Yatharth Hospitals reported a healthy revenue growth which was marginally below our estimates, while...

JBCP is well-positioned to capitalize on immediate growth opportunities. We expect 29% EPS CAGR...

APTUS reported a healthy quarter led by pick up in disbursements, steady spreads and...

PCBL Ltd (erstwhile Phillips Carbon Black) is the leading manufacturer of carbon black, which...

The Axis Top Picks Basket delivered a return of 11.6% in the last six...

Started by renowned orthopaedic surgeon Dr Vikram Shah, Shalby is a multi-specialty hospitals chain...

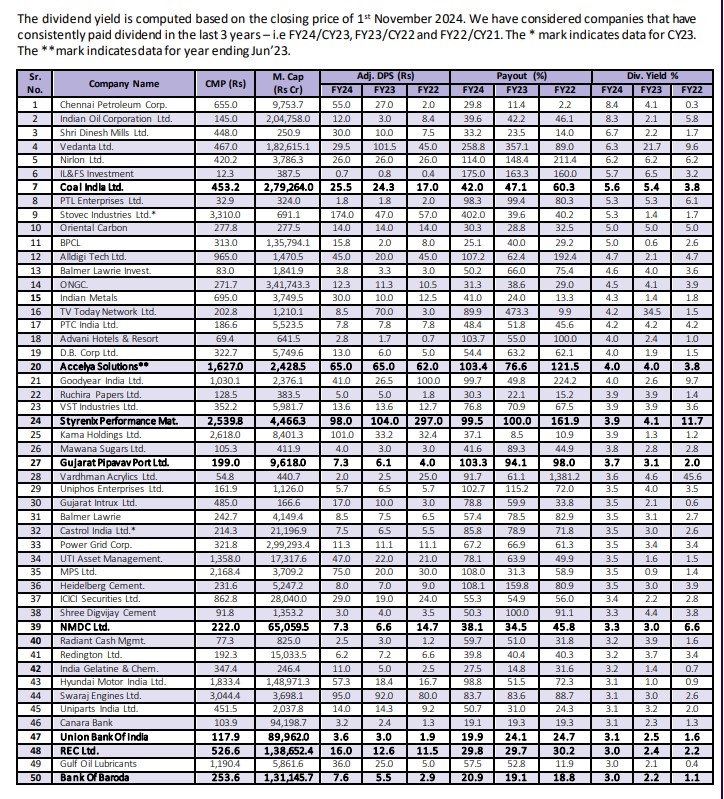

The dividend yield is computed based on the closing price of 1st November 2024....

We remain upbeat on DLFU’s growth prospects on strong sectoral tailwinds (industry-wide consolidation, record...

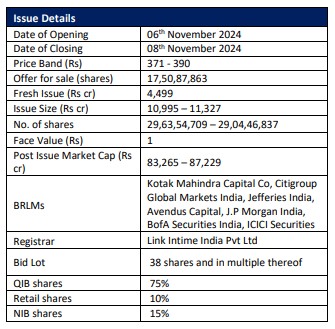

Swiggy Ltd (Swiggy) is a new-age technology company offering users an easyto-use convenience platform...

The company has demonstrated solid performance, achieving strong growth in the loan book while...