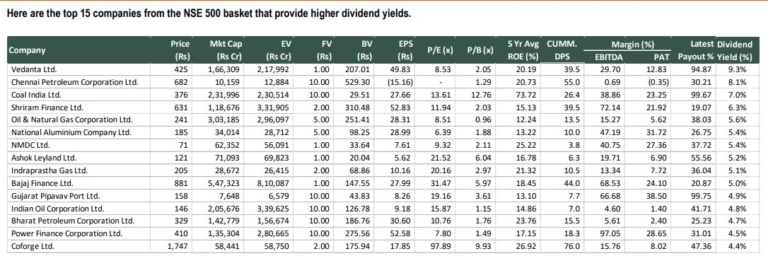

Here are the top 15 companies from the NSE 500 basket that provide higher...

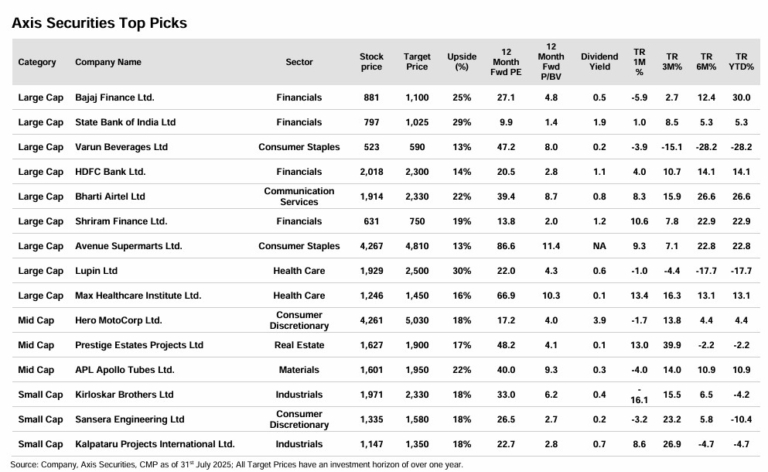

Based on the recent developments, we have made one change to our Top Picks...

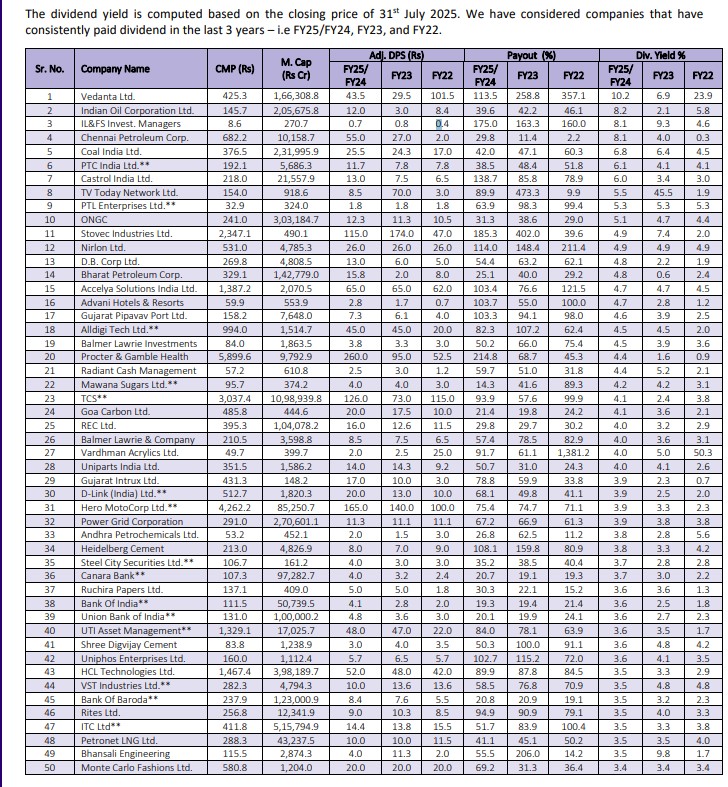

The dividend yield is computed based on the closing price of 31st July 2025....

OCCL reported much better performance & stronger margins than our estimates. The performance was...

Hitachi Energy (Hitachi) reported an EBITDA of INR 1.5bn, thrice its base quarter last...

Sobha reported highest ever quarterly presales of Rs20.79Bn, a growth of 11%YoY & 13%QoQ....

We believe MPL is poised for PER re-rating post robust earnings growth for consecutive...

Lower Limeroad losses, greater operational efficiencies and better offline margins drove a 166bp y/y...

Huhtamaki’s Q2CY25 performance was better than our estimates. Revenue declined YoY by ~4% but...

Shyam Metalics offers a unique play in the Indian metals space, with a combination...