Kshitij Anand of ET has pointed out that the best option for investors in the present market conditions is to buy stocks that are quoting at their lowest forward PEs.

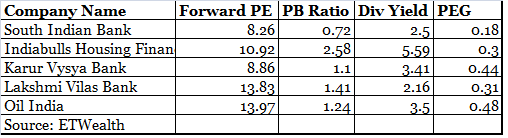

The list of the said cheap stocks that are a good buy are as follows:

(Image credit: ET – Click for larger image)

The stocks have been recommended by the experts on the following basis:

1. South Indian Bank recommended by Motilal Oswal

After a strong September quarter, the focus on granular low-ticket retail and SME advances, coupled with increasing share of core deposits, should provide stability to the bank’s margins going forward.

The management is focusing on increasing efficiency of the existing network and cutting the flab from the system.

Motilal Oswal expects PAT CAGR of 21 per cent over FY16-19 and ROAs to improve 10bp to 65bp by end-FY19. Current valuations largely discount the negative.

2. Karur Vysya Bank recommended by Centrum

Karur Vysya is a small old generation private bank. The whole banking sector is doing very well and a lot of stocks moving higher in term of valuation, but this is one stock which has seen relatively lower participation, and is available at a decent valuation

Karur Vysya Bank saw its second-quarter profit fall by 11.2 per cent to Rs 126.31 crore from last year as expenses rose. Gross non-performing assets (NPAs) as a percentage of advances rose to 2.29 per cent from 1.79 per cent earlier.

The bank had a return on the asset in FY15 of about 0.9 which has moved to 1% in FY16 and our expectation is that it is further likely to move to 1.1 plus in the current year and the year after.

3. Indiabulls Housing Finance recommended by Motilal Oswal

Indiabulls Housing Finance’s (IHFL) transformation from a diversified lender to a focused mortgage player has yielded returns, with RoE/ROA improving from 3 per cent/0.8 per cent in FY09 to 26 per cent/3.5 per cent in FY16.

Moreover, its focus on mortgage and market share gains should drive AUM growth of 26 per cent over next two years.

IHFL is among the lowest-levered HFCs (4.6 times) to support growth. Asset quality trend is likely to remain stable, while its improved borrowing profile, better credit rating, and liquidity buffer should help maintain healthy spreads.

4. Oil India recommended by HDFC Securities

The recent production cuts announced by Opec and non-Opec members augur well for the company as its earnings are highly sensitive to movement in crude prices. The production cuts would provide support to crude prices and it would counter-balance the increase in shale oil supplies and increased output from Iran.

OIL, IOCL and BPRL have jointly acquired 23.9 per cent and 29.9 per cent stakes in Vankorneft and Taas Yuryakh, Russia. Total acquisitions cost is $ 3.14 billion (OIL’s share 33.5 per cent). The acquisition would be value accretive for the company in the long run.

OIL’s stock performance will move in tandem with the crude prices. If the OPEC and non-OPEC members do not stick to the announced production cuts, crude prices will again start falling. This could impact OIL’s margins and stock price.

5. Lakshmi Vilas Bank

Lakshmi Vilas Bank (LVB) has posted a 44.6 per cent increase in its net profit helped by lower cost of funds for the quarter ended September 30, but asset quality took a hit.

The bank’s asset quality weakened due to a Rs 75 crore bill discounting fraud in one of its branches and slippage of the account of a food processing unit to the tune of Rs 61 crore. However, the management is upbeat about the coming year despite various headwinds.

NS Venkatesh , ED, said that the 2017 outlook is much brighter than in 2016 because the credit growth had slowed during the demonetisation period.

Going ahead, the problems will get sorted out and we will see a little bit more robust credit growth because we expect the budget to be positive.

In today’s scenario everybody is scaring of putting money in banks due to NPA stress, hence the valuations are lower.