Axis Securities’ last Year Performance (New Year Picks 2024) delivered astounding Returns of 35.8% since last year vs. Nifty 50 Return of 10.8%. Target was achieved for 6 calls out of 9 calls. However, status is Open from the long-term perspective.

We continue to believe in the long-term growth story of the Indian equity market. However, with current valuations offering limited scope for further expansion, an increase in corporate earnings will be the primary driver of the market returns moving forward. Hence, bottom-up stock picking with a focus on ‘Growth at a Reasonable Price’ and ‘Quality’ would be keys to generating satisfactory returns in the next one year. We also suggest a “Buy on Dips” strategy in the stocks listed below with an investment horizon of over 12 months.

We present Six Golden Themes for 2025

• Structural Play in Premium Consumption

• Growthstory of the Indian Healthcare Industry

• Companies with higher growth potential in the Infrastructure value chain

• Pharma and Telecom as a Defensive Play

• Real Estate led by Demand Visibility

• Reasonable valuation play in BFSI

• Right mix of Rate Cut Cycle, Defensive, Infra, and Consumption

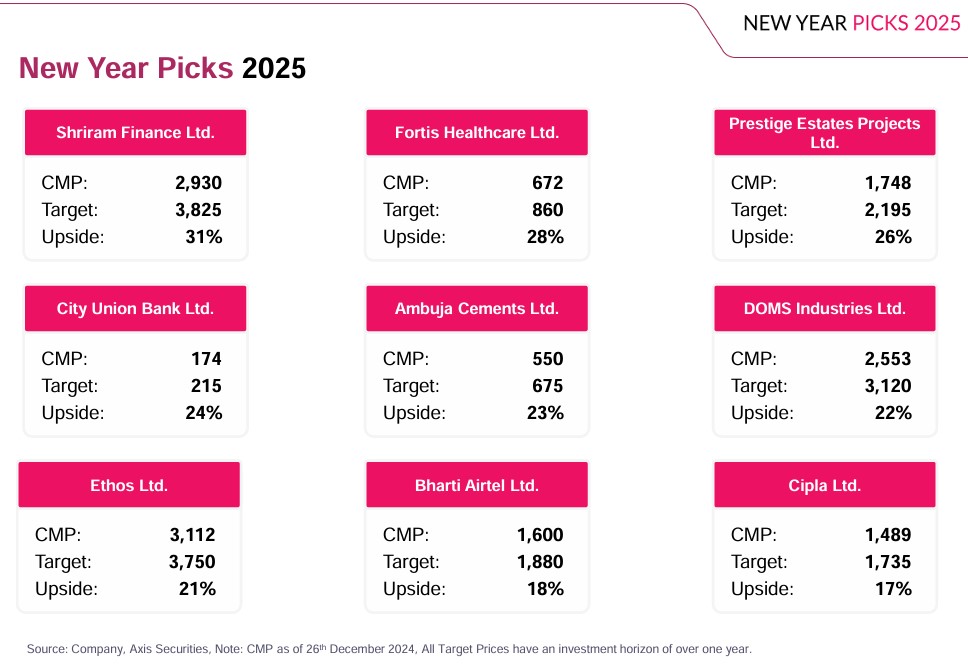

Our New Year picks for 2025 are: Shriram Finance Ltd, Fortis Healthcare Ltd, Prestige Estates Projects Ltd, City Union Bank Ltd, Ambuja Cements Ltd, DOMS Industries Ltd, Ethos Ltd, Bharti Airtel Ltd, Cipla Ltd