Mohnish Pabrai & Guy Spier – old India hands

Mohnish Pabrai, the internationally renowned stock picker, knows Dalal Street like the back of his hand.

In fact, it would not be an exaggeration to say that Mohnish learnt the ropes of investing in the dusty by-lanes of Dalal Street whilst hobnobbing with the local punters.

He achieved great name and fame due to his success with Indian stocks.

Stocks like Satyam Computers, Kotak Mahindra Bank, Blue Dart, Dr Reddy etc became mega multibaggers after Mohnish bought them and established his reputation as an ace stock picker.

Mohnish is so indebted towards Indian stocks that he promotes them at every opportunity that he gets.

His latest news letter to the distinguished investors of Pabrai Funds is an example of this.

“I love what we own in India. We’ll make a lot of hay from our Indian holdings in the years ahead … We also have the highest exposure we’ve ever had to companies based in India (over $100 million or over 18 percent of the pie),” Mohnish has said, the pride at being of Indian origin very evident in his tone.

Guy Spier is also, despite his Israeli origin, very much an Indophile.

This is established by the fact that Guy Spier brought his family to India for a family vacation and shared a video of the happy times that he has had here.

The affection for India can be partly traced to the fact that Guy also achieved great name and fame in the investing community because CRISIL, his favourite stock pick, became a mega multibagger.

The logic for picking CRISIL was elementary. Guy rationalized that if rating agencies like Moodys and S&P could achieve such great success in foreign countries, there is no reason why they cannot replicate it in India. He was perfectly correct in his analysis.

Warren Buffett has no choice but to come to India

“It is inevitable that Berkshire will end up with meaningful amount of capital in India,” Mohnish said, his eyes sparkling with excitement.

“Warren understands that he has a very limited number of opportunities to deploy capital in the United States and that India has some great companies run by great managers with great franchises,” he added.

“There are many companies in India which are in the mould of Berkshire,” he emphasized even as Guy Spier nodded in agreement.

Piramal Enterprises is the next Berkshire Hathway

At this stage, we have to compliment Tanvir Gill for her presence of mind because when Mohnish remarked that India has “great companies run by great managers with great franchises,” she immediately asked him to name the stock.

“I visited Piramal and their annual report reads like a Berkshire Report,” Mohnish replied.

“Ajay Piramal is the Warren Buffett of India?” Tanvir asked, giving yet another glimpse of her razor-sharp mind and ability to seize the initiative.

“He is pro shareholder, he is focussed on maximisation of shareholder returns while following the highest ethics. To see that in India is fantastic. It is wonderful,” Mohnish replied with a big smile on his lips.

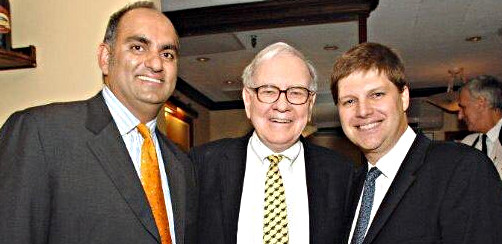

(Three Musketeers looking to invade Dalal Street)

| PIRAMAL ENTERPRISES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 45,026 | |

| EPS – TTM | (Rs) | [*S] | 54.09 |

| P/E RATIO | (X) | [*S] | 48.24 |

| FACE VALUE | (Rs) | 2 | |

| LATEST DIVIDEND | (%) | 875.00 | |

| LATEST DIVIDEND DATE | 17 MAR 2016 | ||

| DIVIDEND YIELD | (%) | 0.80 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 836.01 |

| P/B RATIO | (Rs) | [*S] | 3.12 |

[*C] Consolidated [*S] Standalone

| PIRAMAL ENTERPRISES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | MAR 2017 | MAR 2016 | % CHG |

| NET SALES | 923.94 | 1733.51 | -46.7 |

| OTHER INCOME | 50.46 | 111.54 | -54.76 |

| TOTAL INCOME | 974.4 | 1845.05 | -47.19 |

| TOTAL EXPENSES | 722.55 | 1265.87 | -42.92 |

| OPERATING PROFIT | 251.85 | 579.18 | -56.52 |

| NET PROFIT | 11.39 | 147.65 | -92.29 |

| EQUITY CAPITAL | 34.51 | 34.51 | – |

(Source: Business Standard)

Piramal Enterprises is Mohnish Pabrai’s latest stock pick?

It is evident that Mohnish Pabrai and Guy Spier regard Piramal Enterprises as a “great company run by a great manager with a great franchise,” and Ajay Piramal as being “pro shareholder, focussed on maximisation of shareholder returns while following the highest ethics”.

Putting two and two together, there is no reason why the duo would not have either already grabbed the stock or are looking to do at the first available opportunity.

Is Piramal Enterprises a 5x Bagger stock?

It may be recalled that Pabrai and Spier have earlier revealed that they are not interested in buying any stock which has “less than 5x multibagger potential”.

