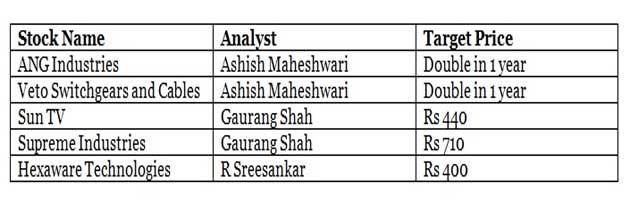

Kshitij Anand of ET has collated the top ideas of leading experts like Ashish Maheshwari of Blue Ocean Strategic Advisors, Gaurang Shah of Geojit BNP Paribas Financial Services and R Sreesankar of Prabhudas Lilladher.

(Image Credit: ET)

(1) ANG Industries: The stock has already appreciated about 50 per cent within a short span of time, but if one can hold it for some more time, it can give up to 100 per cent return within a year or so.

It is a turnaround engineering company with a market-cap of Rs 74-odd crore and if you look at their four verticals, they are into automotive and into body building for tapers and trailers. Apart from that, they are into agri side as well as into heavy fabrication. One can expect a turnaround from their last quarterly numbers, where the company reported a net profit of almost Rs 1.8 crore vis-a-vis a loss of Rs 2 crore, which it reported last year. This company can report an EPS of almost Rs 8 this year. That way this is one of the cheapest heavy engineering stock, which is quoting at a price-to-earnings multiple Rs 5-5.5. Besides their ultimate buyers are companies like Volvo overseas and Ashok Leyland in India.

(2) Veto Switchgears and Cables: This is a midcap company in the consumer electrical space with a market-cap of almost Rs 180-185 crore. It has four verticals, including Switchgears, fans, LED and CFL lights as well as wires and cables.

In the last two quarters, the company’s profit has doubled. But one major trigger coming in is that it has a turnover in multiples size from various verticals. This being the only listed company of the group, all group firms are getting merged into it. So this company’s turnover in profitability will be multi-fold in the years to come. The stock also has the potential to double in a year’s time.

(3) Sun TV: Sun TV is present in four out of the six major circles and has a decent bouquet of channels to offer. The company also operates in the radio segment. There is a little bit of negativity in terms of the management news flow, but we are working with the a target of about Rs 440 on the stock with a one year-plus time horizon.

(4) Supreme Industries: It is a consistent performer. The earnings visibility has improved and going forward the new product addition will definitely add to the positivities in terms of earnings visibility with a one year-plus time horizon. The brokerage has a target of about Rs 710 for the stock.

(5) Hexaware Technologies: Hexaware Technologies has maintained its revenue momentum in Q3 of CY15 with a revenue growth of 3.5 per cent (QoQ) and 16.4 per cent (YoY) in constant currency terms. Investment in new services over the last few quarters has helped the company increase wallet share and drive revenue growth. The company has been able to improve the win rate in large deals and, as a consequence, has an order-book of $100 million from new clients. This will be an incremental boost to CY16 revenue growth.

The company is on track to achieve industry-leading revenue growth in CY16/CY17 along with stable margins. A steady growth trajectory, reasonable valuations and attractive dividend yield (4 per cent) make Hexaware a compelling buy. The analyst has a target price of Rs 300 for the stock.

What’s the target price of Hexaware Technologies? It shows Rs. 400 in the table and Rs. 300 in the narrative.

Kalpraj Dharamshi enters Ricoh India with 73000 shares @ average price of Rs.920

I am surprised that there were not many calls about sugar stocks.

Most have doubled since September 15.

How come?

What about metal stocks?

Yes sugar stocks keep on doubling but it happens only after they have already become half.

ANG Industries – The Co has defaulted on its loans and rated D. Moreover the Debt/EBITDA is more than 7 time.. Think these are very important points to be covered in any analysis which aims to educate investors on recommendations.

This looks like a operator driven stock..as it looks like given the current financials and smallish market cap

ANG Industries – 141 crores of loan. And Owners are selling their stake in the company. why ? these 2 negatives..

What is reason for huge fall in stock prices of Ang industries in last 5 trading sessionstandards.

Of these, ANG Industries turned out to be a joker in the pack ! A fall of 70% from its peak and a wealth destroyer ~