In FY24-25, sales volume reached 64mn cases, up 4.1% from the previous year. Net...

Traditionally a basmati rice company, LTFOODS has evolved into a multi-product FMCG player with...

Signature Global maintains a confident outlook for FY26, projecting pre-sales of Rs 12,500 Cr...

Aditya Birla Capital continues to deliver robust growth across lending, AMC, and insurance verticals,...

The stock is trading at a 1-year forward P/E of 48x, above the 5-year...

Cummins India (KKC) delivered robust performance in Q1FY26 which surpassed our estimates. Revenue, EBITDA...

Amid a globally uncertain and challenging environment marked by inflation, currency fluctuations, and geopolitical...

Considering export opportunities and now with sustainable double digit margins potential we remain positive...

Man Industries Ltd has stellar growth potential on the back of (a) Foray into...

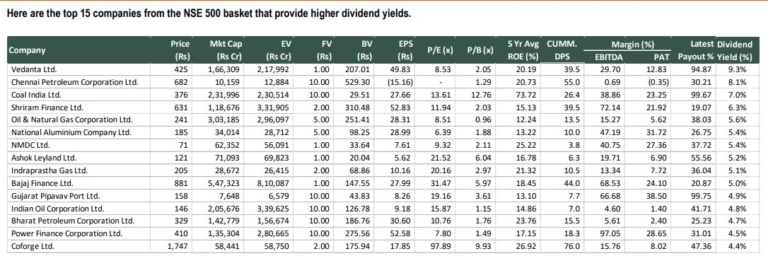

Here are the top 15 companies from the NSE 500 basket that provide higher...