The board of directors of ITC Ltd had approved demerger of its hotels business on 14th August, 2023 based on which retail investors can take benefit of the opportunity. Below are the demerger details:

➢ Demerger ratio: 1:10 (1 share of ITC Hotels for every 10 shares of ITC Ltd)

➢ Record date: 06th January, 2025

➢ No. of outstanding shares in ITC Hotels post demerger: 2,08,11,71,039.

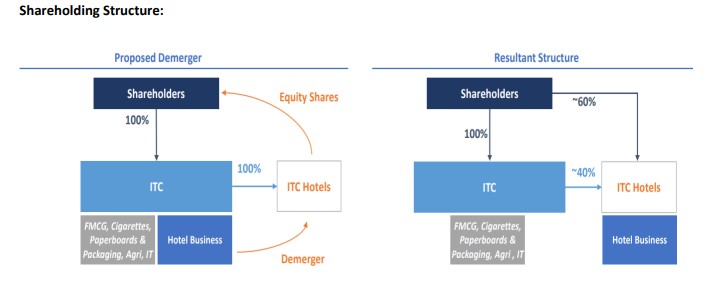

Shareholding Structure:

Notes:

1. Taking average EV/EBITDA multiple of 25.0x of its industry peers Indian Hotels and EIH Ltd.

2. We expect ITC Hotels to generate PAT of ~Rs 546 cr in FY25E given the negligible debt on books and assuming a tax rate of ~28%.

3. Closing price of 27th Dec.

Our view: ITC Hotels is one of the largest hotel companies with 140 hotels and ~13,000 operating keys as of Oct’24. The company targets to grow its portfolio to 200+ hotels and 18,000+ keys by 2030. Around 35% of the hotel portfolio is owned by ITC Hotels and the balance is managed (including franchise model). The ARR and RevPAR of its owned hotels has grown 20%/18% YoY respectively in FY24 with occupancy level of 69%. The return ratios are healthy with RoCE of ~20%. It has a net cash surplus with negligible debt on books, thus providing healthy growth opportunity going ahead.

Given the attractive growth potential for domestic tourism industry and strong company financials, ITC Hotels has a long runway to capture the growth opportunities in the tourism industry. Investors can participate in the growth story of ITC’s hotel business by purchasing a minimum of 10 ITC shares on or before 03rd January, 2025. The average EV/EBITDA multiple of its industry peers (Indian Hotels & EIH Ltd) is 25.0x. Assuming that ITC Hotels will list at an EV/EBITDA multiple of 20.0x-30.0x, the share price of ITC Hotels Ltd is expected to list in the range of Rs 113 to Rs 170 per share (as per the computation in the above table).

For ITC Ltd shareholders, post demerger and listing of the ITC Hotels Ltd, there will be no material value addition as the price of ITC Ltd will get adjusted taking into account the holding company discount as shown above. Post listing of the ITC Hotels Ltd, investors will get an opportunity to participate directly in the growth story of ITC’s hotel business. Looking at the robust key addition pipeline for ITC Hotels and strong industry tailwinds, we believe ITC Hotels Ltd has potential to outperform ITC Ltd over a medium to long term period. In the short term, there is a possibility that few shareholders (especially ETFs) may have to forcefully exit ITC Hotels Ltd and this can create pressure on the stock price. We believe, any short term pressure on the stock price of ITC Hotels Ltd will be a good opportunity for retail/HNI shareholders to accumulate quality business in their long term portfolio. Meanwhile, post demerger, investors can also continue to hold shares of ITC Ltd for long term given its diversified FMCG portfolio and steady growth in its core businesses (Cigarette & FMCG). Also, the demerger of its asset heavy hotels business will result in improved return ratios and cash flows. We believe, post demerger, ITC Ltd’s medium term fair value to be Rs 525-550.