Structurally best placed in e-commerce logistics consolidation

India’s e-commerce logistics landscape is divided between captive in-house platforms and independent 3PL players, with materially different economic outcomes. Captive platforms such as Instakart and ATS have achieved scale rapidly, but their financial profiles underscore structural margin dilution, as operations are designed primarily to enable parent ecosystems rather than generate standalone profitability. Sustained losses, high capital consumption, and continued dependence on parent-funded equity highlight the inherent limitations of these players.

Among independent players, Xpressbees and Shadowfax continue to face profitability and sustainability challenges. Despite strong revenue growth, Xpressbees remains structurally loss-making with persistent cash burn, while Shadowfax’s high customer concentration, particularly its dependence on Meesho and Flipkart, creates elevated revenue risk as marketplaces increasingly insource logistics. Both players remain reliant on external capital to fund growth, constraining long-term financial flexibility.

In contrast, Delhivery has emerged as the structurally strongest and most scalable platform in the sector. The company has combined rapid volume led growth with improving profitability, turning APAT positive in FY25 and generating consistently positive FCFF despite heavy capex investment. The acquisition of Ecom Express further strengthens Delhivery’s scale advantage, lifting market share to an estimated 20–23% while enhancing network density and operating leverage.

Importantly, Delhivery’s competitive pricing, high service ratings, and strong seller satisfaction position it well to benefit from ongoing industry consolidation and potential pricing rationalization. With a majority of 3PL peers remaining loss-making, Delhivery is better placed to lead industry wide price resets, sustain volume accretion, and fund growth internally — reinforcing its leadership and long-term competitiveness in India’s express logistics ecosystem.

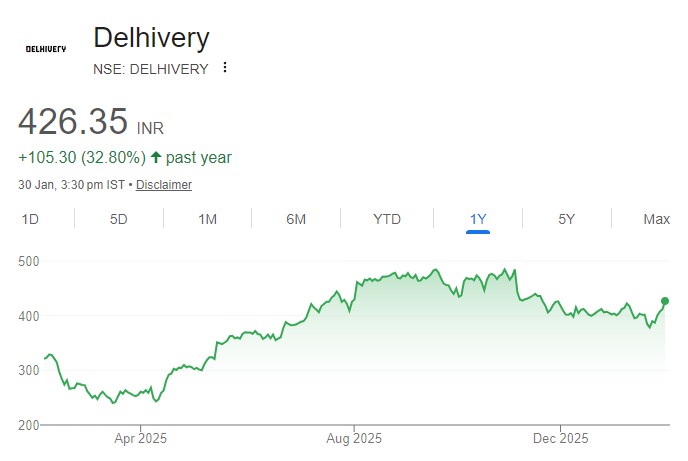

Valuation and view

Delhivery is well-positioned for future growth, supported by strong momentum in its core transportation businesses and a clear focus on profitability. With Express Parcel and PTL segments delivering consistent volume growth and healthy service EBITDA margins, the company expects to sustain 16-18% margins over the next two years.

The integration of Ecom Express is set to enhance network efficiency and reduce capital intensity, while new services like Delhivery Direct and Rapid offer long-term growth potential in on-demand and time-sensitive logistics.

We expect the company to report a CAGR of 15%/41%/52% in sales/EBITDA/APAT over FY25-28. Reiterate BUY with a TP of INR570 (based on DCF valuation)