Ratnaveer Precision Engineering (RPEL), established in 2002, is a Gujarat based stainless steel (SS)...

Stanley Lifestyles Limited is a super-premium and luxury furniture brand in India, one of...

Elgi is the second largest player in the Indian air compressor market (~22% market...

We initiate coverage on Bajaj Electricals (BJE) with a BUY rating and target price...

In our base case, we roll over the Nifty target to Mar’25 to 24,600...

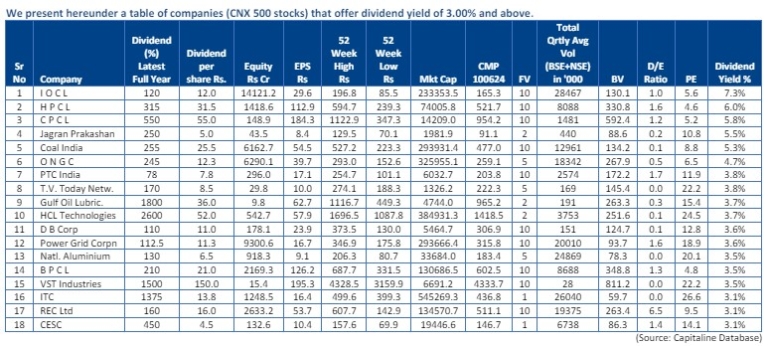

We present hereunder a table of companies (CNX 500 stocks) that offer dividend yield...

In our Sobha (SDL) deep dive note ‘R’eset, ‘R’estart, ‘R’efocus = ‘R’erating, we had...

We expect a 16% earnings CAGR for MANKIND over FY24-27. Considering its strong brand...

Varun Beverages Limited (VBL or the Company) is a significant entity in the beverage...

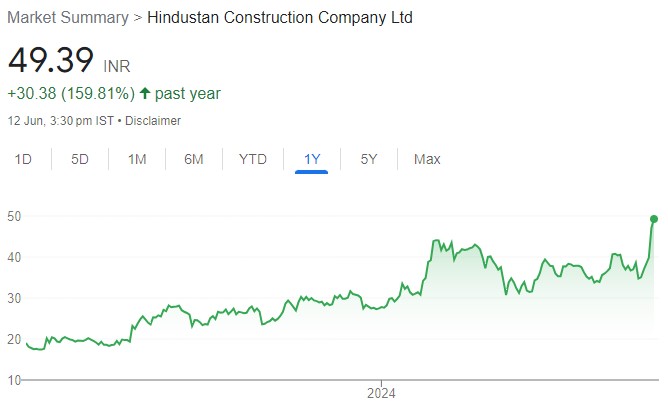

Once the toast of India’s infrastructure space, Hindustan Construction Company (HCC IN) saw its...