Piramal Enterprises has demonstrated that it has wherewithal to give multibagger returns to investors.

The return over the past 24 months is 164% while the YoY return is 114%.

The Company has a market capitalisation of (only) Rs. 45,000 crore which means that a 5x gain is easily achievable in the foreseeable future.

What about Radhakishan Damani’s D-Mart?

Warren Buffett has an affinity for retail stocks as is shown by the fact that he bought a massive truckload of Walmart, the mother of all retail stocks.

Of course, it is another thing that the investment in Walmart did not go well and Warren had to retire hurt.

Warren has also candidly expressed regret at not buying Amazon, the e-retail behemoth.

Warren Buffett To Shareholders: ‘We Messed Up By Not Investing In Amazon’ https://t.co/yXKSn2NNaf pic.twitter.com/lKmJjsCenN

— Deadline Hollywood (@DEADLINE) May 7, 2017

He has described Amazon as an “incredible business” and Jeff Bezos as a “remarkable businessman”.

Mohnish Pabrai hinted that Warren is looking for consumer facing businesses like D-Mart.

“He would be very interested in consumer non-durables. There are a number of such companies that are emerging and they are growing very rapidly” he said.

“India is growing and there is a set of companies which have the size and the scale,” he added.

Conclusion

Warren Buffett has already described India as an “incredible investing opportunity”, implying that he is looking to catch the next flight to Dalal Street and shop for multibagger stocks. We have to be prepared to roll out the red carpet to welcome him and help him in the noble endeavor!

But will buffett invest in a company with a 40 PE ? i thought he is a guy who loves buying cheap..!!

Good question !! 🙂

PE is not good measure to consider any stock cheap or overvalued.

I agree to that.. but buffett with the teachings of Graham go totally against investing at higher PE’s and BV’s.. Even though the Company has a higher PE the return ratios seem very moderate..

Kjndly get to know influence of munger on Buffet’s investment strategy.

Sir, would you be kind enough to explain to all we learners what’s Munger’s influence on Buffet’s investment strategy.

Any idea why sales of such a great stock has fallen by 47 and profit by 92%? Was something demerged from this?

I am wondering too.

147.65 cr is the consolidated net profit for q4 2016, For q4 2017 the consolidated net profit is 296.09 cr. Hope this makes it clear.

That’s Because Standalone result is provided. Consolidated result is much better compare to last year.

Nice to know about this company, which has grown so significantly throughout the last 15+ years! From Rs 40+ in 2002 to Rs 2600+ in 2017 – something like 65 times in 15 years. 5.5 times in last 5 years, 2+ times in 2years 1+ times in one year etc.

The question is not about the P/E, because if the company is into many verticals and growing at a high rate, then high P/E is not an issue. Latest quarter growth (consolidated) was 60%! Even if it achieves a 30% CAGR, this P/E will look small. The question is, how long it will take to rise 5 times from here? 5 years?

The analysts have issued a certificate about the strong ethics and abilities of the promoters. Let us believe that. But see the timing of this report! The company/group is planning to raise Rs5000 crores from equity/debt as per their latest filings! Coincidental or Unrelated?

Perhaps a ploy (of someone) to attract new investors to a company that has already grown 5.5 times in last 5 years or 65 times in 15 years!

The question is, how much juice is left for new (long term) investors?

at 2600 – is it still a 5x multibagger… it has already given tremendous returns… so is there still juice left?

Although I believe that one should not have more than 20 stocks in portfolio ,and no stock should be more than 10 % of Investment ( if after appreciation it has gone up more than 10% it is different case) and one should have minimum 2 % in any stock.But this rule of minimum holding is only if you are able to buy at reasonable prices.My view is that in over heated market one should be very conservative ,and if one still like to take exposure in any good company ,it should be started at small fraction of 1% of portfolo,and should be bought in atelast 10 Parts spread over one to two year period..Never average out if such stocks goes down,rather average it on up side if stock is going up ,so that your average price can protect of any down side and you have time to exit without a bleeding nose.You can live with out any 5X ,but you should avoid 1/5 X at such high levels.My this view has nothing to do with the stock under discussion ,but can be applied in all Quality Stocks,where you feel you have missed out a great secular growth story.Slow and steady wins the race ,playing stock like 20-20 cricket match may be risky ,so play like test match,bulid your portfolio like class bats man build their innings.

Hi,

I am Nitiin Khandkar, the owner of bqinvesttraining.com, and had interviewed Guy Spier last year. In this blog post, you have shared a link to my interview, but you should also have included a reference to me or my venture/interview.

The interview presented in two parts, can be accessed here:

http://bqinvesttraining.com/interview-guy-spier-part-i/

http://bqinvesttraining.com/interview-guy-spier-part-ii/

Other interviews can be accessed here:

http://bqinvesttraining.com/interviews-list/

Piramal had invested in Telecom and pharma, he makes money and moves out. Look for another opprtunity.