Nifty Outlook:

Post the breakout that was witnessed on 12th January. The index has been unable to sustain at higher levels and thus a sharp sell-off has wiped all the gains that was achieved over the last few trading sessions. This has been fuelled by FII’s significantly selling in both cash and index futures. FII’s have liquidated all their long positions and at the same time, they have added fresh shorts. On 20th January; 15 long contracts were added compared to the addition of 6,339 short contracts in index futures. The long/short ratio has significant come down from the highs of 69% to 46%; indicating unwinding of long positions. Additionally, on the index options front, FII’s are liquidated a significant number of callshorts; which is a bearish indicator. To conclude, the data is negative from FII’s point of view now. Option data is indicating negative bias as long as the index is trading below 21,800 level. Hence, itis now Advisable to stay cautious with 21,300 as a support

Weekly Expiry Point of View:

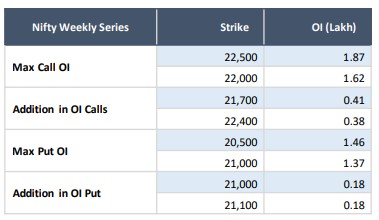

Option chain data for this weekly/monthly expiry is indicating a trading range of 21,500-22,000 zones. On the call side, 22,000 is the strike with highest OI. Majority of call writing was witnessed at this level; indicating resistance. On the put side, 21,500 is the strike with highest OI. As per the data, net call-put writing is indicating significant addition of call writers; which is a bearish indicator. It is advisable to be cautious with longs. Further weakness can be expected as long as index is trading below 21,800 levels.

Strategy:

The sentiment on Nifty is bearish. However, the strategy can be played out by selling 1 OTM CALL & selling 1 OTM PUT.

Nifty Theta Scalping:

SELL 1 LOT CALL NIFTY 25JAN2024 22,000 @ 22 | SELL 1 LOT PUT NIFTY 25JAN2024 21,250 @ 26

Target – COMBINED PREMIUM 24 POINTS | Stop Loss – COMBINED PREMIUM 70 POINTS