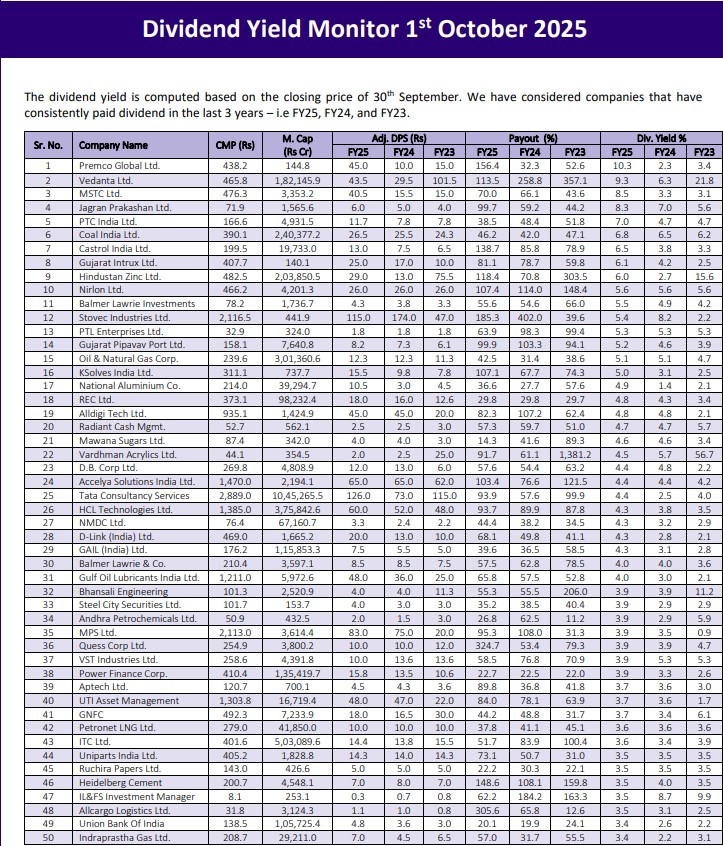

The dividend yield is computed based on the closing price of 30th September. We...

Valuation remains inexpensive (~33x FY27E). We assign 40x for earnings CAGR of 19.4% over...

MIIL and its three senior executives are barred from accessing or dealing in the...

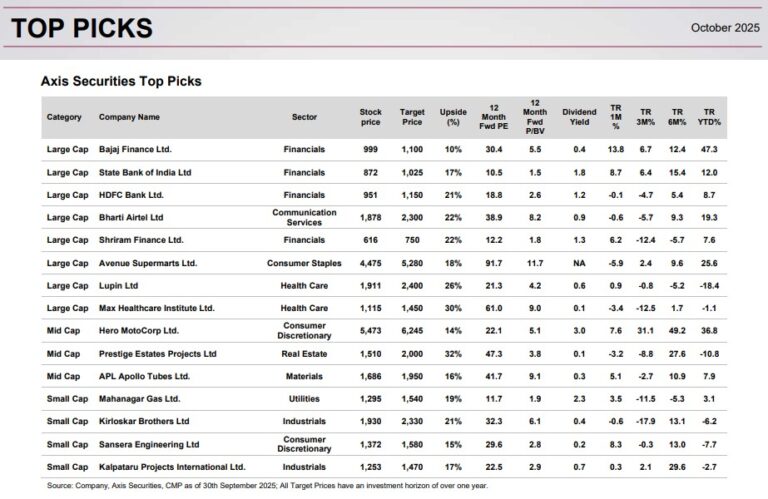

Our focus remains on Growth at a Reasonable Price, ‘Quality’ stocks, Monopolies, Market Leaders...

Over the two last months, gold prices have risen by 15% (+42% YoY). Despite...

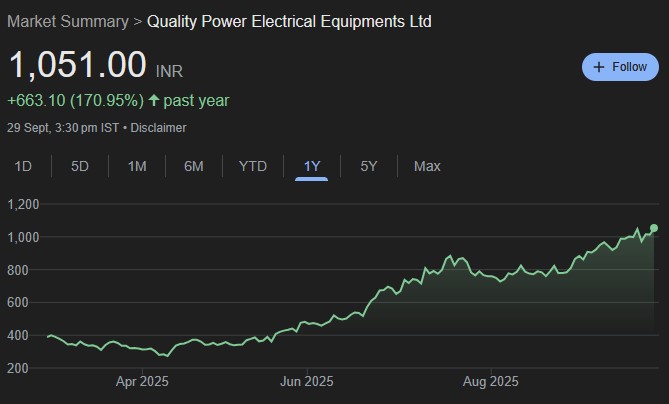

High entry barriers in HVDC, FACTS, 400 kV AC, 765 kV AC and UHV...

Radico Khaitan is one of the recognised IMFL company in India with portfolio of...

The stronger performance over FY24–25 (16%/19% PAT growth seen in FY24/FY25) has not really...

We initiate coverage on EPACK durable with BUY rating based on its commendable value...

Minda Corporation is evolving from a conventional auto component manufacturer into a high-value, technology-driven...