Surge in LT Foods triggers alarm bells in BSE HQ

Normally, when a stock surges like a rocket for no rhyme or reason, alarm bells start clanging at the offices of the BSE and the sleuths there get alerted.

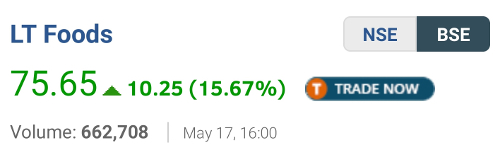

This happened on Wednesday when LT Foods a.k.a Daawat suddenly surged a mammoth 16% and took everyone by surprise.

The BSE sleuths came rushing out to investigate the matter and demanded an explanation from the management for the surge.

The surge also created great excitement in Dalal Street with the punters thronging the street, asking each other the reason for the surge.

However, I was not perturbed and was cool as a cucumber.

I know from experience that stocks which have the backing of Dolly Khanna and Porinju Veliyath are bound to exhibit such traits sooner or later.

It is customary for such stocks to surge like rockets and give multibagger gains even as novice investors stare at them in wide-eyed disbelief.

LT Foods, the pride in the portfolios of Dolly Khanna and Porinju Veliyath

When Porinju first bought LT Foods and also sent out a subtle buy call, I studiously ignored it and did not even bother to report it.

However, when Dolly loaded the stock into her shopping bag, I knew that magic would happen and that we cannot stay on the fringes any longer.

I diligently reported on the incident and also did path breaking research into various basmati stocks.

In particular, I emphasized that Ekansh Mittal of Katalyst Wealth has declared that the entire packaged foods industry is at an inflection point and that basmati stocks will be the big beneficiaries.

A similar view has been expressed by other leading experts such as Shyam Sekhar, Manish Bhandari, HDFC Sec, ICRA etc, all of which have been systematically referred to in my report.

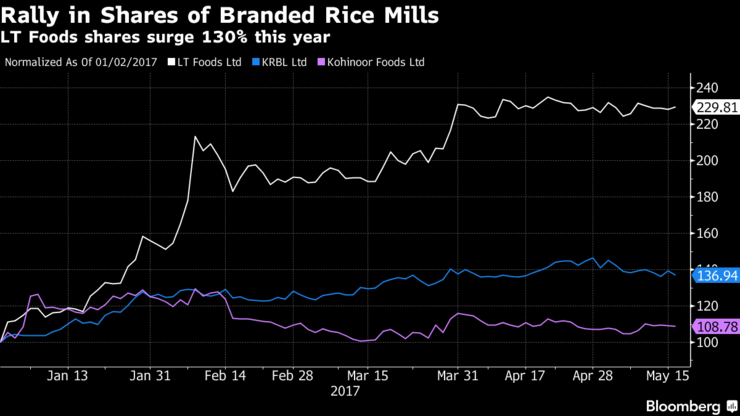

(Image credit: Bloomberg)

Company will become a FMCG Company and double turnover to Rs 6,000 crore by 2020

“We are targeting to double our turnover by 2020. We have made growth. From leading basmati rice company, we want to become a FMCG company,” VK Arora, the CMD revealed.

Strong volume growth

The two major brands, ‘Daawat’ and ‘Royal’, registered strong volume growth of about 25 per cent both in domestic and overseas markets in 2015-16.

The growth in turnover during FY 2016-17 is expected to be 8-10 per cent. In volume terms, the growth is estimated at 20-25 per cent.

Undisputed leader in USA market

LT Foods has a presence in over 65 countries.

“US is our biggest export market. We have become undisputed leader in American market with 45-50 per cent share in basmati trade,” Arora said with noticeable pride in his voice.

LT Foods to expand to Europe and Middle East to capitalize on surging demand for basmati

Now, the big news is that LT Foods has created an ambitious plan to expand its operations to Europe and Middle East so as to cater to the heavy demand for basmati rice in those regions.

“We want to concentrate and increase sales of our branded products, especially in the U.S. and Europe, as we see huge potential there and in the Middle East“, Ashwani Arora, the JMD of LT Foods, said.

