The dividend yield is computed based on the closing price of 4th March 2026

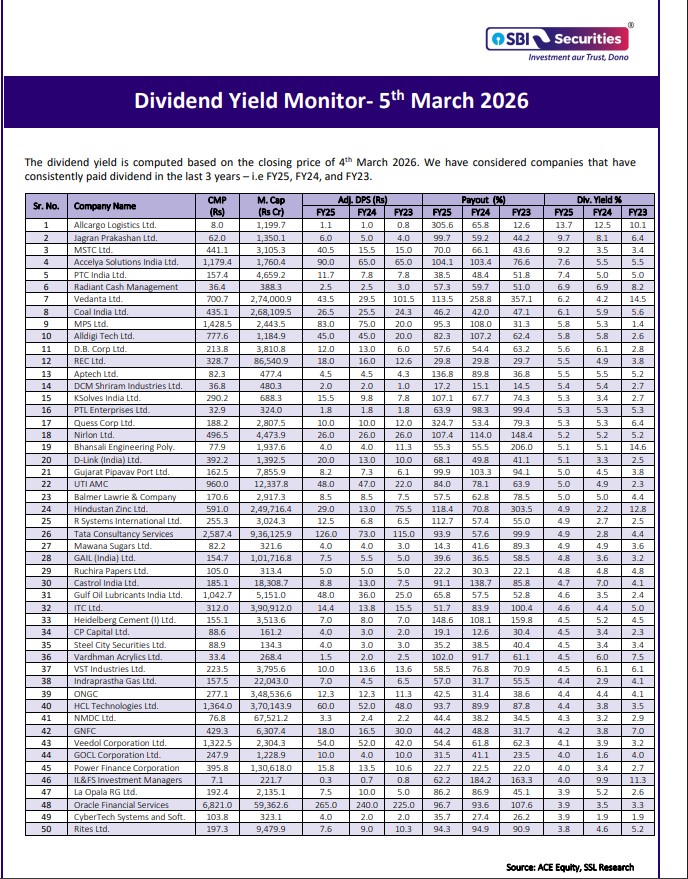

Dividend Yield Monitor- 5th March 2026

The dividend yield is computed based on the closing price of 4th March 2026. We have considered companies that have consistently paid dividend in the last 3 years – i.e FY25, FY24, and FY23.