Our Take:

LG Electronics India Limited (LGEL) is a market leader in India’s large home appliances and consumer electronics space, with a strong brand franchise built over more than two decades. The company holds leadership positions across key categories such as refrigerators, washing machines, and air conditioners, supported by a wide distribution network, local manufacturing scale, and strong after-sales service. LGEL’s market share in the offline channel, which accounts for 78% of major home appliances and 77% of the consumer electronics market (excluding mobile phones), in key categories such as TV/refrigerators/Room AC/Washing Machines stood at 27.5%/29.9%/17.3%/33.4%.

LGEL has curated a wide range of portfolios across its 2 business segments – Home Appliances and Air Solutions, and Home Entertainment. Refrigerators had the highest revenue contribution across products categories, at 27.5% in FY25, followed by Air conditioners at 21.6% and Washing machines at 20.7%. Apart from core hardware business, the company is also investing in high margin B2B, AMC and data center cooling businesses.

As appliance penetration in India remains structurally low relative to global averages, LGEL is well positioned to benefit from rising disposable incomes, premiumisation trends, and increasing urbanisation. Over the past few years, LGEL has demonstrated steady revenue growth, aided by new product launches, localisation of manufacturing and deeper penetration into tier-2/3 markets. The company’s focus on energy-efficient, smart and premium products has helped improve average selling prices, while operating leverage and cost rationalisation initiatives have supported margin stability despite periods of input cost volatility. We believe LGEL’s strong parent backing and access to technology provide it with a sustainable competitive moat in an increasingly crowded market.

Overall, LGEL is a high-quality consumer franchise with strong cash generation, leadership positioning and long-term growth visibility. While near-term performance may be influenced by demand cycles and competitive intensity, the company’s scale, brand equity and execution capabilities position it well to compound earnings over the medium to long term.

Valuation & Recommendation:

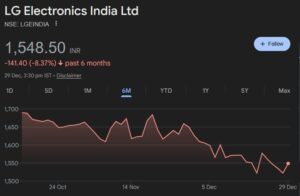

LG has delivered resilient performance despite external headwinds in recent quarters. With rising disposable income, increasing penetration of the organised market and premiumisation expected to drive sustained growth in the industry, LGEL is at the forefront to capture the growth with its leadership position. We expect revenue/EBITDA/PAT to grow at 9%/11%/11% CAGR between FY25-28E.

Going forward, the company has outlined a clear strategy to maintain its leadership position through new product development and industry leading technology. It aims to further drive penetration through the new LG essential series. Additional revenue drivers include increasing ancillary businesses such as AMCs, B2B and data center cooling products, which are high margin and have a huge runway for growth.

LGEL aspires to create a global export hub in India through its new production facility in Sri City, Andhra Pradesh that will cater to exports in the South Asian countries. The company plans to invest about Rs 5,000 cr in a phased manner over the next 4-5 years in this new facility which it believes would be a strategic asset in consolidating its South India business and creating a global export hub. With initial plans to produce Room ACs at the new facility, the company aims to install new production lines for refrigerators and washing machines in the following year.

While margins have come under pressure in H1FY26 on account of elevated commodity prices and ramp up of marketing and go-to-market initiatives, LGEL has several margin levers such as increasing premium mix, higher localisation, improving efficiency and reduction in logistics cost from its upcoming facility, which are expected to drive margin normalisation in the upcoming quarters.

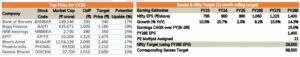

We believe investors can buy the stock in Rs 1509-1555 band (33.3x FY28E EPS) and add on dips in Rs 1400-1441 (31.0x FY28E EPS) band for a base case fair value of Rs 1669 (36.5x FY28E EPS) and bull case fair value of Rs 1780 (39.0x FY28E EPS) over the next 2-3 quarters

Very nice Analysis. But what do you thinks about other electronic stocks?