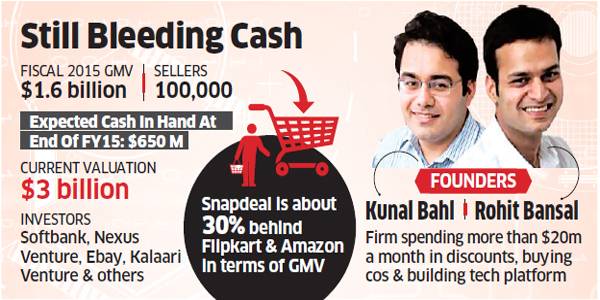

The valuations of E-Com ventures are truly mind-boggling. Flipkart, after its latest round of fund raising, is valued at nearly $15B (Rs. 90,000+ crore). Snapdeal is valued at $3B (Rs. 18,000 crore). This is astronomical for sites that are essentially an interface between suppliers and buyers.

Even a car portal site like cardekkho.com, which posts classified advertisements for vehicles, is commanding a valuation of $300M (Rs. 2000 crore) while housing.com, a site for posting classified real estate advertisements, is valued at Rs. 1500 crore. This madness is causing even obscure companies with half-baked websites like Logix Micro to command premium valuations.

(Image Credit: ET)

None of these E-Com companies are anywhere close to breaking even, let alone make a profit. Instead, they are bleeding cash, day after day.

The business model consists of high-decibel advertisements and giving aggressive discounts to woo customers. The idea is to notch up “Gross Merchandise Value” even though it comes at the cost of suffering heavy losses.

Snapdeal is reported to have suffered a loss of Rs. 1500 crore in fiscal year 2014-15. Snapdeal is supposed to be 30% behind Flipkart and Amazon in terms of Gross Merchandise Value. This suggests that the losses of Flipkart and Amazon may be much higher.

Even Amazon.inc, which has been in existence for the past 15 years or so, reported only a meager quarterly profit for the last three months of 2014. It warned that its finances are “inherently unpredictable” and that it could make an operating loss of up to $450m.

This sorry state of affairs is causing great concern amongst traditional brick n’ mortar investors and also amongst some entrepreneurs who have made big money from the internet.

Ramesh Damani was at his polite best stating that he would stay away from e-com ventures as their valuations are in “nose bleed” territory.

Samir Arora of Helios Capital was blunt. “Investors in e-com ventures are guaranteed to lose money over time” he declared in his typical forthright manner.

He also mocked the investors of e-com ventures in his tweet:

“What do you call valuations of Indian internet companies? Kehte hai isko hawa hawaii, hawa hawai, hawa hawaiiiiiii.”

What do you call valuations of Indian internet companies?

Kehte hai isko hawa hawaii, hawa hawai, hawa hawaiiiiiii.

— Samir Arora (@Iamsamirarora) March 5, 2015

The same criticism was leveled earlier by Alok Kejriwal, founder of Games2Win.com. He called the online retail business “a treadmill of promise” where you have to do something to “help you scrape through another quarter in terms of funding, financing and promise”. He also pointed out that on Flipkart’s GMV of $1B, it had lost nearly $250M. “Its’ a question of who blinks first” he warned about the intense rivalry between the online retailers.

The latest to sound a warning about “why this tech bubble is worse than the tech bubble of 2000” is Mark Cuban. Mark Cuban is one of the earliest internet entrepreneurs, known for having sold broadcast.com in 1999 to Yahoo for a whopping $5.7B.

“If we thought it was stupid to invest in public internet websites that had no chance of succeeding back then, it’s worse today” Mark Cuban warns about the private equity invested in unlisted e-com companies. “I have absolutely not doubt in my mind that most of these individual Angels and crowd funders are currently under water in their investments. Absolutely none. I say most. The percentage could be higher” he warns in a grim tone.

