Overview

DCX Systems is a company engaged in the system integration of electronic systems and subsystems, along with allied products such as Printed Circuit Board Assemblies (PCBAs) and cable & wire harnessing. It was incorporated in 2011-12 and went public on 9th November 2022, raising ₹400 crore through an Initial Public Offering (IPO). DCX Systems’ products are primarily used in the defence and aerospace sectors, catering to the high standards of precision engineering required in these industries.

They have evolved into a highly regarded Indian Offset Partner (IOP) for foreign original equipment manufacturers (OEMs). They are one of the largest IOPs for ELTA Systems Limited and Israel Aerospace Industries Limited, System Missiles and Space Division (IAI Group, Israel).

They operate through their manufacturing facility located at the Hi-Tech Defence and Aerospace Park SEZ in Bengaluru, Karnataka, and facility is spread over an area of 30,000 square feet. DCX’s subsidiary, RASPL, has set up an additional manufacturing facility for PCBA, spread over an area of 40,000 square feet.

Order book

On 31st December 2023, the order book stood at ₹1095 crore. Execution during the three quarters following December 2023 amounted to ₹1079.90 crore. As of 31st December 2024, the current order book exceeds ₹3000 crore.

[Major order: L&T order of ₹1250 crore received on 01.07.24 with a 3-year execution period, to be executed linearly]

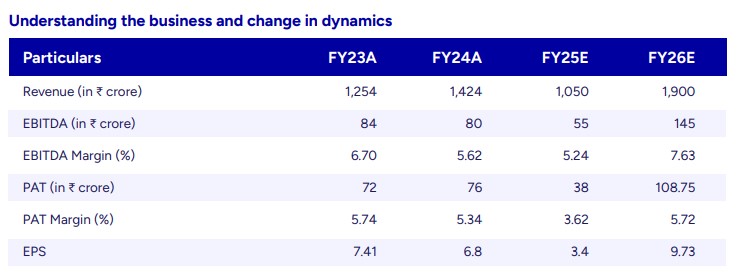

Understanding the business and change in dynamics

1. Previously, DCX started as an Indian offset partner for foreign OEMs, primarily generating revenue as an IOP for Israel.

2. Now, it caters to India, Israel, the United States, and Korea.

3. Due to the Indian government’s shift towards the “Make in India” initiative, items previously imported are now being manufactured by Indian OEMs such as BEL, HAL, L&T, and other Indian companies. This shift will likely lead to an increase in orders from Indian defence PSUs and private companies.

4. In 2024, DCX added a major customer: Lockheed Martin Global, USA. They have received orders from Lockheed Martin across various verticals, including system integration and PCBs, totaling over ₹850 crore. These orders include: ₹460.30 crore for electronic assembly received on 8th November, 2024; ₹380 crore for PCBs to RASPL received on 28th October, 2024, and ₹16.53 crore received on 8th February, 2024. All orders have an execution period of 12 months.

5. They have also added Ametek Inc., Collins Aerospace, and Beam Trial as customers, which is expected to drive larger orders over time and expand DCX’s global reach.

6. Total Offset Obligations pending with foreign OEMs, as per the Defence Offset Management Wing (DOMW), amount to USD 13.21 billion. DCX is targeting an opportunity size of USD 1 billion within this market. The government is further strengthening these offset norms, which can generate more business opportunities for DCX.

7. The shift from import to “Make in India,” the tightening of offset policies, the expansion into new geographies and customer acquisition, the successful implementation of backward integration for PCBAs, and the promising prospects of the NIART business in the Indian Railways have positioned DCX favorably.

8. Further, in India, Bengaluru is emerging as a significant hub for commercial aviation aircraft manufacturing, with Tata’s collaboration with Lockheed Martin. This development presents potential opportunities for DCX in the civil aviation sector.

9. The company is focusing on the transfer of technology (TOT) from Israel and the US to manufacture a list of indigenous products that cannot be importśed and must be manufactured within India.

10.As per Ministry of Defence rules, any defence order below ₹2000 crore must have an Indian company as the prime contractor, with a requirement for 40-50% of the product to be sourced domestically.

11. With short-term borrowings of ₹63 crore and cash equivalents of ₹980 crore, the company has a strong financial position to further invest in new technology transfers and product development.