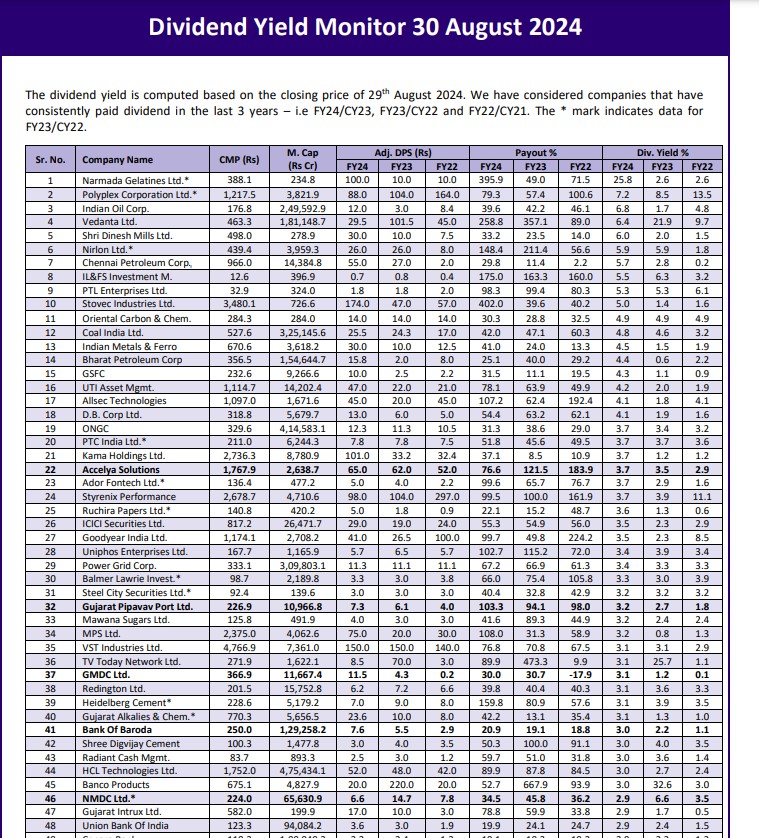

The dividend yield is computed based on the closing price of 29th August 2024. We have considered companies that have consistently paid dividend in the last 3 years – i.e FY24/CY23, FY23/CY22 and FY22/CY21. The * mark indicates data for FY23/CY22.

The dividend yield is computed based on the closing price of 29th August 2024. We have considered companies that have consistently paid dividend in the last 3 years – i.e FY24/CY23, FY23/CY22 and FY22/CY21. The * mark indicates data for FY23/CY22.