Investors throng Dalal Street after WSJ declares end of Bear Market

It is hard to believe that just a few days ago, Dalal Street was like a deserted ghost-town.

Only a few jobless punters like me were loitering around, idly watching the World go around.

However, today it is a bee-hive of activity.

Punters of all shapes and sizes are thronging the place, eager to scoop up stocks.

The reason for the renewed interest is because it is now officially declared by the Wall Street Journal that the dreaded Bear market has come to an end and a new Bull market has begun.

“A new bull market has begun. The Dow has rallied more than 20% since hitting a low three days ago, ending the shortest bear market ever,” the authoritative publication stated, much to the relief of everyone.

Breaking: A new bull market has begun. The Dow has rallied more than 20% since hitting a low three days ago, ending the shortest bear market ever. https://t.co/06YS0XqWGP

— The Wall Street Journal (@WSJ) March 26, 2020

This is corroborated by the views of other experts.

“We’re entering a new bull market,” Ari Wald, an expert with Oppenheimer Fund told Yahoo Finance.

Andrew Slimmon of Morgan Stanley expressed a similar view.

He has given cogent reasons as to why there are “healthy signs” that a new “bull market” is emerging.

The S&P 500 just posted its biggest weekly gain since 1974. All in the face of an health and economic crisis. Morgan Stanley's Andrew Slimmon details the 'healthy signs' in the new "bull market".https://t.co/OFrCr6w1SM pic.twitter.com/4EZQX45Fcw

— Bloomberg TV (@BloombergTV) April 11, 2020

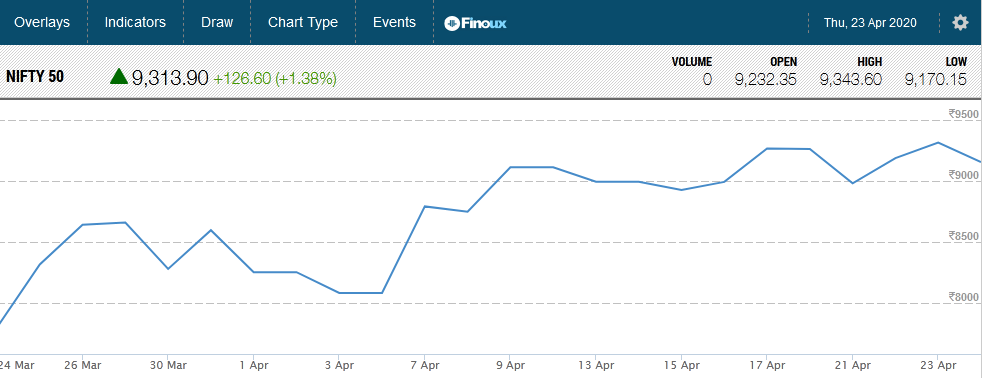

If you did not buy at 7500, will you buy at 9300?

Sanjiv Bhasin rightly pointed out that people who are fence sitters will always be fence sitters.

If they could not muster the courage to buy stocks when the Nifty was at 7500, the chances of their being able to be do so now when the stock prices are much, much higher is very remote.

“If you could not buy at 7,500, you are not going to buy at 9300; you will never buy at 10,000 and if this market goes back to 7,500 you will never buy. So like I said, this fear will let 90% of the people just sit on the sidelines,” he observed in a pithy manner.

In fact, this is the reason he had implored us in February 2020 “to buy the fear for sweetest April rebound“.

Overriding global fear seeing stocks get cheap… watch out for 2nd half of March—- could see sharpest rally globally & locally-Buy the Fear for sweetest April rebound ?

— sanjiv (@sanjiv_bhasin) February 27, 2020

No doubt, the advice was very sound indeed because April has been a very profitable month for us.

If you see the right price in the right stock, start nibbling on it

Sanjiv Bhasin advised that there is no point in our being “ticker watchers” and waiting endlessly for a crash to buy stocks.

Instead, if we like a stock and it is at a reasonable price, we can start nibbling and deploy at least a portion of our capital into it.

“If you have not bought this market and you are sitting on the sidelines, all you will do is be a ticker watcher,” he said.

“If you can see the right prices and the right stocks, then you do not want to miss this opportunity because the upside again after this in August and September, which I can foresee, can be huge,” he added.

He pointed out that there are huge bargains in mid-cap stocks which are waiting to be bought by us.

“The midcaps or the value picks which are giving you an extreme advantage or an opportunity and that is where you should be really investing,” he suggested.

Virus will show signs of abatement Nifty will hit 10,000 by April end: Sanjiv Bhasin https://t.co/sTTUT9Po66 via @economictimes

— sanjiv (@sanjiv_bhasin) April 16, 2020