Join my PMS and travel the Globe

Basant Maheshwari has a penchant for traveling to exotic places across the Globe.

He posts pictures of these picturesque places and draws gasps of admiration from his army of followers.

Some disgruntled follower commented that Basant is able to afford these trips because of the high fees he charges his clients.

Basant was not fazed by the comment.

“If you’d been our client then instead of ranting you would have also been roaming around in Europe,” he quipped, implying that his PMS is posting massive gains and his clients are rolling in riches.

If you’d been our client then instead of ranting you would have also been roaming around in Europe …Yes ! https://t.co/p3YNs2D2PP

— Basant Maheshwari (@BMTheEquityDesk) November 14, 2019

A similar situation arose when Basant announced that he has bought a palatial sea-facing flat in South Mumbai.

360 degree view from our new home in Mumbai. ‘Kahi door jab din dhal jaye.’ pic.twitter.com/SYBHj1ngEw

— Basant Maheshwari (@BMTheEquityDesk) May 10, 2019

He jokingly advised a disgruntled follower who was complaining about living in a slum in Dharavi to invest in Basant’s PMS to be able to afford a posh flat.

Feels sad to hear that. You should transfer your PMS to us.

— Basant Maheshwari (@BMTheEquityDesk) May 10, 2019

Basant also periodically takes potshots at rival PMS providers.

He mocked some unnamed advisers whose “stocks are down 50% and more”.

It’s been a stock picker’s market for some investors and their ‘pat my back friends’. Almost all their stocks are down 50% and more. Wonder what skill they use(d) ? Keep scratching – the head !

— Basant Maheshwari (@BMTheEquityDesk) November 14, 2019

This is how “expensive” stocks become “cheap”

Basant is the author of a bestseller book named “The Thoughtful Investor”.

The Book has a number of practical examples of how investors can snare multibagger stocks.

Basant referred to an extract from the book about how “expensive” stocks become “cheap” and go back to being “expensive“.

Guess what – that’s how expensive stocks get cheap and expensive back again. And don’t need analysts to write reports. It’s math ! pic.twitter.com/6jkWfgdrmA

— Basant Maheshwari (@BMTheEquityDesk) November 9, 2019

The excerpt reads as follows:

“BUY BANK STOCKS THAT DILUTE EXPENSIVE EQUITY:

A bank that dilutes equity at a high price to book is an instant rerating candidate. Axis Bank and HDFC Bank went up in 2007, just after they made a near $1billion and $660 million equity dilution respectively at over 5 times price to book. While Axis Bank almost doubled up post the dilution, HDFC Bank moved up more than 50% in the next six months.

When a bank dilutes expensive equity it raises the overall value of the book and makes the stock look cheaper on the post dilution price to book basis.

On the other hand, PSU banks diluting equity at nearer their book value see negligible impact on the book and hence those stocks do not move that much either.

Analysts do argue that having cash on balance sheet isn’t the same as deploying the cash in the market but it generally takes twelve to eighteen months for a bank to deploy its incrementally raised cash.

However, the three things to remember for an investor who intends to gain from a bank that dilutes expensive equity are:

a. The equity should be diluted at a very high price to book value. A bank that issues capital at 5 times book is a better stock price appreciation candidate than a bank that raises capital at 2 times its book.

b. The quantum of dilution should be large when compared to the present net worth (book value). A bank that raises capital equal to 70% of its existing net worth is a better price appreciation candidate than the one that is raising incremental capital for 20% of its net worth.

c. The bank with a RoE of more than 20% is a better rerating candidate than a low RoE bank, as markets don’t pay higher multiples for low RoE banks.”

Bajaj Finance, the unstoppable juggernaut

Basant’s astute followers rightly surmised that he is referring to Bajaj Finance, one of his all-time favourite stocks.

Bajaj Finance ticks all the boxes referred to by Basant in the excerpt.

I think this is in response to Bajaj Finance blockbuster QIP which happened at a high Price to Book of around 9X.also its existing ROEs are around 23%. So Mr maheshwari is expecting more upside in Bajfinance

— Sleepytrader (@sleeepyinvestor) November 9, 2019

It is notable that Bajaj Finance was able to raise a large sum of Rs. 8500 crore at a relatively petty equity dilution of 3.5%.

Bajaj Finance to raise Rs 8500 Cr with a floor price of Rs 4020, a dilution of just 3.5%

If Yes Bank wants to raise the same money today, it will need to dilute 50%

In January 2017, both had the SAME Market Capitalization!

— sandip sabharwal (@sandipsabharwal) November 4, 2019

Basant has repeatedly extolled the virtues of Bajaj Finance.

