(Image credit: Chennai Angels)

First of all, we must pay tribute to the stock picking ability of Dolly Khanna aka Rajiv Khanna. Long before NAMO came on the scene and ceramics and sanitaryware become the buzzwords, Dolly had grabbed a massive chunk of Cera Sanitaryware’s stock. It is much later that the other stock pickers woke up to the potential of ceramic and sanitaryware stocks and put out a buy on them.

Dolly Khanna’s latest stock pick is Asian Granito, a micro-cap with a market capitalisation of only Rs. 363 crore. In the December 2014 quarter, she scooped up a chunk of 3,82,454 shares. The investment is worth Rs. 6.11 crore at the CMP of Rs. 160.

The quickest way to get a grip on Asian Granito is to read the interview of Bhupendra Vyas, Chief Operating Officer. In that, Bhupendra Vyas points out that Asian Granito is among the top five ceramic tile manufacturers in India. He states that the company manufactures and markets interior and infrastructure products like vitrified wall and floor tiles, marble and quartz stone. It was established in the year 2000 and has grown its manufacturing capacity 40-fold in 14 years, from 2500 square meters per day in the year 2000 to over 1 lakh square meters currently (including outsourcing). It is also pointed out that company exports to nearly 42 countries worldwide.

Bhupendra Vyas also explains that the growth of the ceramic industry is dependent on the growth in sectors like hospitality, construction, corporate spaces, residential premises etc. One area of opportunity is the huge middle class population of India with its increased ability and desire to spend with more disposable income on hand. He adds that the challenges for the industry come from increasing input costs and the steep rise in energy costs. The overall slowdown in the economy, which has brought about a slump in the real estate and construction sectors, has indirectly affected the ceramic industry as well, he says.

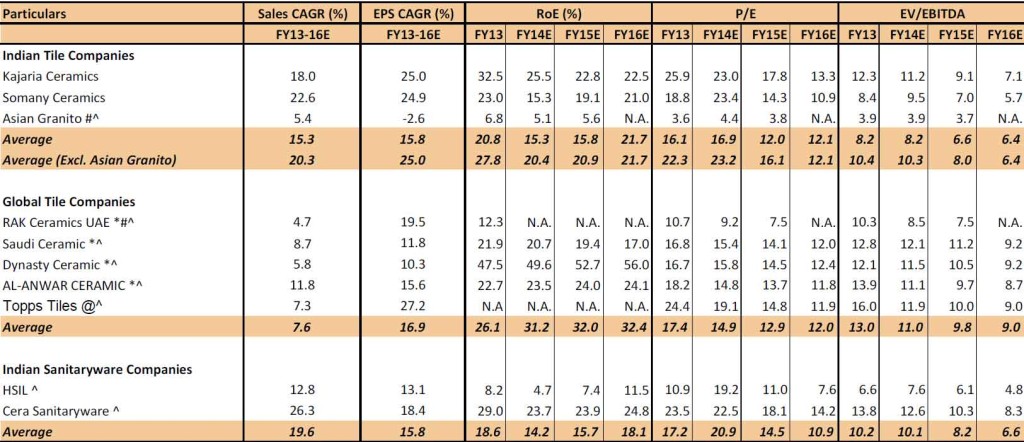

Daljeet Kohli of IndiaNivesh has also conducted a detailed study of the ceramics industry and of the various players in it. In particular, he has compared Kajaria Ceramics and Somany Ceramics with Asian Granito.

Daljeet’s report reveals that while Kajaria and Somany are expected to have impressive sales CAGR during FY13 to 16E of 18% and 22% respectively, Asian Granito will lag behind with 5.4%. Also, while Kajaria and Somany are expected to report an EPS CAGR from FY13 to 16E of 25% and 24.9% respectively, Asian Granito may report a EPS CAGR of (-) 2.6. If you look at the actual figures of ROE for FY13, Asian Granito lags behind with 6.8% as against the impressive 32.5% for Kajaria and 23% for Somany.

