We recently hosted in Mumbai the Indraprastha Medical management for an NDR. Key takeaways:...

We recently visited SJS's manufacturing facilities in Bengaluru. The company has built end-toend capabilities,...

Delhivery has outperformed the market since announcing the acquisition of Ecom Express, we believe...

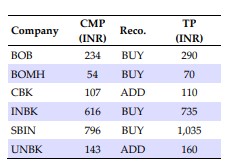

The Indian PSU banking (PSB) sector, once considered structurally broken, is experiencing early signs...

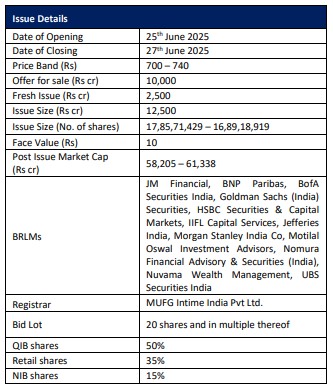

HDB Financial Services Ltd (HDBFS) is categorized as an upper-layer NBFC by the Reserve...

Incorporated in 1985, Bansal Wire is the second largest manufacturer of steel wire in...

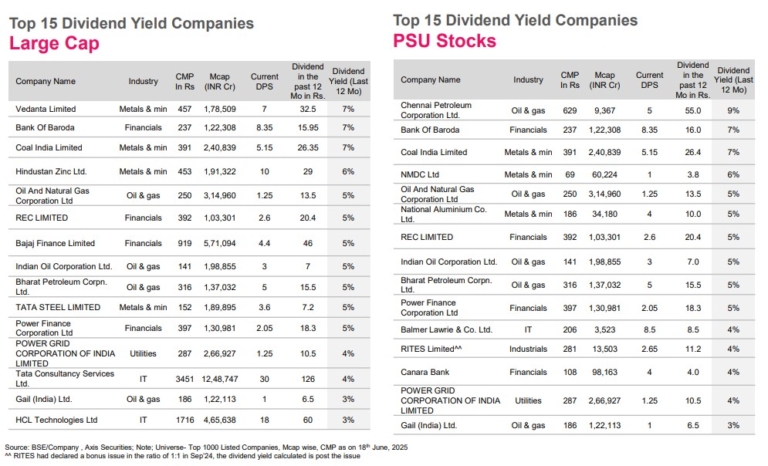

Top 15 Dividend Yield Companies as of 18th June 2025 in Large Cap, PSU...

We initiate coverage on Swiggy with a BUY rating and 12-mth DCF based target...

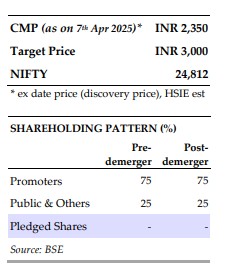

Siemens Energy India Ltd (SEL) captures the maximum value among its peers as it...

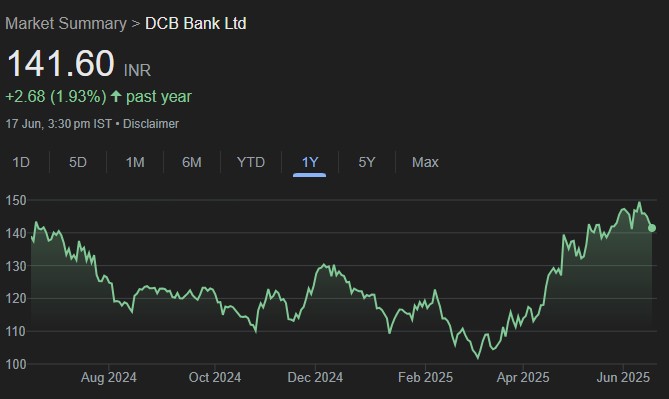

We met Mr Praveen Kutty, MD&CEO of DCB Bank (DCB). Highlights: 1) Management is...