As far back as in July 2022, when the markets were in the doldrums, Madhu Kela had predicted that there would be a rally and advised us to buy stocks ASAP.

“Better grab your seat before it gets too crowded. The correction happened because of macro factors. When the macro comes under control, obviously stock prices will not stay low. Now is the chance to build what you want to buy over the next three, four months,” he had advised (see Grab stocks now before hordes rush in & push prices up. SBI, ICICI Bank are good buys: Madhu Kela).

He pinpointed banking stocks as a good buy on the logic that they have been unjustifiably battered despite good fundamentals and would rebound sharply.

“Private banks have delivered 23 percent negative returns in the last three years while PSU banks are almost flat. In the last eight years, there has been unprecedented amount of clean-up which has happened from the banking sector,” he stated.

Sridhar Sivaram had echoed this advice in August and stated that Banking stocks are entering a “golden phase” and that there is a lot of money to be made:

“We think that the next three years may be a golden phase for banks in general. Within the financial basket, I will just buy the top four, five banks. One can argue whether one is better than the other. I think all of them will do well. You pick your stock and just stay put for three years I think there is a lot of money to be made in the banks,” he emphasized.

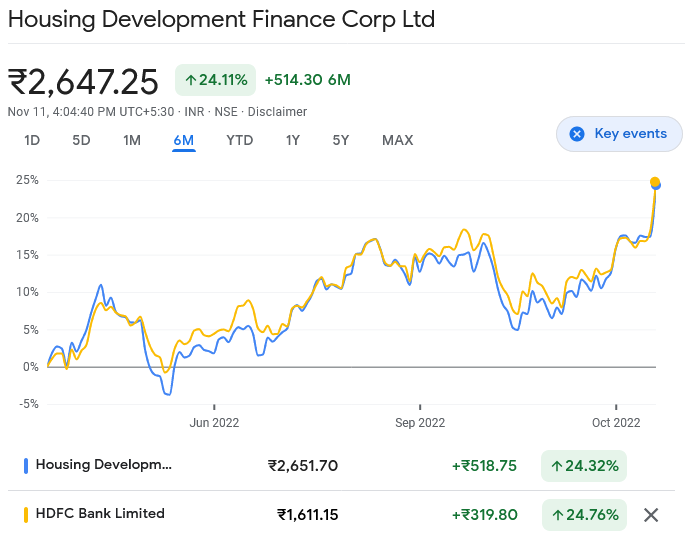

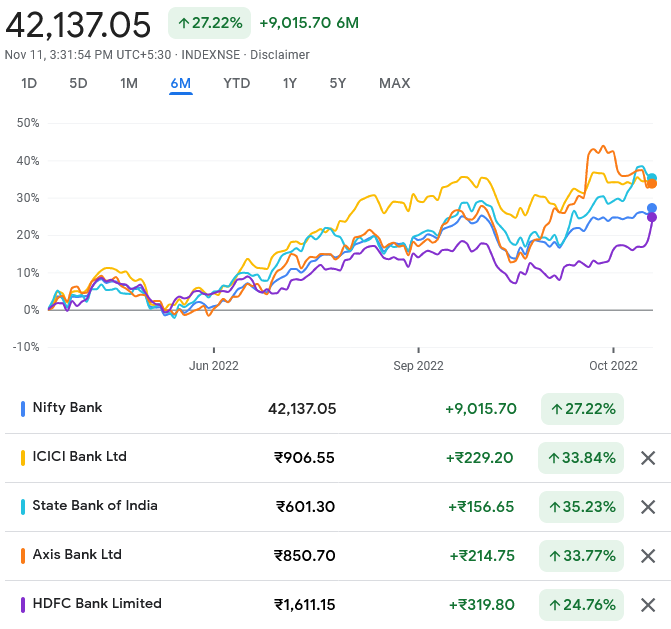

Now, in November 2022, Banking stocks are very much in fancy on Dalal Street. The entire sector is up 27% in the past six months with SBI, ICICI and Axis delivering 30+% returns. Even HDFC Bank, which is alleged to be an underperformer, has yielded 25% return over the past six months.

According to Sridhar Sivaram’s latest interview, Banking stocks are still a good buy despite the steep rally. They can give hefty returns over the next few years.

“These banks could give you easily 20% compounded over the next three-four years,” he said.

PSU Banks are also a good buy

According to Sumeet Bagadia, an expert in technical analysis, PSU Banks like SBI, BOB, Canara Bank and Indian Bank have potential to offer respectable gains in the near future.

“PSU Bank has just begun to bulk up and has entered a rise with leading indices. As Bank Nifty made new highs, support was aided by PSU stocks as well. On a daily time frame, the momentum indicators as RSI and MACD remain on the positive side. PSU Bank would continue to outperform in the short to medium term. As volatility is now contracting, long term investors would be more confident to stay invested. Last week, PSU Bank has delivered 6.46 percent return and we expect the PSU Index might test 4000 levels in coming days,” he said in the ET.

He opined that the financial giants HDFC and HDFC Bank are likely to continue their strong upward momentum.

“HDFC Bank and HDFC were in long consolidation and finally managed to give a breakout. In past months resistance was seen in HDFC Bank around Rs 1500 to Rs 1520 levels, which it was struggling to cross higher. HDFC Bank finally gave a breakout along with good volumes and we expect this momentum to continue further and take HDFC Bank to Rs 1700 to 1750 levels. HDFC had resistance around Rs 2480 to Rs 2500 levels and now has given a breakout. We expect this momentum to continue and take HDFC to Rs 2750 to Rs 2800 in coming days,” he advised.