| Overview of Asian Granito’s figures | |||

| (Figures in Rs Cr) | 2014 | 2013 | 2012 |

| Net Sales | 759.14 | 708.36 | 623.80 |

| Operating Profit | 65.09 | 72.28 | 69.25 |

| Profit Before Tax | 22.49 | 25.38 | 27.01 |

| Profit After Tax | 14.14 | 17.11 | 18.05 |

| Share Capital | 22.58 | 22.16 | 21.06 |

| Reserves | 257.76 | 242.46 | 218.52 |

| Net Worth | 280.34 | 264.62 | 239.58 |

| Loans | 269.11 | 258.13 | 199.97 |

| Operating Profit Margin (%) | 8.57 | 10.20 | 11.10 |

| Net Profit Margin (%) | 1.86 | 2.42 | 2.89 |

| Earning Per Share (Rs) | 6.26 | 7.71 | 8.41 |

| Dividend (%) | 0.00 | 10.00 | 10.00 |

| Dividend Payout | 0.00 | 0.11 | 2.11 |

| Core Ratios Of Asian Granito | 2014 | 2013 | 2012 |

| Debt-Equity Ratio | 0.94 | 0.88 | 0.73 |

| Operating Margin (%) | 7.72 | 9.05 | 9.82 |

| Net Profit Margin (%) | 1.68 | 2.14 | 2.56 |

| Return on Capital Employed (%) | 8.11 | 10.51 | 11.65 |

| Return on Net Worth (%) | 5.19 | 6.79 | 7.79 |

Apart from poor ROE’s, Asian Granito has also a bit of debt in its books. Also, the promoters’ holding is low at 37%.

In the past, Asian Granito’s poor return ratios was priced in because while its P/E for FY13 was only 3.6, its peers, Kajaria and Somany, commanded P/Es of 25.9 and 18.8%.

However, at the moment, Asian Granito is quoting at a P/E of 24x based on the TTM EPS of Rs. 6.62.

We must also bear in mind that Asian Granito has surged quite a bit in the recent past. In the last one year, the stock has given a return of 370%. The six month return is 118% and the three month return is 56%.

Whether Dolly Khanna’s magic wand will propel Asian Granito to higher orbit or whether it will run out of breath over excessive expectations from it remains to be seen.

Kajaria Ceramics Promoters too have picked up a big stake through Cheri Cherry ceramics, while the promoters holding do not appear to be at 37% only. While asian overeseas and Artistique Ceramics Pvt Ltd are sure to be some what related to asian granito promoters family, is it a sheer coincidence that the Promoters who are Patels while most of the large minority shares too are Patels and their shareholding remains always unchanged ? are these Patels an extended family of the mgt?

.May be in times to come these shares will get accounted officially through creeping acquisition in the promoters category. As far as low margins are concerned, I personally believe that they actually have margins almost equal to Kajaria and cera and somany but at present corporate governance might not be highest…however as it has always seen in the past most of such managements which have actually high margins and their company belonging to high trajectory, once they get limelight from the entry of peer respected shareholders like Dolly khanna and much more to follow, will soon be reporting actual results.. once this happens the stock looks grossly undervalued.. it is at present in terms of sales to market cap/EV when compared to Kajaria/cera… Would like other fellow boarders comments…

At least Dolly and Arjun have bought decent quantity. They both will sell once people will start following blindly in few days.

While always writing quality quality stuff, how can he write inferior business here.

If you feel his work is inferior, please start writing your own blog. Probably by name ‘superior investor’. we would be happy to follow it..

His job is to report information, He has not recommended the stock, he has put all the pros and cons, while simply stating that an ace investor who did a 10 bagger in cera has jumped on and entered into another tile company in a high profile entry. That is all. Please do not get personal..

Arjun keep on the good work

How is this possible? I can’t seen anything in her personal holdings on moneycontrol.com and neither in company’s key public holding patterns. is this stake less than 1%?

Look at BSE India corporate announcements.

Amit,

I was not able to get any info on this in BSE India corporate announcements. Can you please help me in getting this data. Also, if they have purchased in NSE, how to know that data as well.

Thanks,

Hi,

Can any one tell me how to track which person has purchase what stock? I.e. how Arjun came to know that Dolly Khanna has purchased this stock in Dec 2014. Can any one tell me the procedure to get this data?

Thanks

is it possible to know what price she entered into Asina Granito? i mean between quarters SHP disclosures the stock has appreciated a lot.

Am I the only one who thinks above numbers are not as impressive if compared to price rise.

Asina Granit was purchased by Dolly Kharma not Dolly Khanna. Please check the following links.

http://www.moneycontrol.com/bse/shareholding/stocks_hold.php?type=1&res=search&id=4844

http://www.moneycontrol.com/bse/shareholding/stocks_hold.php?type=1&res=search&id=51966

121/- Is Dolly exiting this stock?????

looks like all the patels, artistique ceramics, asian overseas limited are related parties to promoters.

Lets hope corporate governance improves, the business or atleast the marketing and distribution for Asian granito is improving.

Even big corporate like VIP industries had these kind of hidden promoter holdings and they apologized for unintended oversight (!) and SEBI let them go.

http://corporatedir.com/company/asian-granito-india-limited

http://corporatedir.com/officer/00233565

http://corporatedir.com/company/artistique-ceramics-private-limited

http://corporatedir.com/company/asian-overseas-limited

looks like all the spatula, artistique ceramics, Asian Overseas Limited are related parties to the promoters.

Lets hope corporate governance improves, is the business or at least the marketing and distribution of Asian Granito improve.

Even large company like VIP industry had that kind of hidden promoter holdings and for unintentional mistake (!) And SEBI let them go apologized.

http://corporates.review

voilaaaaaaaaaaaaaaaaaaa