Finally Logix ended at lower circuit 🙂

Nice article today 😛

nice article…why should the consumer complain…after all he is getting many choices to shop…and shopping will keep the economy buoyant…investors are responsible for their own decisions…anybody putting $ 1 Billion would have done due diligence, I feel

who is ” samir arora”

who make money by some tweet, actually they cheating their follower or retail investor

Sameer Arora is not an expert in stocks he is playing for himself like many other so called experts. In short a retail investor should never go in line with such big bull (or bear) “super stars” of stock market. Every one appearing here with their own analysis have their own vested interests tomake money. One should say buy this and buy that means he is already invested on this and that at lower levels and he is trying to unlock his investments at higher levels and the poor investors hard earned money (sometimes even borrowed) are getting into a big trap. So do own study and invest if you are highly convinced and not by conviction of such advisors.

The current market valuation of e-commerce companies is similar to dot.com companies’ valuation during 1999-2000 when any company with a remotely similar sounding name of IT would command a stratospheric valuation. This over exuberance and competitive euphoria (as is to compete that I should not be left behind in this game of investment) ended very fiercely with almost all investors losing up to 90% of their wealth. Similar would be the fate of this time investors in e-commerce companies.

E-commerce boom in 2000 is very different from what it is today. One has to understand that Internet is REAL and most of us cannot live without Internet even for a day.

The so called Stock Pundits have never seen these kinds of valuations and are thinking this is a bubble, however things will look quite sane to people who have seen these valuations in other markets or even higher valuations in other markets.

SoftBank has had a great success in e-commerce industry, as they came out of a pretty successful IPO of Alibaba in the USA.

It took them 15 years to make huge gains out of Alibaba and for them to get into another hot market like India after China is a good bet and if you ask someone else like Samir Arora / Ramesh Dawani who has no clue about technology it might look like a bubble for them.

Flipkart was reportedly at a billion dollar turnover last fiscal with a 7 billion dollar valuation and both its volume and valuations are growing day by day. Does guys like Samir Arora know that Flipkart even sells Mutual funds too and many people do buy.

These so called Demi gods who predict future stock movements are not picking the point that incredible volumes with which these companies are operating and are growing a mere 400 per cent for three years in a row.

Hope it helps.

Regards

Bhs

Thanks Bhs for such a nice comment

There is an article in Fortune: Mark Cuban is wrong about today’s tech ‘bubble’

http://fortune.com/2015/03/06/mark-cuban-is-wrong-about-todays-tech-bubble/

Tech companies may be overvalued like they were in 2000, but the fallout will not be worse this time around.

Yesterday there was a lot of online and cable news debate over the notion of an early-stage tech investment bubble, prompted by this blog post by entrepreneur, investor and NBA franchise owner Mark Cuban. More specifically, Cuban argued that today’s ‘bubble’ is worse than the 2000 bubble because this version involves so many individual investors plugging money into securities for which there is no liquidity.

I see why everyone is talking about what Cuban wrote, but his argument is bizarre.

To start, let me stipulate that there was more liquidity for Pets.com shares in 2000 than there is for new stock in a 6-month-old mobile app (although there may be more liquidity for that mobile app stock today than there was for still-private Pets.com stock in 1999, but that’s beside the point).

The trouble with Cuban’s thesis, however, is that the vast majority of “angels” investing in those mobile apps should be able to afford possible losses, because they are accredited investors (read: millionaires and/or those making at least $200k per year). Remember, equity crowdfunding rules have not yet been finalized. And even when (if?) equity crowdfunding is legalized, there are expected to be strict limits on the amount that unaccredited investors can shell out (at least per company). Compare this to 2000, when anyone could put their life savings in a specious public stock. How could it be worse to lose all of a $5k investment in an illiquid startup than $75k of a $100k investment in a liquid dotcom-era company?

It might have been more interesting to see Cuban make a more indirect argument, about how unaccredited investors can plow cash into mutual funds that are investing in pre-IPO startups at massive valuations. But, even there, such investments typically represent just a small portion of overall portfolio holdings.

Cuban may ultimately be proven right that today’s tech valuations are even more inflated than were the tech valuations of 2000. But it won’t be small individual investors who bear the brunt of the fallout.