We recently met Mr. Shyam Srinivasan, the outgoing CEO of Federal Bank (FB), to...

VA Tech Wabag (Wabag) bagged a mammoth order of INR 27bn (equivalent to its...

Headquartered in Chennai, WABAG Group has a history spanning more than 90 years. With...

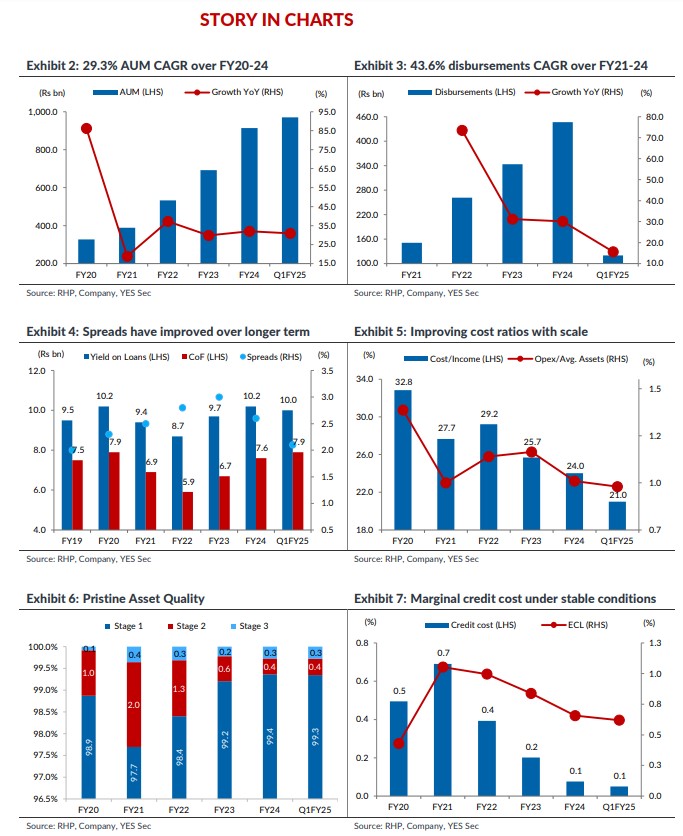

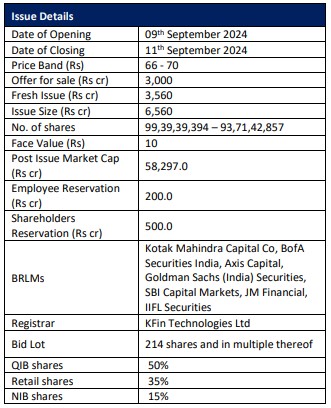

With an AUM of Rs971bn as of June 30th 2024, Bajaj Housing Finance (BHFL)...

InCred Equities has released its much awaited list of high-conviction stocks for September 2024....

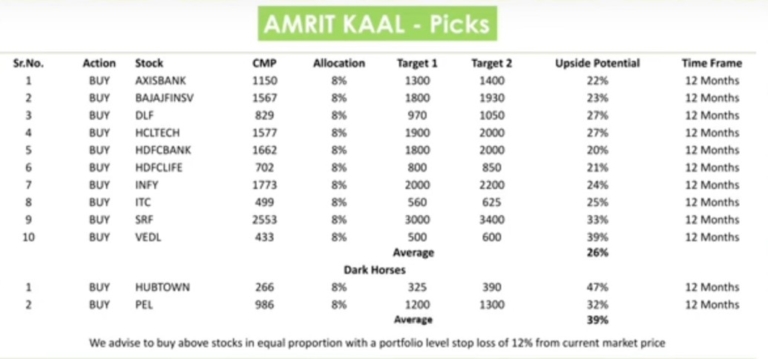

Rahul Sharma of JMFICS has recommended an 'Amrit Kaal' basket of 16 stocks with...

Bajaj Housing Finance Ltd (BHFL) is the second largest housing finance company (HFC) in...

AWFIS sees demand for flexible office space clocking 25–27% CAGR in the coming years...

HG Infra has showcased an impressive 24.2% revenue CAGR during FY18-24, thanks to its...

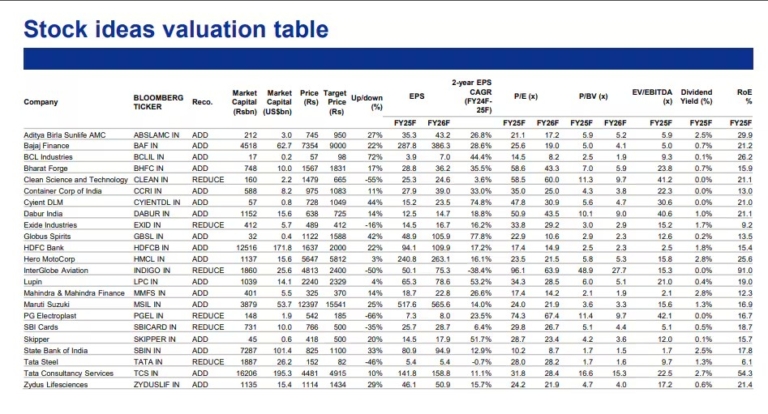

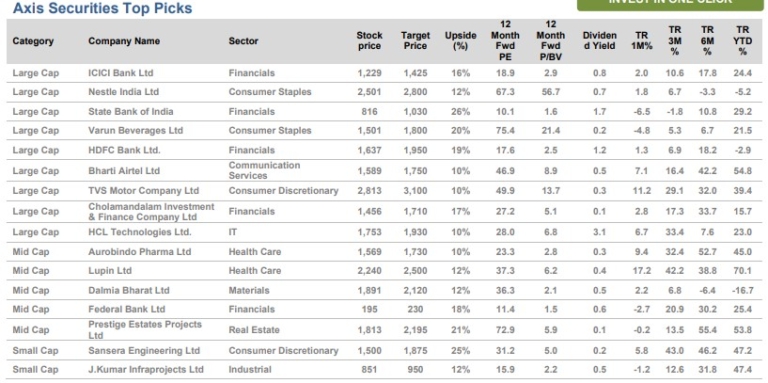

Top Stock Picks, 9 Large-Cap, 5 Mid-Cap & 2 Small-Cap stocks for up to 26% upside by Axis Securities

Based on the above themes, we recommend the following stocks: HDFC Bank, ICICI Bank,...