Premium powerhouse at scale

We initiate on LGEIL at ‘BUY’ with a PT of INR 1,630, valuing the stock at 45x Dec’27E EPS based on an EPS CAGR of 16% and average RoE of 27% over FY26–28E. We laud LGEIL’s: (1) market leadership across categories (>25% share ex-ACs) and leading margin (FY25 – 12.8%); (2) support from parentco, providing a competitive keel; (3) breadth of manufacturing capabilities (~95% of products); and (4) robust fundamentals (average RoE/RoCE of 33%/29% over FY18–25 and sustained OCF/FCF generation.

Among India’s leading home appliances brand, LGEIL has retained pole position in the offline channel across categories, including refrigerators, ACs, washing machines and televisions. This dominance, we believe, is driven by its robust brand recall, edge in technology and innovation, strong parentage and widespread distribution.

LGEIL’s dominance in the premium category, in-house manufacturing capabilities and presence in higher-margin categories (B2B products, service contracts and exports) have helped it sustain a margin profile superior to peers. Furthermore, to expand its reach, LGEIL has launched the ‘LG Essential’ series, specifically to cater to the mass-premium needs of a vast majority of Indian households. Scale-up in the abovementioned alongside macro tailwinds shall aid LGEIL keep up revenue/PAT growth.

LGEIL benefits from its parentco’s massive scale, focus on technology and R&D (annual R&D spend of ~USD 2bn), not to mention manufacturing excellence. This is critical to LGEIL’s dominance across categories, particularly due to aggressive competition and ever-evolving consumer preferences. LGEIL manufactures ~95% of its products in-house (Noida and Pune facilities), giving it control over supply chain and granting scale benefits. It has also announced a third manufacturing unit with an investment of INR ~50bn in Sri City (Andhra Pradesh), expected to be operational by FY27E.

Premium home appliances brand, with industry-leading margin: LG Electronics India Limited (LGEIL) is among India’s leading home appliances brands. It has retained pole position in the offline channel, ahead of its closest peer, across categories (market share >25% ex-ACs), including refrigerators, ACs, washing machines and televisions. LGEIL enjoys the highest margin vs. peers (~13% in FY25, Samsung/Havells at 10%, Voltas/Blue Star/Whirlpool ~7%), which we believe stems from: (1) a higher share of premium products and market leadership therein; (2) ~95% of products manufactured in-house; and (3) contribution from inherently higher margin categories including B2B products (~10% of revenue), service & AMC (~3%) and exports (~6%).

Strong parentage a moat; key to outpacing competition: LGEIL works closely with its Korean parentco (LG Electronics Inc.) for: (1) product innovation, and design (LGEIL’s R&D spend at ~0.4% of revenue; parentco spends ~USD 2bn annually, ~3–4% of revenue), which, should help LGEIL maintain an edge over peers; (2) manufacturing technologies, related technical knowhow; and (3) lastly, allocation of global exports. These are key to LGEIL’s dominance across categories, particularly given aggressive competition, and ever-evolving consumer preferences in the Indian market.

In-house manufacturing capabilities an added advantage: LGEIL manufactures ~95% of its products in-house (Noida, Pune facilities), giving it control over supply chain and granting scale benefits. LGEIL has announced a third manufacturing unit with an investment of INR 50bn in Sri City (Andhra Pradesh), expected to be operational by FY27E, focusing initially on ACs/AC compressors, then washing machines and refrigerators. This unit should ~2x capacities in key segments, and 3x AC compressor capacities.

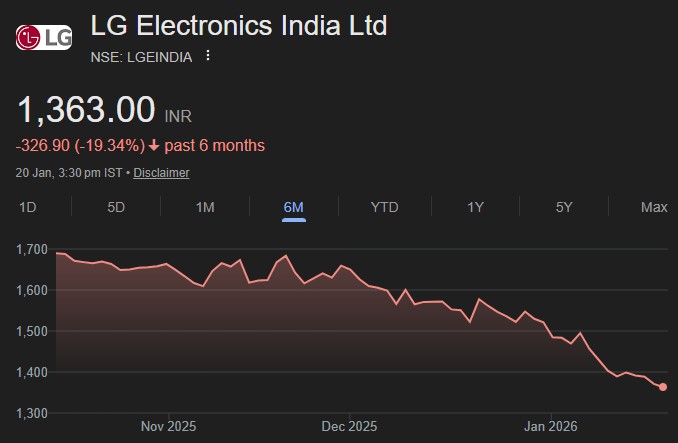

Reward leadership and strong fundamentals; initiate with ‘BUY’: We initiate on LGEIL with a BUY and PT of INR 1,630, valued at 45x Dec’27E EPS, supported by an EPS CAGR of 16% and avg. RoE of 27% (FY26-28E). Over FY18-25, LGEIL has delivered an avg RoE/RoCE of 33%/29%, and has consistently generated OCF and FCF. Despite a lower EPS CAGR than peers, we do not accord a P/E discount to LGEIL given: (1) market leadership across categories and leading margin; (2) support from parentco, aiding competitive advantage; (3) manufacturing capabilities; and (4) strong fundamentals.