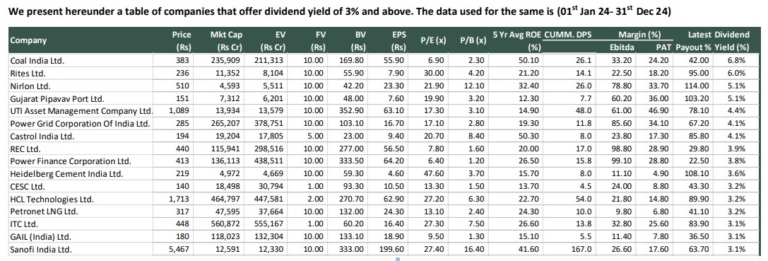

Selection criteria – Market cap should be more than 500 Cr, Dividend yield should...

New hotels addition continued at healthy pace: The organized players continued to add new...

The company has strong balance sheet with net cash of ₹750 cr+. Asset light...

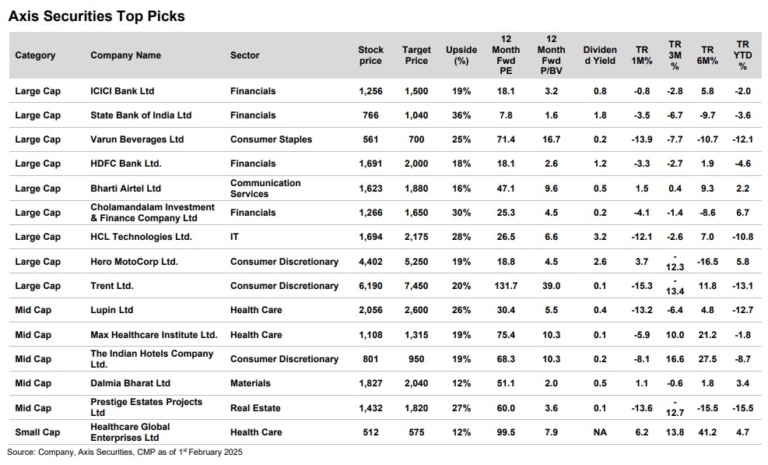

Axis Top Picks Basket delivered excellent returns of 12% in the last year against...

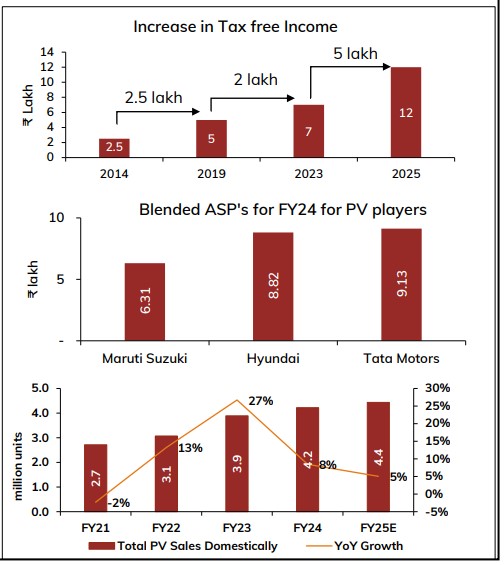

The Government in Budget 2025-26 has tried to balance the three cornerstones of the...

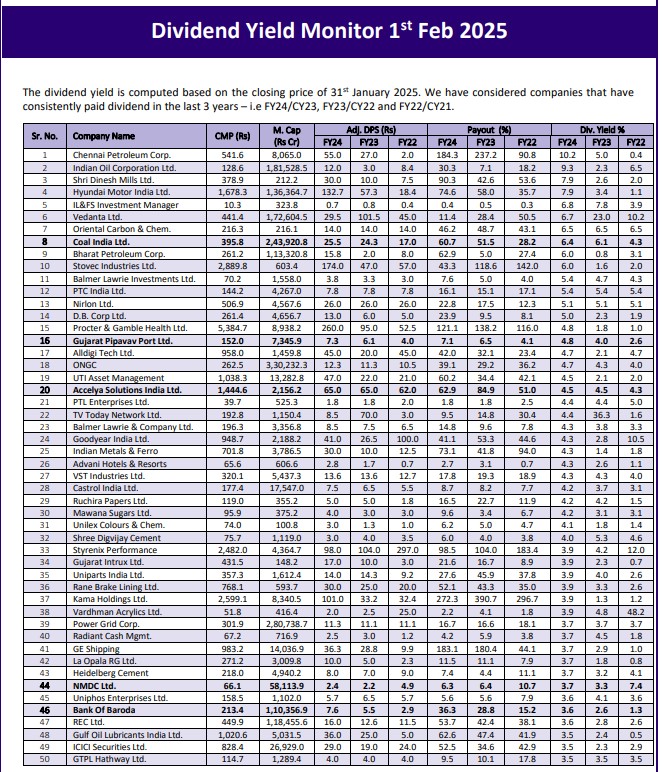

The dividend yield is computed based on the closing price of 31st January 2025....

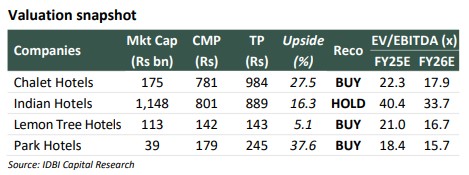

Chalet has been our preferred pick amongst the domestic hospitality space. The company’s focus...

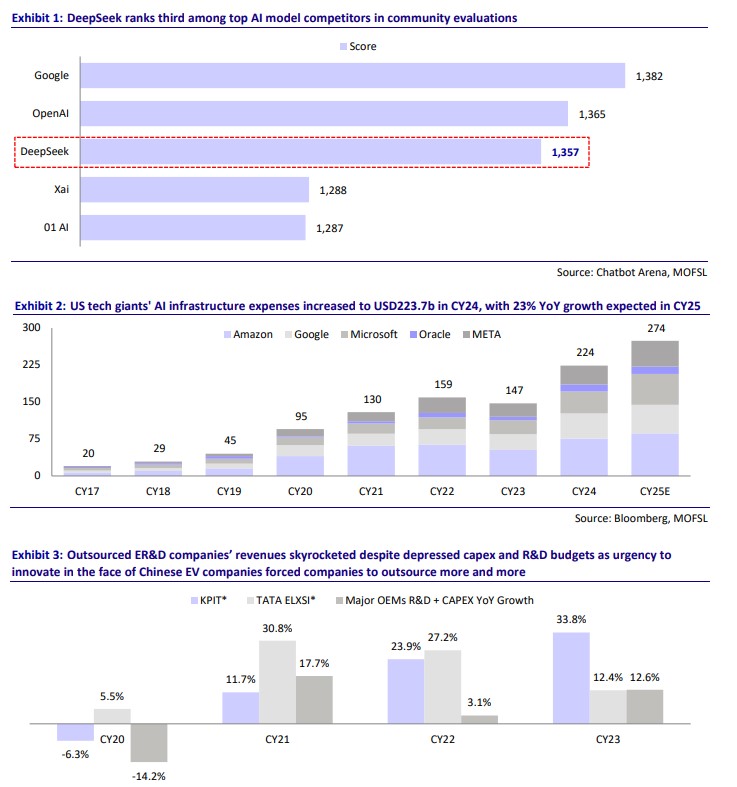

DeepSeek, a Chinese AI startup, has developed the R1 model, which rivals leading AI...

Yatharth has shown a strong performance on a nine-month basis and is likely to...

We view DCB is set to deliver returns and could possibly become a 1%...