In fact, the Company has already taken several steps in furtherance of this ambitious plan.

It has bought two rice brands called ‘Gold Seal Indus Valley’ and ‘Rozana’ Hindustan Unilever Ltd. These brands have a strangle hold in the Middle East. It has also purchased a brand called “817 Elephant” which is well known in the U.S. and Canada.

In addition, the Company is setting up a plant in Rotterdam to cater to the giant European market.

Ashwani Arora revealed several important aspects of the business of LT Foods:

(i) Game plan is to profit from the packaged foods business and not deal in raw rice.

“We want to be recognized as a food company, not a commodity trader ….. The trend is health plus convenience. We are following that trend and developing our whole product range based on the theme,” Arora said.

(ii) There is great demand for basmati rice in foreign countries. Basmati accounts for about 38 percent of total rice consumption in the Middle East, 4.4 percent in Europe, 1.3 percent in the U.S. and 1.2 percent in Asia;

(iii) LT Foods already has more than 50 percent of the basmati rice market in the U.S. The share in the Middle East and European markets also have scope to increase significantly;

(iv) The Company has set up a joint venture with Japan’s Kameda Seika Co to manufacture and market rice-based snacks in India;

(v) The Company has joined hands with Future Group in December to process and sell south Indian rice;

(vi) The revenues are expected to almost double to $1 billion by 2020 from an estimated 32 billion rupees ($500 million) in the year ended 31st March 2017;

(vii) Improvements in procurement, processing, sales and distribution should help lift operating profit as a percentage of revenue to 15 percent in the coming years from 12 percent;

(viii) There is great demand for packaged food products due to rising incomes and modern convenience stores. Branded food products account for 26 percent of total basmati sales in the country;

(ix) LT Foods annually sells about 200,000 tons of branded basmati rice in India, capturing a market share of 20 percent;

(x) Branded packaged rice accounts for about two-thirds of its sales, while trading and value added products such as organic cereals and brown rice make up the rest;

(xi) The company is aiming to increase its annual rice processing volumes to 500,000 tons in two years from 400,000 tons by outsourcing mills owned by third parties;

(xii) Fresh capital expenditure will not be incurred. Instead, the production will be outsourced because a lot of idle capacities are available;

(xiii) Rice milling will be increased by 25% in 2 years by outsourcing;

(xiv) There will be increased expenditure on branding and advertising the products. The focus is to invest in brands and markets.

The stock is cheap and is an ideal investment candidate: Anand Rathi

Ajay Thakur of Anand Rathi Securities has recommended a buy of LT Foods. He explained that valuations of the stock are inexpensive and the rising share of its branded business, cost efficiency-led margin gains and better inventory management are expected to drive greater free cash flow and return ratios.

Conclusion

Prima facie, the ambitious plans announced by LT Foods should catapult it into a higher trajectory of growth and profitability. Hopefully, this will send the stock price surging into the stratosphere and translate into multibagger gains for Dolly Khanna, Porinju Veliyath and whoever else chooses to stand shoulder to shoulder with them!

Hi this is the beginning of lt foods long way to go

Well not just this LT foods but all other Rice stocks will have a good run-up in future.

This brand of rice is already in the markets of Middle East, Europe and USA for the last 5 years. Did not understand what they are talking about new markets?. Hype and scams are usual in the bull markets. Why tail should wag the head. Let the numbers talk but not strategy.

I have been lately tracking rice sector. Do not see such wide notable differences. Krish is right. Let the nos.do the talking. Rice is a commodity sector with inbuilt risk of price fluctuations. In 2015, basmati prices tanked 40-50% due to bumper production and low international demands. From thereo on, it has stabilised. Also, in basmati, it takes 12 to 36 months for the rice to mature. Only then, do you get the price appreciation as desired.

But, I am bullish on this sector from a long term perspective and have invested in a rice company.

LT Foods has high debts….INR 830+ crores.

Net profit less than 100 Crores. ROCE less than 15%.

How can we be assure of company’s sutainability over long term.

I think for some time prices may see consolidation, for long term perspective rice stocks do look good. Honestly not expecting any major change at least till December.