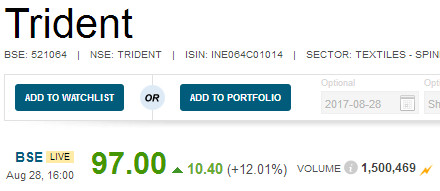

Trident Ltd surges like a rocket

Today’s surge of 12% in Trident Ltd did not come as a surprise to me or to any of the other devoted fans of Dolly Khanna.

We had been assured by Motilal Oswal just a few days ago that Trident Ltd is at the “onset of a high growth cycle” and is a must-buy.

Motilal Oswal is not alone in expressing confidence in Trident Ltd.

I pointed out earlier that Jash Kriplani of Outlook Business has opined that the valuation at 10x is cheap compared to the valuations of its peers like Welspun, Indo Count and Himatsingka Seide.

Edelweiss has stated that Trident Ltd is “moving up the value chain”.

A number of other luminaries such as IDBI Capital, Ventura Securities, CRISIL, HDFC Sec, Dynamic Levels and Sanjiv Bhasin have conducted a thorough analysis of the Company and given it the all-clear signal.

Of course, the biggest confidence booster is the fact that Trident Ltd ranks third in Dolly Khanna’s portfolio, which implies that it is a high conviction pick for her.

The stock is up 154% over 24 months and 74% over 12 months.

Since I first reported the matter in Feburary 2017 (see Dolly Khanna’s Latest Stock Pick Is A “Hidden Gem” With Huge Potential For Gain: Experts), the stock is up about 45%.

GNFC, Dolly Khanna’s latest fertilizer stock pick

I reported earlier that Dolly Khanna has made her debut into the fertilizer sector and holds a chunk of 15,81,099 shares of GNFC as of 31st March 2017.

The holding as of 30th June 2017 is 15,73,373 shares.

I have already drawn attention to all the salient features of GNFC and will not repeat them for the sake of brevity.

Monopoly supplier of TDI, benefit of anti-dumping duty

The core point worth noting is that GNFC is the monopoly manufacturer of a specialty chemical called TDI (toluene diisocyanate) which has wide application in a number of industries.

The said TDI is subject to anti-dumping duty which means that marauders from China, Japan and Korea are kept at bay. Instead, GNFC is in the position to call the shots with respect to pricing, delivery terms, credit period etc.

Upgrade in credit rating by ICRA

ICRA has upgraded GNFC’s rating which implies that the financials and credit worthiness are ship-shape.

Dr Rajiv Kumar Gupta, the MD, attributed the upgrade to “major turn around & historic performance in FY 2016-17”.

Due to major turn around &historic performance in FY 2016-17 ICRA upgrades GNFC Long term rating frm AA -DOUBLE A MINUS to AA(DOUBLE A) ????

— Dr Rajiv Kumar Gupta (@drrajivguptaias) August 16, 2017

Robust Q1FY18 results

The quarterly results for Q1FY18 appear to be robust, at least to my untrained eye.

The net sales surged 11.14% while the operating profit surged 21.11%. The net profit surged 31.47%.

| GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2017 | JUN 2016 | % CHG |

| NET SALES | 975.3 | 877.58 | 11.14 |

| OTHER INCOME | 28.5 | 20.24 | 40.81 |

| TOTAL INCOME | 1003.8 | 897.82 | 11.8 |

| TOTAL EXPENSES | 798.51 | 728.31 | 9.64 |

| OPERATING PROFIT | 205.29 | 169.51 | 21.11 |

| NET PROFIT | 66.55 | 50.62 | 31.47 |

| EQUITY CAPITAL | 155.42 | 155.42 | – |

(Source: Business Standard)

Debt-free status expected by end of FY18

Rajiv Kumar Gupta explained that in Q1FY18, the margins of the chemical business improved while the losses of the fertiliser losses reduced.

He revealed that the debt has reduced to 0.17 percent from 0.37 percent and that the target is to make the company debt free by the end of this financial year.

It is obvious that if the Company does become debt-free, it will be a candidate for re-rating and will be entitled to command higher P/E multiples.

GNFC is a “fantastic” PSU blue-chip stock: DD Sharma

GNFC has now caught the attention of DD Sharma, the veteran stock picker.

DD Sharma explained all the salient facts and figures about the stock in his usual meticulous fashion.

He is so impressed by GNFC’s powerhouse credentials that he described it as a “fantastic” stock.

DD Sharma’s target price of Rs. 450 means that gains of 55% are on the anvil

At the end, he projected a target price of Rs. 450 for the stock which implies that gains of up to 55% from the CMP of Rs. 290 are due from the stock.

GNFC is a “long-term wealth creation idea” with “solid fundamentals”: Vikas Sethi

Vikas Sethi, the noted stock market expert, is also bullish about the prospects of GNFC.

He called it a “long-term wealth creation idea” and recommended a buy on the following logic:

“GNFC is a company with solid fundamentals. It is a leading manufacturer of TDI where it has a dominant 50% market share and we have of late seen a surge in the prices of TDI because of disruption in China, Japan and Korea. That is tremendously positive for this company. To add to this, this company would be a major beneficiary of good monsoon, farm loan waiver and the government’s focus on rural economy. To add to this all, the recent reduction in GST rates on fertilisers from the earlier fixed 12% to 5% also would be pretty positive. And this company also has been appointed as a nodal agency for digitalisation of residential townships by NITI Aayog which would also be a big positive. All in all, it is good stock and at the current levels, it trades at a reasonable valuation. I am bullish on the stock. One should buy into this stock at the current levels and my targets are Rs 400 in a year.”

Conclusion

Prima facie, GNFC appears to be a powerhouse given its Blue-Chip PSU status, monopoly producer status, reasonable valuations, imminent debt-free status etc. There is no need for us to be inhibited given the confidence expressed by stalwarts like Dolly Khanna, DD Sharma and Vikas Sethi!

Very insightful. Looks like a great investment

There is lot of debt on its balance sheet, makes it very risky

Wanted to invest in stock market. Wanted to know the tips from you.