N Chandra, “God’s Gift“, caused stock price to triple & give 300% gain

It is a fact that the stock price of Tata Consumer Products (earlier known as ‘Tata Global Beverages‘ (TGBL)) languished for decades, with no investor interest whatsoever.

However, the appointment of N. Chandra to the helm of affairs transformed the fortunes of the Company.

The stock surged like a supersonic rocket to an ATH of Rs. 396, delivering mammoth gains of 300% to its lucky investors.

This is why Rakesh Jhunjhunwala, the Oracle of Mumbai, rightly described N. Chandra as the “Gods Gift to the Tatas“.

Big Bull Rakesh Jhunjhunwala on Tatas : "My role model on life are the Tatas. And the Tata group is blessed to have N Chandrasekaran as chairman." @TataCompanies https://t.co/Qrdd6IlUNd

— Chandra R. Srikanth (@chandrarsrikant) July 24, 2018

TCPL is the flagship of Tata Group’s FMCG ambitions

Gautam Trivedi of Nepean Capital has advised that we should ride piggy-back on N. Chandra’s broad shoulders and rake in the riches.

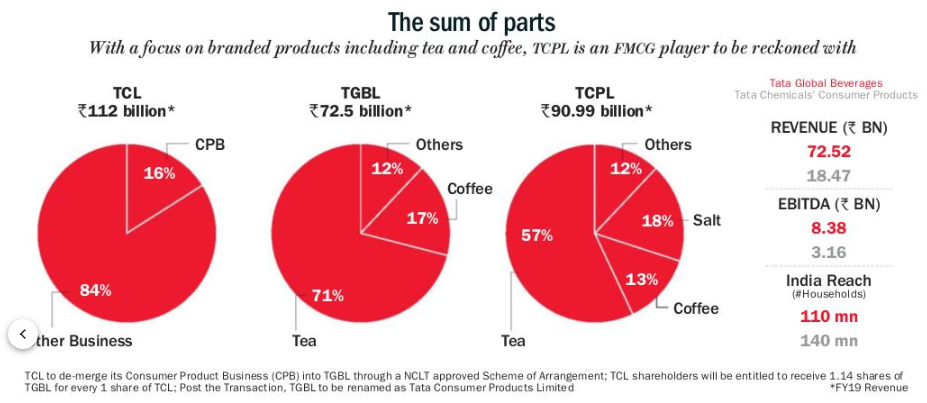

“TCPL has become the Tata group’s vehicle for its FMCG ambitions with 91% of the revenue coming from branded products. The combined company is now home to various brands and businesses and the revenue mix is also set to change going forward,” he has stated in the latest edition of Outlook Business.

He has also pointed out that TCPL is the second largest branded tea company in the world and one of the largest in India.

It boasts of numerous iconic brands like Tata Tea, Tetley, Eight 0′ Clock, Tata Coffee Grand, Himalayan Water, Tata Sampann etc.

It also has a stranglehold over 50% of Starbucks India, a known money-spinner popular with the deep-pocketed glitterati.

“TCPL will be able to leverage the Tata group’s other consumer-facing businesses, namely Trent, Indian Hotels and Vistara,” Gautam Trivedi has added.

Sunil D’Souza’s appointment as MD is a major trigger

Everyone in the FMCG sector is familiar with the achievements of Sunil D’Souza, a whiz-kid.

Sunil D’Souza learnt the ropes of the FMCG business at PepsiCo, where he slaved for 14 long years.

The stint at Pepsi came handy when he joined Whirlpool, the MNC conglomerate manufacturer of white-goods like A/c, Fridge etc.

He showed his mettle by causing Whirlpool’s sales to grow 14% CAGR and to profits to grow 27% CAGR over a 5-year period.

“Sunil D’Souza brings strong domain knowledge of consumer products businesses, and a successful track record of leadership. His experience and expertise will be very valuable in shaping and developing TGBL for the future,” N. Chandra said, complimenting the appointment.

In addition to Sunil D’Souza, TCPL has roped in other top brass such as Ajit Krishna Kumar (COO), Adil Ahmed (head of international), Rakesh Sony (head of strategy and M&A) and Rishi Dang (head of US business).

Gautam Trivedi has described these appointees as “major triggers” for TCPL.

Financials are in ship-shape condition

TCPL has a healthy balance sheet which generates free cash flow of Rs. 10 billion, according to Gautam Trivedi’s analysis.

He has also pointed out that the trailing twelve months (TTM) financials of TCPL have combined revenue of over Rs. 95 billion and Ebitda of over Rs. 12 billion.

This implies that the financials are strong and the company has no liquidity constraints whatsoever.

(Image Credit: Outlook Business)

What about valuations?

Naturally, the questions arises whether the valuations of TCPL are cheap given its numerous virtues.

Gautam Trivedi has ruefully conceded that the stock is presently quoting at 24.5x FY21 price to earnings, which cannot be considered as being “cheap” under any standards.

However, he has assured that the P/E will expand as the story plays out.

He has also opined that TCPL is likely to catch up to the stratospheric high valuations of its illustrious peers such as Hindustan Unilever, Nestle, Dabur etc.

Obviously, if that happens, we will have multibagger gains to feast on.

“Over the next five to 10 years, the company will introduce more FMCG products and pump them through its extensive nationwide distribution. We believe Tata Consumer Products is the next food and beverages giant in the making,” he concluded.

No doubt, TCPL is a good stock for long term. It has many times given good trading and short term investing opportunities. Hopefully, it will continue to do this in future also. By the way, arjun you have done a great analysis. Keep sharing such articles 🙂