“As competition shrinks, the strong lender will get an easy access to market share capture without diluting customer quality,” says Basant Maheshwari (@BMTheEquityDesk) on Bajaj Finance. https://t.co/PmxflM69lM

— BloombergQuint (@BloombergQuint) July 18, 2019

Not just the results there’s something consistent about Bajaj Finance’s stock price also before and after the results. Own it no recommendations.? pic.twitter.com/nRGLTwPlFJ

— Basant Maheshwari (@BMTheEquityDesk) July 13, 2019

Bajaj Finance. Cute na? ?

# No recommendations. Own it. https://t.co/95on1K5ep6

— Basant Maheshwari (@BMTheEquityDesk) May 17, 2019

He has also revealed that he owns Bajaj Finance “to the neck”.

On an earlier occasion, in August 2017, some skeptics had doubted the sustainability of Bajaj Finance’s success.

Wonder why a marquee company & market Darling, Bajaj finance needs three IBs to raise $700m in a QIP!

Must be a walk in the park, right?— Shyam Sekhar (@shyamsek) August 14, 2017

However, thankfully, these fears were unfounded. Bajaj Finance has gone on to give a massive gain of 145% since then.

The YoY gain is itself a mammoth 83%.

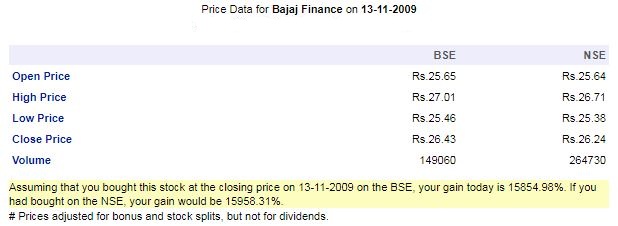

Over the past 10 years (13.11.2009), the stock has given an eye-popping gain of 15854% (158 bagger!).

Forget logic, what works, works; what doesn’t, doesn’t

Basant is conscious of the fact that the gravity-defying stunts of Bajaj Finance defy logic.

The stock is presently quoting at a nose-bleed valuation of 13x PBV which is exorbitant by any standards.

However, Basant counseled his followers not to sweat too much or lose much sleep over Bajaj Finance’s alleged exorbitant valuations.

“The leading stock of the bull market doesn’t care about your logic for why you didn’t buy it ! It just keeps going up,” he said, implying that we have to tighten our seat belts and ride the gravy train instead of prematurely bailing out.

The leading stock of the bull market doesn’t care about your logic for why you didn’t buy it ! It just keeps going up.

— Basant Maheshwari (@BMTheEquityDesk) November 15, 2019

It is worth recalling that Billionaire Jim Simon has offered similar advice to us.

Jim Simon has earned a CAGR return of 66% over the past 30 years and beaten the track record of legendary investors like Warren Buffett, George Soros and Peter Lynch.

“The whys in the markets don’t always make sense,” the veteran Billionaire authoritatively declared, when asked as to how he raked in a massive fortune of $28 Billion by out-performing the legends!

Basant’s as per Renuka has easily beaten RJ’s return as per his PMS return. Basant definately is our JIM!

It will be interesting to track Shyam,Porinu and Basant PMS performance over a period of time. Interesting time ahead.

I like this competition !Super Bullish PNB Housing- Ugly Duckling Sintex and Chor Companies LEEL:)

What is so great in “Super Bullish PNB Housing”. It is also at roughly 40% of its peak price.

There is nothing great , the only common thing is that these were stock recommended by them to public. So retail investor need to know that all these 3 stalwarts can do mistakes. They need to learn that there is no use of bitching about each other on Twitter.

For the last 1-2 years, his PMS wasn’t doing well and was in the news for wrong reasons. A turnaround in last 3 months thanks to good market, he is back with vengeance scoffing at everyone.

How do you know his PMS was not doing well for the past 1-2 years?

Go through the previous posts on this forum and you will discover what their performance was. Ofcourse, given people have short memories, they might erase all the old data and pump in new figure which looks glorious to attract new bakras.

All market masters tagging PM for tax cuts. LTCG .etc But none on Delhi pollution and few even rooting to get more manufacturing done in our country. Sad state that we have such market masters with just selfish motive of only increasing their wealth.Most of them live in Mumbai and when this hits Mumbai lets see what they do.

I had heard from sources that the likes of Damani, Jhunjunwala.etc were planning to have a candle march in front of Dalal street against the pollution.However some political forces compelled them not to conduct it.

Mumbai and Kolkatta also among to 10 polluted cities of world.

Never follow guys like BM, PV etc. as they would have invested in lower valuation and give prophesy when stocks skyrocketed…so retail investors will be late and can get trapped. Only use this stock description for studying in detail and invest based on valuation.

Good news is always often spoken and bad ignored with regards to stock market, Basant would have definitely exited at losses in stocks like PNB HFL, CanFin Homes, his favourite at one point in time.

nobody is talking about the history of Basant who once ran an advisory service and had to shut down for his poor reasons, do your homework well before giving any pms