NIFTY Elliott wave perspective. Big picture is strong 4Since index still hovers around our...

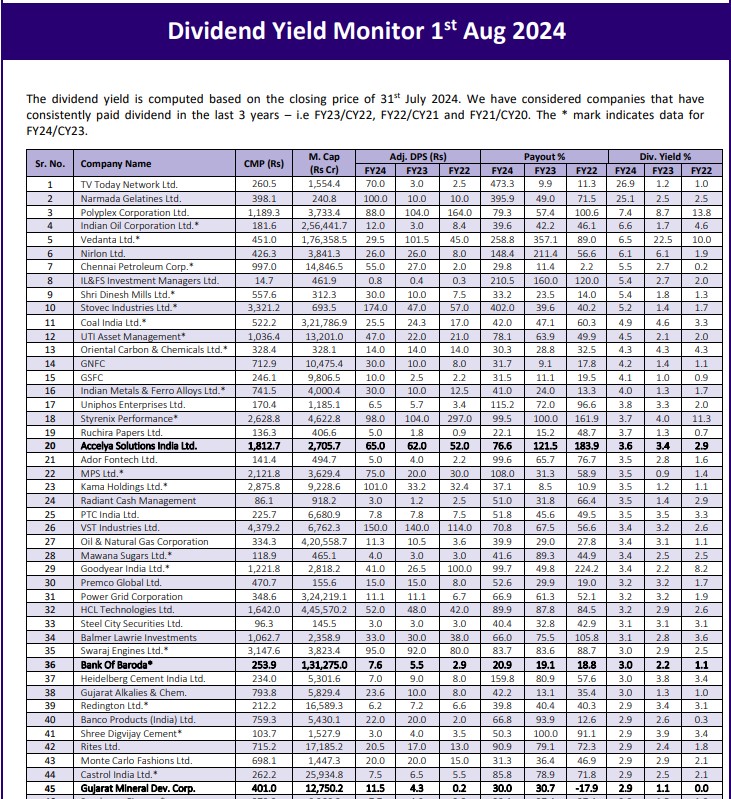

The dividend yield is computed based on the closing price of 31st July 2024....

Hi-Tech Pipes has mammoth growth prospects in the structural steel tubes space given its...

Sobha Developers Limited’s (SDL) FY24 annual report largely reflects operational excellence and market leadership...

We see Transport Corporation of India (TCIL) as a good opportunity in the current...

Steel Strips Wheels Ltd. (SSWL), is a Chandigarh based company involved in designing...

Mankind Pharma has agreed to acquire Bharat Serum Vaccines (BSV) for EV of INR136b,...

Asset-light model can potentially generate strong RoE and RoCE: The company boasts an asset-light...

Ratnaveer Precision Engineering (RPEL), is a Gujarat based stainless steel (SS) product manufacturer focused...

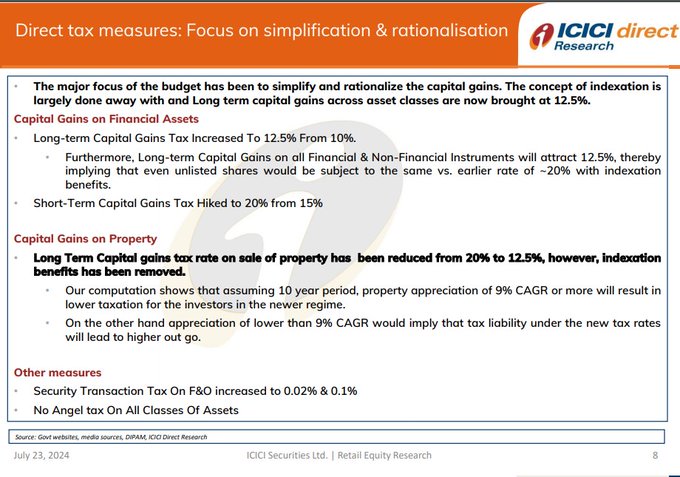

The spotlight of the Union Budget 2024-25 was anchored on pillars of a) Youth...