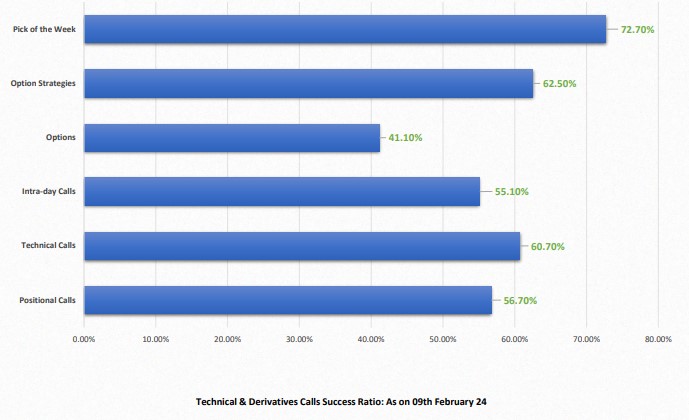

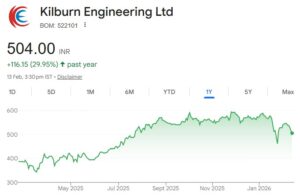

Chola Securities has issued a report card as to how their Fundamental & Technical Stock Recommendations have fared. All recommendations have given good returns to investors & traders. The initiating coverage recos have given 69%. The Dark Horses basket hsa given 34%. The Evergreen basket has given 23%. Diwali Picks have given 57% return

Chola Securities has issued a report card as to how their Fundamental & Technical Stock Recommendations have fared. All recommendations have given good returns to investors & traders. The initiating coverage recos have given 69%. The Dark Horses basket hsa given 34%. The Evergreen basket has given 23%. Diwali Picks have given 57% return.

See Also: Evergreen Stock Basket & Dark Horses Stock Basket by Chola Securities