The remarkable aspect about the stock market, as in politics, is that there are no permanent friends or foes. Yesterday’s darling can be today’s pariah and today’s pariah can be tomorrow’s darling.

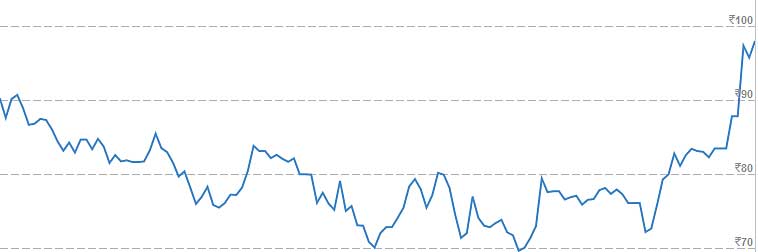

DCB Bank, which was basking in the sun, after being labeled a potential 100-bagger in Motilal Oswal’s prestigious 19th Wealth Creation Study, suddenly found itself on the frying pan after its aggressive expansion plans did not meet with the approval of the cognoscenti.

Kotak Securities led the crusade against DCB Bank. It tore the mid-cap Bank apart by labeling its expansion strategy “a very dangerous, unexpected and disappointing shift in their strategy of steady improvement in cost ratios, focusing on risk and improving return ratios“. It also expressed “disappointment on the change in the investment hypothesis, which earlier rested on steady loan growth, healthy capital structure, cost control and management execution leading to better return ratios”.

Such an aggressive attack is normally unusual in the rarified and genteel world of merchant bankers. However, it did set the tone and forced the hands of the other brokerages, all of whom hastily downgraded the beleaguered bank to sell status. Even Motilal Oswal, perhaps reluctantly, downgraded DCB Bank to sell.

Fortunately, DCB Bank’s management, under the dynamic leadership of Narsee Munjee and Murali M Natrajan, had the good sense to launch damage control measures. They announced a roll-back of some measures and a softening of some others. This soothed the frayed sentiments of the cognoscenti to some extent. The duo also got down to improving the operating parameters of the Bank.

These pro-active measures are bearing fruit because analysts are again warming up to DCB Bank and giving it pride of place in their list of recommended stocks.

Kotak Securities is again at the forefront. It upgraded DCB Bank to “add” from “sell” on the basis that the bank would deliver 15-16 percent return on equity in the long-term.

Understandably, the stock surged 8% as everyone rushed to congratulate it over its changed fortunes.

Motilal Oswal also heaved a sigh of relief. “Post management strategy change for franchise expansion the stock has moved in-line with our expectation (corrected sharply) and valuations have now become comfortable. We upgrade earnings by 3-5 % for FY16-18E to account for better than expected PPP performance. We expect ROA and ROEs to be ∼1 % and ∼11 % over FY16-18E. Based on Residual income model, we value DCBB at 1.4x FY18 PBV and revise rating to Buy” it said.

ILFS has also recommended a buy on the basis that the performance is “healthy” and valuations are “comforting”.

With this, the beleaguered investors of DCB Bank can rest easy that not only is their capital safe and sound but they are also assured of pocketing a reasonable return therefrom. In fact, if the Bank’s top brass continues with their salutary attitude of caring about investors’ sentiments, the day is not far when the Bank may truly attain the coveted status of a 100-Bagger!

I had already discussed in stock talk that DCB correction was OK upto 100 as it was over priced at 150 along with whole market.But sell call with target of 70 etc was totaly rubbish. I had always maintained that it is a three digit stock.Now sell callers need to explain why they created panic in small Investers.DCB is long term buy which will outperform NIFTY ,Bank NIFTY and will be among best performing Bank stock irrespective of unconistant stand of analysts.Small investers should not follow these analysts who change views at change of hat.More over bank management knows how to expand bank,if these analysts know better,they should start their own bank.

And wonder how just changing 150 branches over 12 months to now over 24 months suddenly puts it back on rails.

And why this change? What does the bank say abt it? Well – the change in strategy had been decided after receiving feedback from its investors, analysts and other stakeholders on its previous expansion plans.

Indeed brilliant. Time to have a makeover of the board and senior management. Lets fill it up with invetors, analysts and other unidentified / unnamed stakeholders ( who knows what breed these stakeholders belong too)

Indeed the bank is in good hands to deliver a 100x in 33 years

Perfectly said.These brokerage houses created panic.Now they have come back with buy call.Actually all bigwigs are here to loot small investors.

Yes, so it seems. But you have to understand that this is nature of stock markets. Somebody buys and somebody will sell. Somebody gains then somebody loses. its the nature of this market. I have started thread for small investors/ retail investors. You can follow that thread (at your own risk of course).

DCB Bank and Kotak Bank are in the same industry. Kotak Bank and Kotak Securities are connected entities. Isnt it unethical practice by Kotak to ridicule and create panic in such a situation? Shouldnt SEBI investigate? I am not an investor so far in this scrip, but I am concerned about those who may have wrongly exited with stock going down after such panic calls, and these so called brokerages that gave sell calls may have accumulated more stock at lower prices in the process. If SEBI cannot curb these games of big boys, then it will be left with only the funds and institutions, no retail investor will survive. Already the numbers are dwindling.

By the way, what is wrong in DCB’s risk-focused expansion plan when all and sundry are doing so, and the RBI giving so many new bank licences (small, payment banks, NBFCs etc)?

If any investors uses the strategy to copy these fund houses, then they have every right to play with both your mind and emotions. If you are a confident investor and use your own parameters, then these articles have no bearing. But I do understand your point of view. Small, weak investors are very susceptible to such fund houses or EXPERTS. And in this regard SEBI should look at them with slight disapproval.

Hi,

I had been saying for a while that these panic is for no reason. Now that is proved fortunately i bought stocks as the price went down. So now sitting on some profit.

want some fresh recommendation

#Niveza #Review on Mid-cap Banks Status::

Fundamentals of DCB Bank are looking cheap at current levels. Interest income is gaining the momentum year on year. Net earnings moving slightly faster than the revenue growth. At the level of 16 PE, DCB Bank is looking decent at current levels. The expansion plans are looking good and as per the expectations, bank is also delivering well. After the crash, stock has gained more than 40% in last couple of months. Still the stock is looking a better buy a far as valuation is concerned. Recently bank has revised MCLR and Base rate, but the management is sure that this will not affect the profit margins of the Bank. After the upgrade of Kotak Securities from “sell” to “buy”, it enters investors portfolio suddenly.